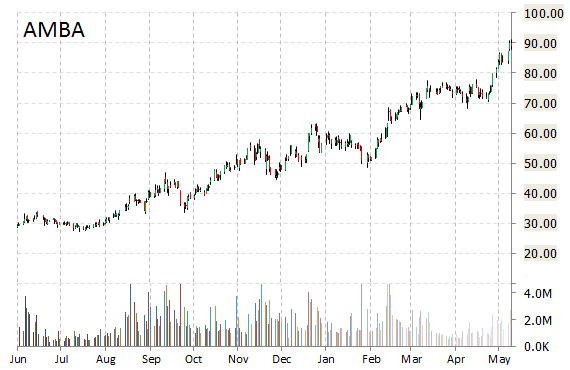

Ambarella, Inc. (AMBA) was reiterated a ‘Buy’ by Stifel analysts on Friday. The broker also raised its price target on the stock to $99 from $73.

Ambarella, Inc. shares are currently priced at 57.67x this year’s forecasted earnings compared to the industry’s 17.92x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.95 and 31.74, respectively. Price/Sales for the same period is 12.57 while EPS is $1.57. Currently there are 8 analysts that rate AMBA a ‘Buy’, 4 rate it a ‘Hold’. No analyst rates it a ‘Sell’. AMBA has a median Wall Street price target of $73.00 with a high target of $96.00.

NXP Semiconductors NV (NXPI) was reiterated as ‘Buy’ with a $130 from $120 price target on Friday by Stifel.

In the past 52 weeks, shares of semiconductor company have traded between a low of $53.81 and a high of $112.81 with the 50-day MA and 200-day MA located at $101.53 and $88.63 levels, respectively. Additionally, shares of NXPI trade at a P/E ratio of 0.74 and have a Relative Strength Index (RSI) and MACD indicator of 74.91 and +5.88, respectively.

NXPI currently prints a one year return of about 79% and a year-to-date return of around 45%.

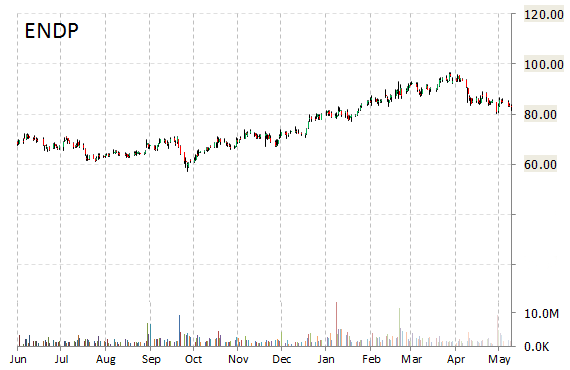

Endo International plc (ENDP) rating of ‘Buy’ was reiterated today at Guggenheim with a price target increase of $110 from $100 (versus a $82.94 previous close).

ENDP shares recently gained $1.02 to $83.96. Guggenheim’s target price suggests a potential upside of 31% from the company’s current stock price.

In the past 52 weeks, shares of Dublin, Ireland-based company have traded between a low of $57.14 and a high of $96.58. Shares are up 12.75% year-over-year and 15.00% year-to-date.

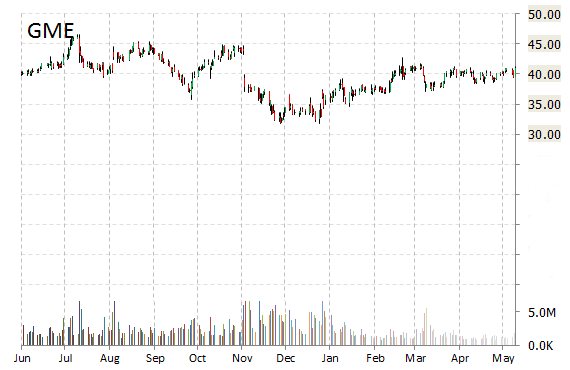

Shares of GameStop Corp. (GME) are up $3.06 to $43.98 in mid-day trading after Telsey Advisory Group reiterated its ‘Market Perform’ rating and increased its 12-month base case estimate on the name by 1 point to $42 a share.

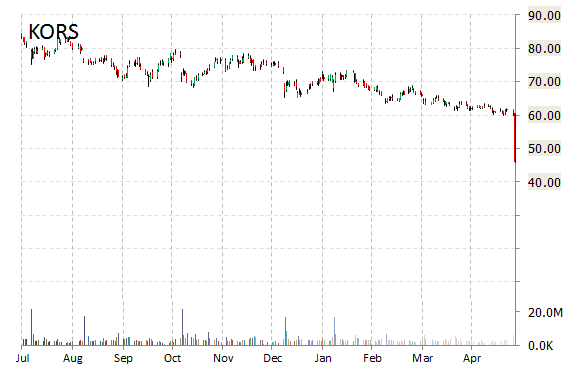

Michael Kors Holdings Limited (KORS) was reiterated as ‘Hold’ on Friday by Maxim Group. Firm believes that company has now transitioned to a mature specialty retailer. Maxim analysts however, cut the name’s price target to $42 from $65.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply