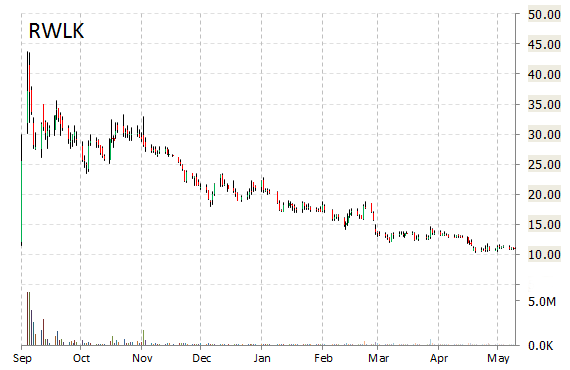

Analysts at Canaccord Genuity are out with a report this morning upgrading shares of ReWalk Robotics Ltd. (RWLK) with a ‘Buy‘ from ‘Hold‘ rating. The firm raised its price target for the company to $17 from $11, implying 54% expected upside.

ReWalk Robotics Ltd. shares have a price/book and t-12 price-to-sales ratio of 3.02 and 33.53, respectively. EPS for the same period is ($6.34).

In the past 52 weeks, shares of Yokneam Ilit, Israel-based medical device company have traded between a low of $10.35 and a high of $43.71 and are now at $13.25. Shares are down 41.42% year-to-date.

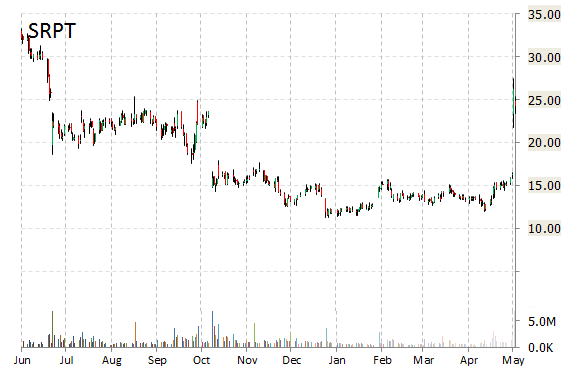

Sarepta Therapeutics, Inc. (SRPT) was reiterated a ‘Strong Buy’ by WBB Securities analysts on Friday. The broker also raised its price target on the stock to $35 from $25.

On valuation measures, Sarepta Therapeutics Inc. shares have a PEG and current ratio of 24.40 and 5.69, respectively. T-12 price/sales is 274.18 while EPS is ($4.13). Currently there are 7 analysts that rate SRPT a ‘Buy‘, 10 rate it a ‘Hold‘. No analyst rates it a ‘Sell‘. SRPT has a median Wall Street price target of $30.00 with a high target of $45.00.

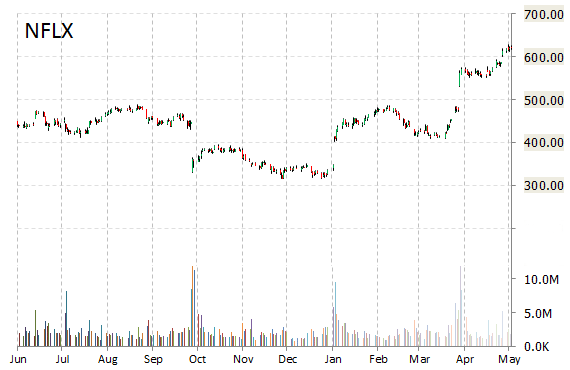

Netflix, Inc. (NFLX) rating of ‘Outperform’ was reiterated today at RBC Capital Markets with a price target increase of $700 from $600 (versus a $623.02 previous close). The firm said the upgrade was due to positive U.S., France, and Germany survey results and the company’s proprietary Original Content Tracking.

NFLX is up $0.59 at $623.61 on normal volume. Midway through trading Friday, 639K shares of Netflix Inc. have exchanged hands as compared to its average daily volume of 3.14 million shares. The stock has ranged intraday in a price between $620.85-$625.85 after having opened at $624.25 as compared to the previous trading day’s close of $623.02.

In the past 52 weeks, shares of Los Gatos, California-based company have traded between a low of $315.54 and a high of $628.50. Shares are up 59.50% year-over-year and 82.38% year-to-date.

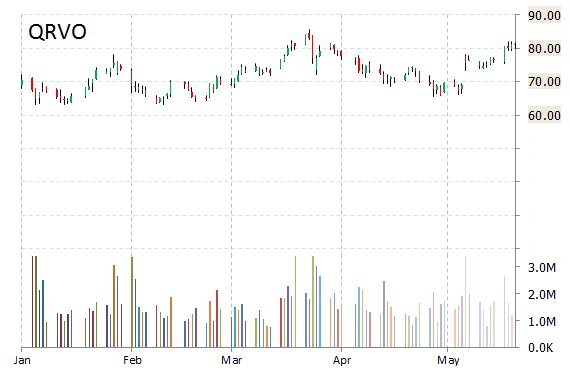

In a report published Friday, Goldman (GS) analysts initiated coverage on Qorvo, Inc. (QRVO) with a ‘Buy‘ rating and $98 price target.

QRVO shares recently gained $3.12 to $84.38. The stock is up about 20% year-to-date trading between a low of $63.02 and a high of $85.63.

Qorvo Inc. closed Thursday at $81.26. The Greensboro, North Carolina-based company has a current market cap of $12.53 billion.

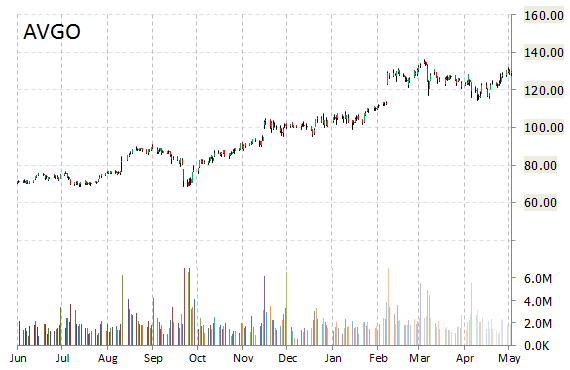

Investment analysts at Mizuho initiated coverage on shares of Avago Technologies Limited (AVGO) in a note issued to investors on Friday. The firm set a ‘Buy‘ rating and a $150 price target on the stock. Mizuho’s price target would suggest a potential upside of 13.27% from the stock’s current price of $132.39.

Avago Technologies Ltd., currently valued at $33.97 billion, has a median Wall Street price target of $144.00 with a high target of $160.00. Approximately 1.06 million shares have already changed hands, compared to the stock’s average daily volume of 2.02 million.

Over the past year, shares of Singapore-based developer of semiconductor devices have traded between a low of $68.71 and a high of $136.28 with the 50-day MA and 200-day MA located at $123.84 and $111.08 levels, respectively. Additionally, shares of AVGO trade at a P/E ratio of 75.09 and have a Relative Strength Index (RSI) and MACD indicator of 66.10 and +5.01, respectively.

Avago Technologies Ltd. currently prints a year-to-date return of around 29%.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply