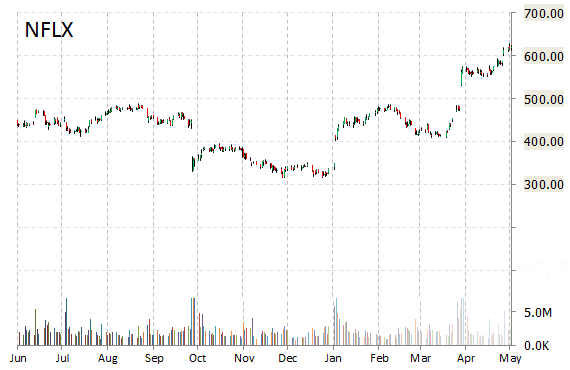

Netflix, Inc. (NFLX) was reiterated a ‘Buy’ by Citigroup (C) analysts on Thursday. The banking giant also raised its price target on the stock to $722 from $584, implying 16.30% expected upside from current pps.

Netflix, Inc. shares are priced at 161.79x this year’s forecasted earnings. The name has a PEG and forward P/E ratio of 18.02 and 177.94, respectively. Price/sales for the same period is 6.49 while EPS is $3.84. Currently there are 23 analysts that rate NFLX a ‘Buy’, 13 rate it a ‘Hold’. 2 analysts rate it a ‘Sell’. NFLX has a median Wall Street price target of $600.00 with a high target of $900.00.

In the past 52 weeks, shares of the Sunnyvale, California-based video streaming company have traded between a low of $315.54 and a high of $628.50 and are now at $620.79. Shares are up 67.23% year-over-year and 81.94% year-to-date.

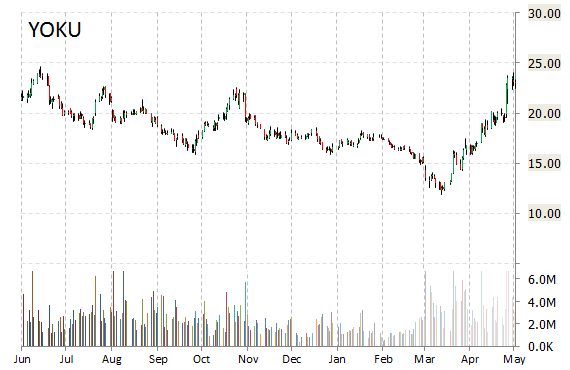

Youku Tudou Inc. (YOKU) was reiterated as ‘Buy’ with a $26 from $20 price target on Thursday by Brean Capital.

Youku Tudou Inc. ADS shares have a price/book and t-12 price-to-sales ratio of 1.96 and 6.57, respectively. EPS for the same period is ($0.72).

In the past 52 weeks, shares of Beijing-based Internet television company have traded between a low of $11.85 and a high of $27.40.

The stock has lost 29.25% year-over-year through Thursday, while the S&P 500 index has gained 12.33%.

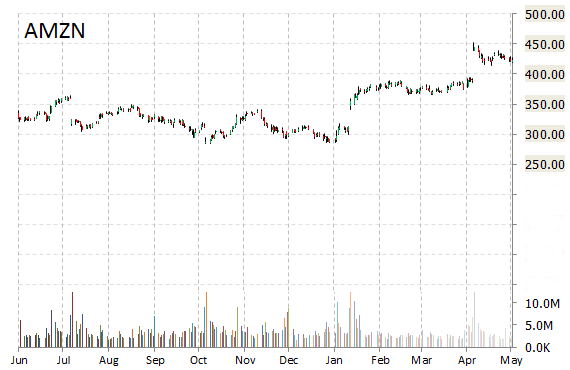

Amazon.com Inc. (AMZN) rating of ‘Overweight’ was reiterated today at Morgan Stanley (MS) with a price target increase of $520 from $450 (versus a $423.86 previous close).

AMZN is up $9.90 at $433.76 on normal volume. Midway through trading Thursday, 2.68 million shares of Amazon.com Inc. have exchanged hands as compared to its average daily volume of 3.63 million shares. The stock ranged in a price between $428.00-$436.90 after having opened the day at $428.25 as compared to the previous trading day’s close of $423.86.

In the past 52 weeks, shares of Seattle, Washington-based e-commerce giant have traded between a low of $284.00 and a high of $452.65. Shares are up 40.73% year-over-year and 36.57% year-to-date.

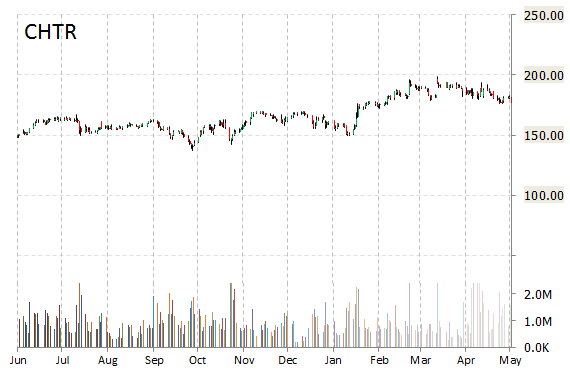

Charter Communications, Inc. (CHTR) was upgraded to ‘Buy‘ from ‘Hold‘ by Wunderlich analysts on Thursday. The broker set its price target on the stock to $221.

CHTR is currently printing a higher than average trading volume with the issue trading 952K shares, compared to the average volume of 1.39 million. The stock began trading this morning at $178.20 to currently trade 0.37% higher from the prior days close of $176.95. On an intraday basis it has gotten as low as $177.04 and as high as $179.44.

Charter Communications’ current year and next year EPS growth estimates stand at 140.00% and 458.80% compared to the industry growth rates of 15.70% and 21.60%, respectively. CHTR has a t-12 price-to-sales ratio of 2.14. EPS for the same period registers at ($2.07).

CHTR shares have declined 5.28% in the last 4 weeks while advancing 1.39% in the past three months. Over the past 5 trading sessions the stock has lost 0.26%.

The Stamford, Connecticut-based company, which is currently valued at $19.91 billion, has a median Wall Street price target of $207 with a high target of $236. Charter Communications Inc. is up 27.34% year-over-year, compared with a 12.33% gain in the S&P 500.

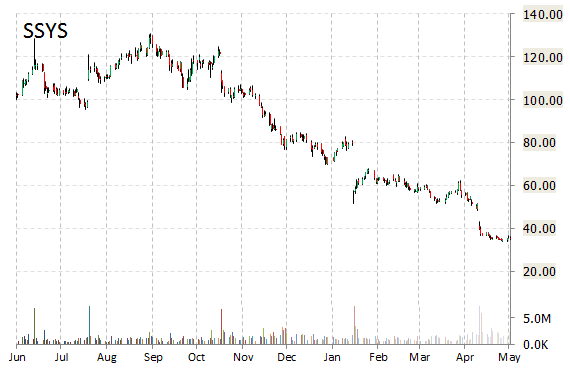

Stratasys Ltd. (SSYS) was upgraded by Oppenheimer analysts to ‘Outperform’ from a ‘Perform’ rating Friday.

SSYS shares recently gained $2.13 to $37.10. Over the past year, shares of Tulsa, Oklahoma-based company have traded between a low of $33.85 and a high of $130.83. Shares are down about 60% year-over-year and 58% year-to-date.

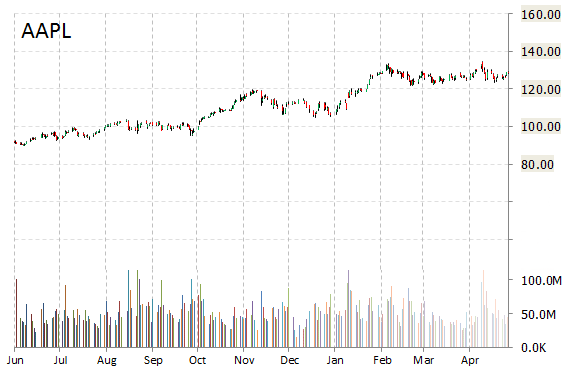

Morgan Stanley (MS) is out with a report this morning reiterating shares of Apple Inc. (AAPL) with an ‘Overweight’ and $160 price target, implying 22% expected return from the stock’s current price.

AAPL shares recently gained $1.25 to $131.31. The stock is up more than 53.20% year-over-year and has gained roughly 19% year-to-date. In the past 52 weeks, shares of the iPhone maker have traded between a low of $86.30 and a high of $134.54.

Apple closed Wednesday at $130.06. The name has a current market cap of $756.48 billion.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply