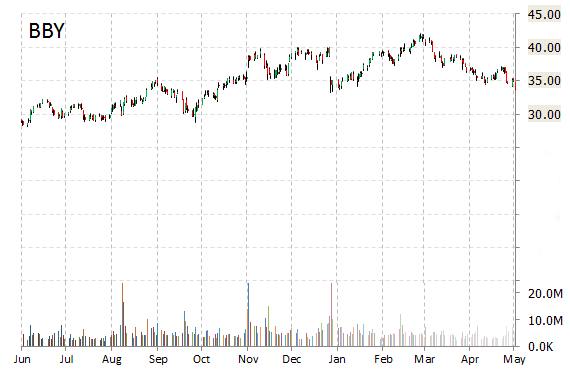

Best Buy Co., Inc. (BBY) shares are up $3.07 to $36.85 in premarket trading Thursday after the company reported its first quarter earnings results.

The consumer electronics retailer posted earnings of $0.37 per share on revenues of $8.56 billion, down 0.9% from a year ago. Analysts were expecting EPS of $0.29 on revenues of $8.46 billion. Q1/15 non-GAAP gross profit was $1.88 million, a marginal improvement from $1.76 million over Q1/14. Net income for the quarter ended May 2, 2015 came in at $129 million, or $0.36 per share (diluted), a decline of 72% compared to $461 million, or $1.31 per share, in the first quarter of 2014.

Hubert Joly, Best Buy president and CEO, commented, “Enterprise revenue of $8.6 billion, in addition to our non-GAAP operating income rate and non-GAAP diluted EPS, all exceeded our expectations during the quarter due to a stronger-than-expected performance in the Domestic business.”

Best Buy’s comparable-store sales rose 0.6 percent last quarter, above Consensus Metrix estimates for a drop of 0.4 percent. International revenue declined 22.1% versus last year.

Liquidity: As of May 2, 2015, the Richfield, Minnesota-based company had net cash and cash equivalents of $2.17 billion from $2.56 billion a year earlier.

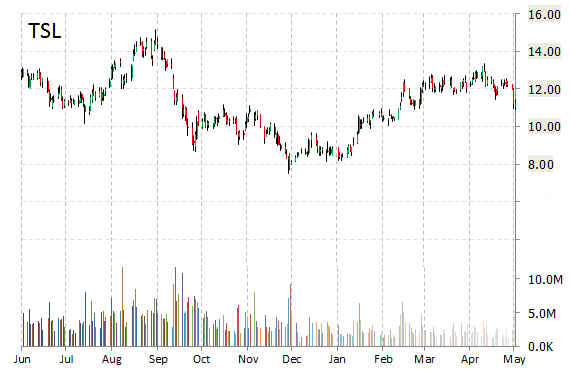

Trina Solar Limited (TSL) reported first quarter EPS of $0.16 before the opening bell Thursday, compared to the consensus estimate of $0.08. Revenues increased 25.5% from last year to $558.1 million. Analysts expected revenues of $509.78 million. Q1/15 gross margin was 18%, up from 15.7% a year earlier. The company’s net income for the period ended March 31, 2015 came in at $13.9 million, or $0.16 per diluted share, from $10.6 million, or $0.13 per diluted share, a year earlier.

Cash Position: As of March 31, 2015, the solar system developer had $682.9 million in cash and cash equivalents, and restricted cash. Total bank borrowings were $912.2 million.

Trina said it expects Q2 to ship between 1,100 MW to 1,140 MW of PV modules, of which 150 MW to 170 MW of PV modules will be shipped to the company’s downstream PV projects, revenues of which will not be recognized.

The stock is currently up $0.67 to $11.73 on 27K shares.

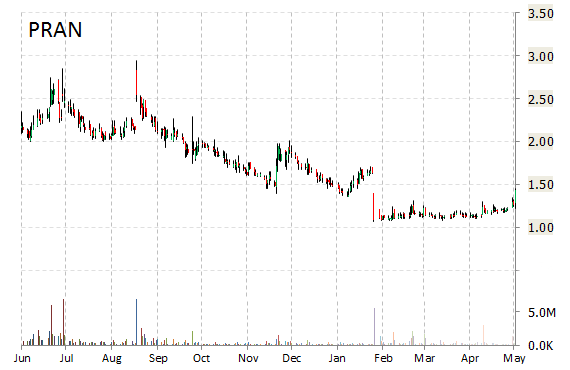

Shares of Prana Biotechnology Limited (PRAN) are higher by 28% to $1.83 in pre-market trading on Thursday following the company’s publication of minutes from the European Medicines Agency regarding the previously announced Orphan Drug Designation for PBT2.

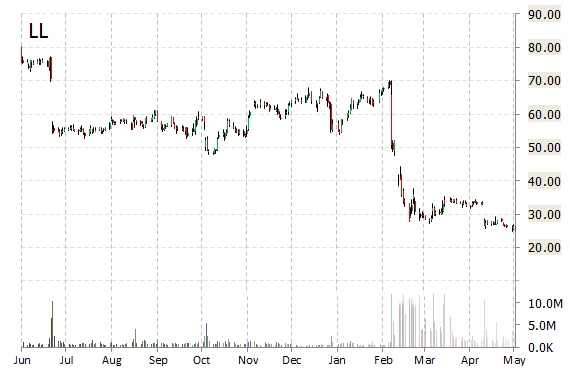

Lumber Liquidators Holdings, Inc. (LL) shares plunged 18.28% to $20.65 in pre-market trading. The company just announced that Robert M. Lynch unexpectedly notified the company of his resignation as the company’s President and CEO. Lumber Liquidators said it intends to commence a national search for Mr. Lynch’s replacement. In the interim, Thomas D. Sullivan, LL’s Founder, will serve as the acting chief executive officer of the company.

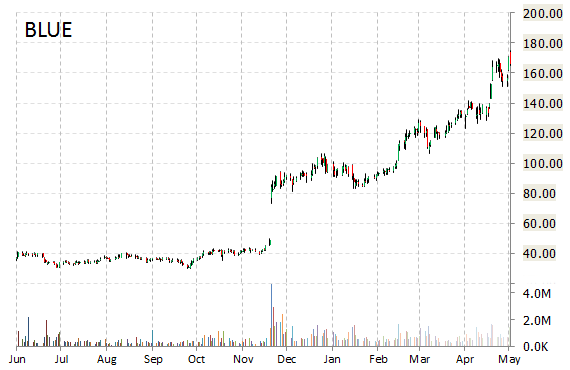

bluebird bio, Inc. (BLUE) share are up more than 19 points, or 11.67%, to $185.05 in early morning trading Thursday, after the company today announced that data from the ongoing Phase 1/2 HGB-205 study of LentiGlobin BB305 Drug Product will be presented in an oral presentation on June 13, 2015 at the 20th Congress of the European Hematology Association (EHA) in Vienna, Austria.

“The early data included in our abstract provide further validation for our approach and important insights into the safety and mechanism of action of LentiGlobin in both beta-thalassemia and sickle cell disease,” commented David Davidson, chief medical officer, bluebird bio.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply