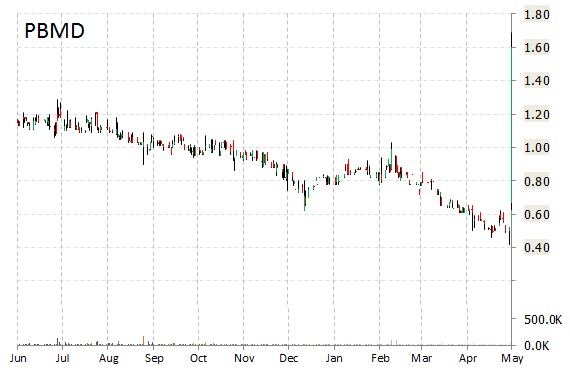

Shares of Prima Biomed Ltd. (PBMD) are higher by a staggering 297% to $6.35 in mid-day trading on 77 million shares on Wednesday following announcement that final CVac data from the Phase 2 CAN-003 ovarian cancer clinical trial has shown a trend for a clinically meaningful improvement in overall survival over standard of care in second remission patients.

“This final clinical data for CVac is most encouraging for cancer patients in second remission. We sincerely thank all patients and medical staff who have participated in the trial over the last five years. Our concerted focus will now be to find a development partner to make CVac widely available to cancer sufferers around the world,” said in a statement Prima Chairman Lucy Turnbull.

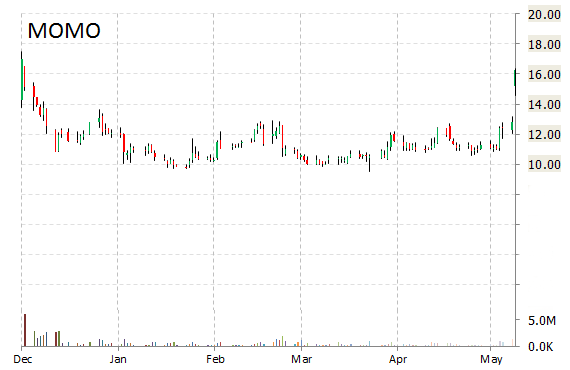

Momo Inc. (MOMO) continues yesterday’s momentum breakout rising sharply on strong volume with 5.3 million shares changing hands, well ahead of its daily average of 634,000 shares. The stock is now up 16.53% at $18.96 and has surged past its December IPO debut highs. Some continuation today could lead to additional upside momentum toward $20/shr.

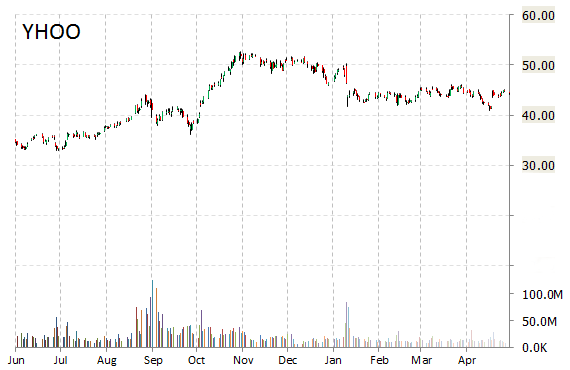

Shares of Yahoo (YHOO) are up 4.2%, at $42.70 in midday trading, bouncing back from a nearly 8% plunge at the end of yesterday’s session, following calls by Morgan Stanley (MS) and SunTrust analysts suggesting YHOO’s pullback on IRS uncertainty should be seen as a buying opportunity.

Also today, Victor Anthony of Axiom Capital Management defended the web portal. During a CNBC interview Anthony said he didn’t think potential measures from IRS will impact Alibaba (BABA) stake spin off. The analyst did acknowlege however, risks to a potential Yahoo Japan spin off.

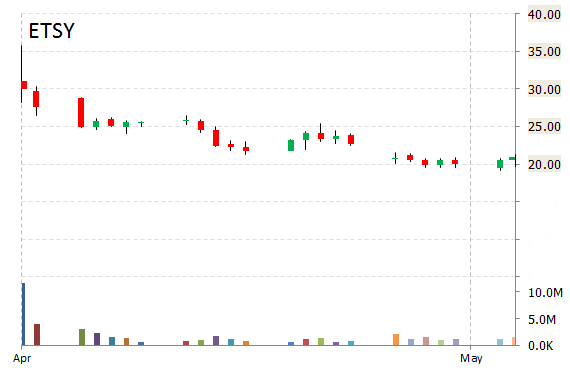

Etsy Inc (ETSY) shares are down nearly 20% to $16.81 in mid-day trading in reaction to company’s disappointing earnings. Etsy reported first quarter EPS of ($0.84) after the closing bell Tuesday, compared to the consensus estimate of $0.00. The Brooklyn, New York-based company posted a first-quarter loss of $36.6 million, or $0.84 per share, after reporting a much slimmer half a million, or $0.01 per share loss in the same period a year earlier.

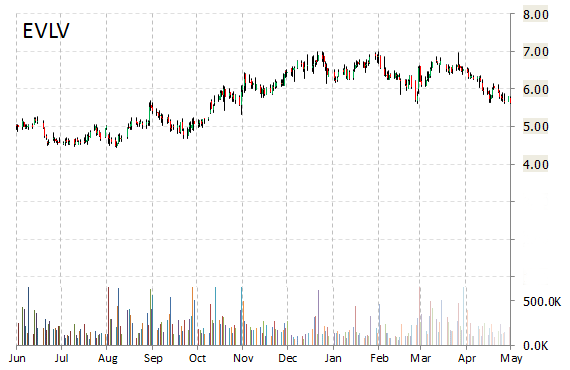

EVINE Live Inc. (EVLV) shares are down a whopping 37% to $3.53 in mid-day trading. The move comes on a big volume too with the issue currently trading more than 4.7 million shares, compared to the average volume of 220K shares. The digital commerce company today reported earnings of ($0.04) per share $0.08 worse than estimates. Revenues fell 0.8% year-over-year to $158.5 million versus the $165.16 million consensus.

Mark Bozek, EVINE Live CEO, stated, “While we hoped to deliver top line growth of at least 3%, several factors including a lower than ideal average selling price in Watches, discounting excess textiles inventory on-air and lower shipping revenues worked against us. These factors also contributed to the decrease in our adjusted EBITDA to $2 million.”

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply