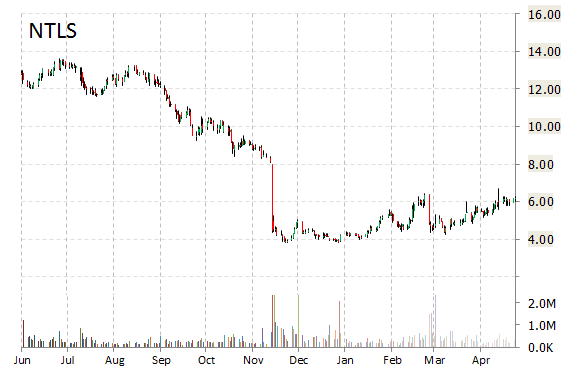

Ntelos Holdings (NTLS) was up more than 20% to $7.71 in early trade following an FT Alphaville story suggesting the regional cellphone company may be a possible takeover target with Shenandoah Telecommunications (SHEN) as suitor. Approximately 2.6 million shares have already changed hands, compared to the stock’s average daily volume of 329K shares.

Fundamentally, NTLS, with its 52-week range being $3.85 to $14.75, shows the following financial data:

- $105.6 million in cash in most recent quarter

- $708.5 million t-12 total assets

- $485.96 million t-12 revenue

- $15.28 million, or $0.65/shr Q1/15 net income

- $86.4 million operating cash flow

On valuation measures, Ntelos Holdings Corp. shares have a T-12 price/sales ratio of 0.27. EPS is ($1.95). The name has a market cap of $159.81 million and a median Wall Street price target of $8.25 with a high target of $12.00. Currently there are 2 analysts that rate NTLS a ‘Buy’, 4 rate it a ‘Hold’. No analyst rates it a ‘Sell’.

In terms of share statistics, Ntelos Holdings Corp. has a total of 22.20 million shares outstanding with 2.06% held by insiders and 87.70% held by institutions. The stock’s short interest currently stands at 18.55%, bringing the total number of shares sold short to 3.19 million.

Shares of Waynesboro, Virginia-based company are down 53.17% year-over-year ; up 48% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply