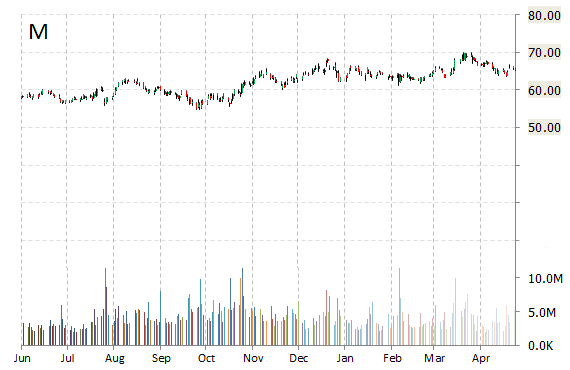

Macy’s, Inc. (M) reported first quarter EPS of $0.56 before the opening bell Wednesday, compared to the consensus estimate of $0.63. Revenues declined 0.7% from last year to $6.23 billion. Analysts expected revenues of $6.32 billion. The department store operator’s net income was $193 million, or $0.56 per share, in Q1 ended May 2 from $224 million, or $0.60 per share, a year earlier.

Same-store sales on an owned plus licensed basis declined 0.1%, compared with the consensus for an increase of 1.1%. On an owned basis, first quarter comparable sales declined by 0.7 percent.

For full year 2015, M provided EPS guidance of $4.70 – $4.80 versus consensus of $4.79 per share. The company also issued revenue projection of $28.4 billion, compared to the consensus revenue estimate of $28.45 billion. Separately, Macy’s said it was increasing its quarterly dividend to 36 cents a share from 31.25 cents, and increasing the share repurchase program by $1.5 billion.

The stock is currently down $0.58 to $64.75 on 225K shares.

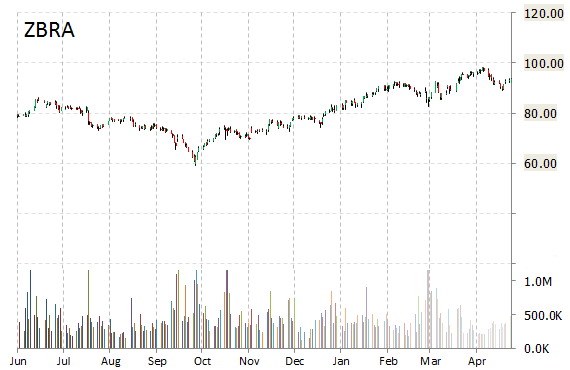

Shares of Zebra Technologies Corporation (ZBRA) rallied $3.30 to $97.00 after the company released its earnings results on Wednesday. The firm reported Q1’15 EPS of $1.39 per share vs. $1.11 consensus on $893.2 million in revenue, up 210% from a year ago. Q1 gross margin was 45.8%, down 5.5 points from 51.3% a year earlier. The company’s net income for the period came in at ($25.3) million, or ($0.50) per diluted share, from a profit of $41.6 million, or $0.82 per diluted share, a year earlier.

The manufacturer of direct thermal transfer label printers guided Q2/15 revenues of $865 – $895 million, as compared to analysts’ expectations of $877.04 million. The management also gave its bottom line range of $1.00 – $1.25 per share, against projections of $1.16 per share.

On valuation measures, Zebra Technologies Corp. Cl A shares, which currently have an average 3-month trading volume of 357K shares, trade at a trailing-12 P/E of 148.67, a forward P/E of 13.79 and a P/E to growth ratio of 1.41. The median Wall Street price target on the name is $101.00 with a high target of $116.00. Currently ticker boasts 3 ‘Buy’ endorsements, compared to 2 ‘Holds’ and no ‘Sell’.

Profitability-wise, ZBRA has a t-12 profit and operating margin of 1.94% and 13.25%, respectively. The $4.85 billion market cap company reported $329.5 million in cash vs. $3.14 billion in debt in its most recent quarter.

ZBRA currently prints a one year return of about 26% and a year-to-date return of around 21%.

The chart below shows where the equity has traded over the last 52 weeks.

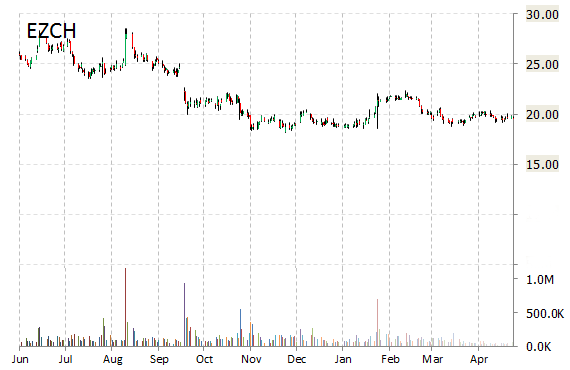

EZchip Semiconductor Ltd. (EZCH) dropped $5.36, or 27.30%, to $14.24 in pre-market trading after it reported fiscal results for the first quarter.

In its quarterly report, the semiconductor company said it earned $0.24 per share, well above the $0.23 per share analysts were expecting. Revenue rose 32.6% to $26.91 million, above views for $26.5 million. Q1 net income was a loss of $8.3 million, or ($0.28) per share (diluted), compared to net income of $6.1 million, or $0.21 per share (diluted), in the first quarter of 2014.

Cash Position: EZchip’s Q1 cash, cash equivalents, marketable securities and deposits totaled $184.1 million vs. $185.8 million as of Dec. 31, 2014. Operating cash flow was $7.7 million.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply