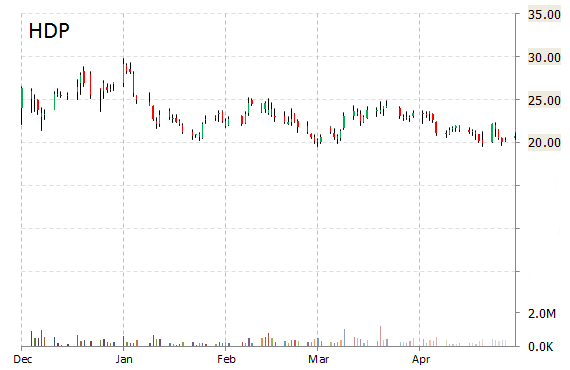

Hortonworks, Inc. (HDP) shares are up $3.21, or 14.73%, to $25.00 in after-hours trading Tuesday after the company reported its first quarter earnings results.

The tech firm reported non-GAAP earnings of ($0.77) per share on revenues of $22.8 million, up 168.2% from $8.5 million a year ago. Analysts were expecting EPS of ($0.82) on revenues of $18.2 million. Q1 gross profit was $11.3 million, up from $2.6 million a year earlier. The company’s GAAP net loss for the period came in at $40.13 million, or ($0.77) per basic and diluted share, compared to a GAAP net loss of $20.3 million or ($5.25) per basic and diluted share in Q1/14.

“We are pleased with our first quarter performance which was highlighted by strong revenue growth and the addition of 105 new support subscription customer logos,” said in a press release Rob Bearden, CEO and chairman of Hortonworks. “This brings our support subscription customer base to over 400 and represents over 200% year-over-year growth in our customer base. Coupled with our 143% dollar-based net expansion rate over the trailing four quarters, it is becoming more evident that our land and expand strategy is leading to rapid Hadoop adoption across many enterprise organizations.”

For Q2/15, HDP provided revenue guidance of $22.5 – $23.5 million, compared to the consensus revenue estimate of $20.36 million.

Cash & Investments: As of March 31, 2015, Hortonworks said it had cash and investments of $170.6 million, compared to $204.5 million as of December 31, 2014.

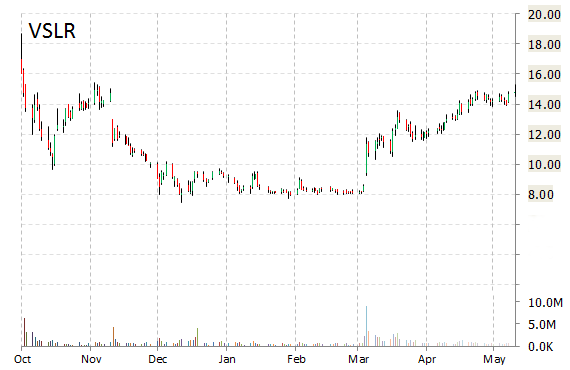

Vivint Solar, Inc. (VSLR) reported first quarter non-GAAP EPS of ($0.57) after the closing bell Tuesday, compared to the consensus estimate of ($0.37). Revenues increased 171.4% from last year to $9.5 million. Analysts expected revenues of $8.06 million. Q1/15 net income loss was $59.9 million, or ($0.57) per diluted share, compared to a net loss of $36.5 million, or ($0.49) per diluted share a year earlier.

The solar company said it installed 46 MW worth of solar cells in the first quarter, a 131% increase from the year-ago quarter. Vivint Solar, which guided Q2/15 revenues of $14 to $15 million, as compared to analysts’ expectations of $17.13 million, expects to install 63 MW to 67 MW worth of solar cells in the second quarter.

VSLR is currently down $1.10 to $13.87 on 1.24 million shares.

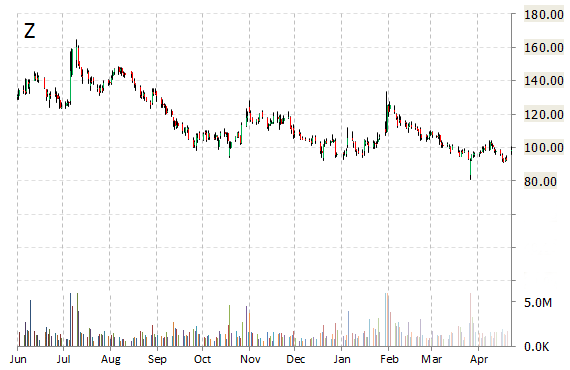

Shares of Zillow Group, Inc. (Z) are down $0.03 to $97.98 after the company released its earnings results on Tuesday. The firm reported non-GAAP Q1’15 EPS of $0.05 per share vs. ($0.12) consensus on $127.3 million in revenue, up 92.3% from a year ago. Pro forma net loss for the first quarter was $17.8 million, compared to a net loss of $23.8 million in the first quarter of 2014.

“The combined team at Zillow Group is executing extremely well across all of our brands and marketplaces,” stated Zillow Group CEO Spencer Rascoff. “Our already massive audience of home shoppers continues to grow throughout our network of brands, and we are rapidly recognizing the benefits of scale

For fiscal year 2015, Zillow issued revenue projection of $690 million, compared to the consensus revenue estimate of $678 million. The company said it filed a delay to its 10-Q citing Trulia acquisition, and that it expects to file the Form 10-Q with the Commission within five calendar days of the original prescribed date.

On valuation measures, Zillow Group Inc. Cl A shares, which currently have an average 3-month trading volume of 2.00 million shares, trade at a forward P/E of 63.21 and a P/E to growth ratio of 12.68. The median Wall Street price target on the name is $108.50 with a high target of $130.00. Currently ticker boasts 5 ‘Buy’ endorsements, compared to 11 ‘Holds’ and no ‘Sell’.

Profitability-wise, Z has a t-12 profit and operating margin of (13.38%) and (6.12%), respectively. The $5.73 billion market cap company reported $308 million in cash vs. $230 million in debt in its most recent quarter.

Z shares have declined 7% since the beginning of the year. The stock has returned 1.13% in the last 52 weeks.

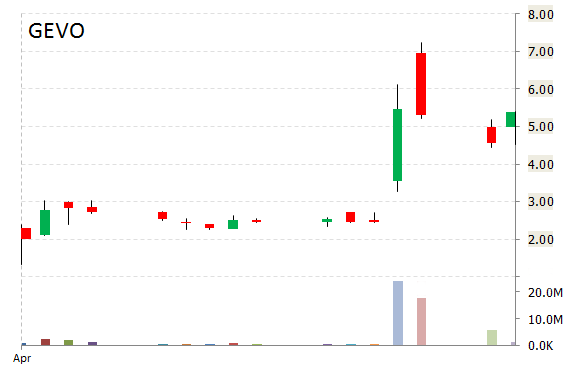

Gevo, Inc. (GEVO) jumped nearly 10% to $5.14 in after-hours trading after it reported fiscal results for the first quarter.

In its quarterly report, the renewable chemicals and biofuels company said it earned ($0.88) per share, well above the ($1.20) single estimate. Q1/15 revenues rose more than 553% to $5.9 million, from $0.9 million for the same quarter in 2014, and versus $6.1 million single estimate. The company said the increase in revenue during 2015 is primarily a result of the production and sale of approximately $5.1 million of ethanol and distiller’s grains following the transition of the Luverne plant to the SBS configuration configuration.

On valuation measures, Gevo Inc. shares trade at a P/E to growth ratio of (0.04). The median Wall Street price target on the name is $15.00 with a high target of $15.00. Currently ticker has 1 ‘Buy’ endorsements, compared to 1 ‘Hold’ and no ‘Sell’.

Profitability-wise, GEVO has a t-12 profit and operating margin of (145.56%) and (140.72%), respectively. The $44.00 million market cap company ended the first quarter with $4.3 million in cash vs. $49.6 million in total liabilities.

GEVO currently prints a one year loss of about 69% and a year-to-date loss of 2.50%.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply