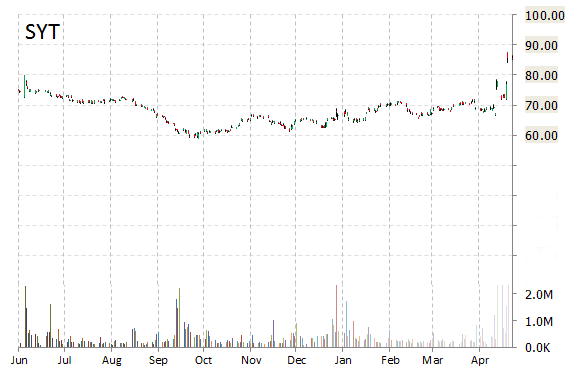

Analysts at JP Morgan (JPM) are out with a report today upgrading shares of Syngenta AG (SYT) with a ‘Neutral‘ from ‘Underweight‘ rating.

Syngenta AG ADS shares are currently priced at 24.65x this year’s forecasted earnings, compared to the industry’s 15.80x earnings multiple. Ticker has a trailing P/E of 24.64 and t-12 price-to-sales ratio of 2.59. EPS for the same period is $3.52.

In the past 52 weeks, shares of Basel, Switzerland-based agribusiness company have traded between a low of $58.72 and a high of $87.54 and are now at $86.76. Shares are up about 14% year-over-year and 38% year-to-date.

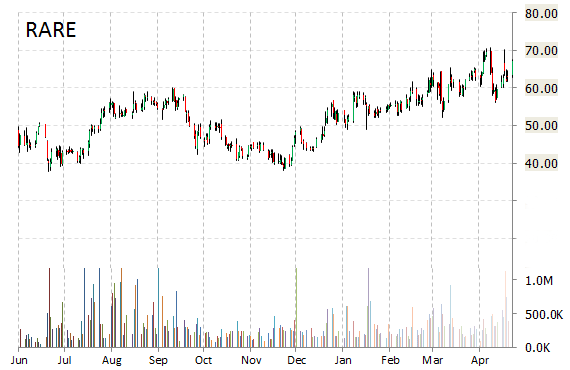

Ultragenyx Pharmaceutical Inc. (RARE) was reiterated a ‘Buy’ by Canaccord Genuity analysts on Tuesday. The broker also raised its price target on the stock to $78 from $68, implying 5.40% expected upside.

RARE is up $6.98 at $74.20 on heavy volume. Midway through trading Tuesday, 564K shares of Ultragenyx Pharmaceutical Inc. have exchanged hands as compared to its average daily volume of 336K shares. The stock ranged in a price between $63.52-$75.47 after having opened the day at $67.30 as compared to the previous trading day’s close of $67.22.

Over the past year, shares of Novato, California-based clinical-stage biopharmaceutical company have traded between a low of $32.02 and a high of $75.47. Shares are up more than 53% this year.

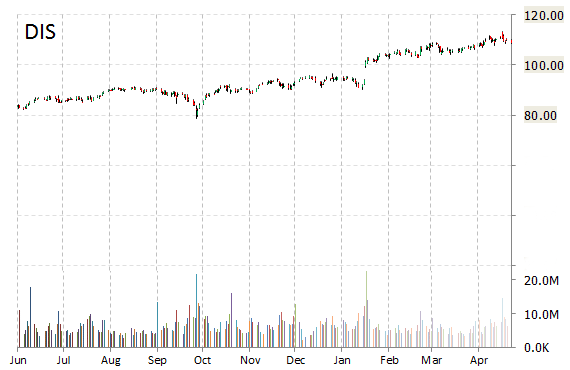

The Walt Disney Company (DIS) rating of ‘Hold’ was reiterated today at Deutsche Bank (DB) with a price target increase of $120 from $105 (versus a $108.60 previous close).

The Walt Disney Company, currently valued at $185.46 billion, has a median Wall Street price target of $120.00 with a high target of $132.00. Approximately 3.8 million shares have already changed hands, compared to the stock’s average daily volume of 5.88 million.

In the past 52 weeks, shares of the entertainment company have traded between a low of $78.54 and a high of $113.30 with the 50-day MA and 200-day MA located at $107.73 and $99.19 levels, respectively. Additionally, shares of DIS trade at a P/E ratio of 1.50 and have a Relative Strength Index (RSI) and MACD indicator of 53.45 and -0.43, respectively.

DIS currently prints a year-to-date return of around 16%.

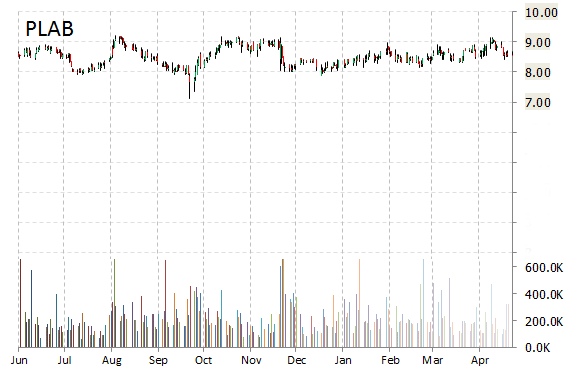

Shares of Photronics Inc. (PLAB) are up $0.62 to $9.19 in mid-day trading after Needham reiterated its ‘Buy’ rating and raised its 12-month base case estimate on the name by 1 point to $12 a share.

PLAB shares recently gained $0.61 to $9.18. In the past 52 weeks, shares of Tulsa, Oklahoma-based photomasks manufacturer have traded between a low of $7.11 and a high of $9.38. Shares are down 3.60% year-over-year ; up 3.13% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply