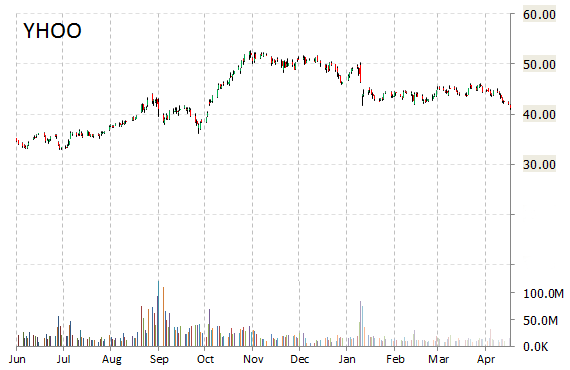

Yahoo! Inc. (YHOO) was reiterated a ‘Buy’ by MKM Partners analysts on Wednesday, noting the stock is attractive as management continues to be aggressive in unlocking value through buy-backs and asset divestitures, while pruning expenses and re-positioning company for growth. The broker however, cut its price target on the name to $58 from $61.

YHOO shares recently gained 23c to $41.53. In the past 52 weeks, shares of Sunnyvale, California-based web portal have traded between a low of $32.93 and a high of $52.62. Shares are up 11.89% year-over-year ; down 18.23% year-to-date.

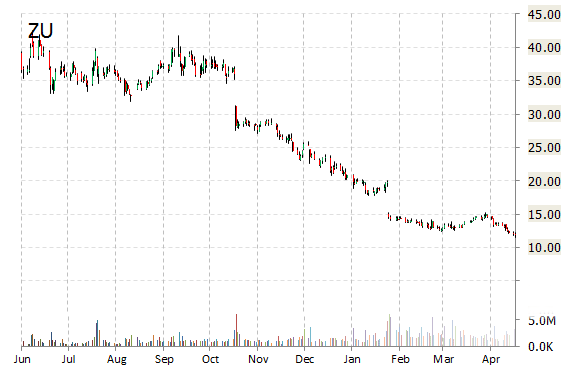

zulily, Inc. (ZU) was reiterated as ‘Hold’ with a $10 from $18 price target on Wednesday by Canaccord Genuity. The firm believes rising social media ad prices and less effective marketing spend are all contributing to weakened guidance. For Q2/15, ZU provided EPS revenue guidance of $285 – $300 million, compared to the consensus revenue estimate of $361.67 million.

zulily, Inc. shares are currently priced at 91.77x this year’s forecasted earnings compared to the industry’s 33.91x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.23 and 24.01, respectively. Price/Sales for the same period is 1.23 while EPS is $0.11. Currently there are 4 analysts that rate ZU a ‘Buy’, 8 rate it a ‘Hold’. No analyst rates it a ‘Sell’. ZU has a median Wall Street price target of $18.00 with a high target of $24.00.

In the past 52 weeks, shares of Seattle, Washington-based online retailer have traded between a low of $9.10 and a high of $42.56 and are now at $10.10. Shares are down 75.60% year-over-year and 50% year-to-date.

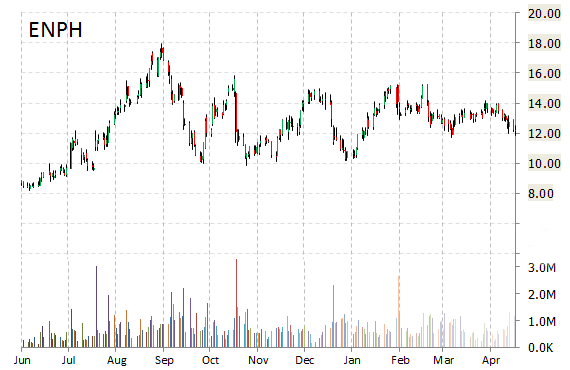

Enphase Energy, Inc. (ENPH) rating of ‘Buy’ was reiterated today at Canaccord Genuity but with a price target reduction of $16 from $18 (versus a $12.11 previous close).

On valuation measures, Enphase Energy Inc. shares have a PEG and forward P/E ratio of 1.28 and 13.44, respectively. Price/Sales for the same period is 1.55 while EPS is ($0.19). Currently there are 7 analysts that rate ENPH a ‘Buy‘, 4 rate it a ‘Hold‘. 1 analyst rates it a ‘Sell‘. ENPH has a median Wall Street price target of $18.00 with a high target of $20.00.

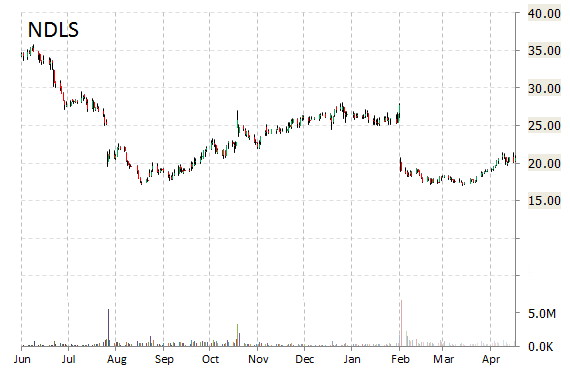

Shares of Noodles & Company (NDLS) are down $4.03 to $16.68 in mid-day trading after UBS reiterated its ‘Neutral’ rating and lowered its 12-month base case estimate on the name by 5 points to $18 a share.

NDLS is currently printing a higher than average trading volume with the issue trading 2.74 million shares, compared to the average volume of 426K shares. The stock began trading this morning at $16.50 to currently trade 19.33% lower from the prior days close of $20.71. On an intraday basis it has gotten as low as $16.14 and as high as $17.70.

Noodles & Co. Cl A shares are priced at 45.15x this year’s forecasted earnings, compared to the industry’s 30.32x earnings multiple. The company’s current year and next year EPS growth estimates stand at 18.40% and 22.20% compared to the industry growth rates of 19.00% and 14.80%, respectively. NDLS has a t-12 price-to-sales ratio of 1.53. EPS for the same period registers at $0.37.

Noodles shares have advanced 16.22% in the last 4 weeks and declined 19.16% in the past three months. Over the past 5 trading sessions the stock has lost 0.67%.

The Broomfield, Colorado-based company, which is currently valued at $498.32 million, has a median Wall Street price target of $23.00 with a high target of $27.00. Noodles & Co. is down 40.95% year-over-year, compared with a 11.25% gain in the S&P 500.

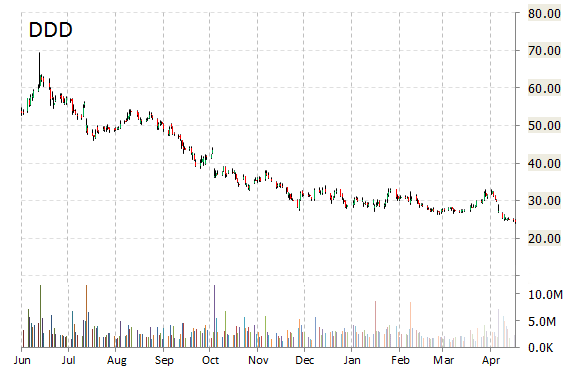

Shares of 3D Systems Corporation (DDD) are down $1.53 at $22.68, after being downgraded to ‘Hold’ from ‘Buy’ at Stifel.

DDD shares recently lost $1.54 to $22.67. The stock is down 49.66% year-over-year and has lost 26.35% year-to-date. In the past 52 weeks, shares of Rock Hill South, Carolina-based company have traded between a low of $22.22 and a high of $69.56.

3D Systems Corp. closed Tuesday at $24.21. The name has a current market cap of $2.53 billion.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply