Abiomed, Inc. (ABMD) shares are up $9.36, or 14.37%, to $74.50 in pre-market trading Tuesday after the company reported its fourth quarter earnings results.

The maker of heart devices posted earnings of $2.24 per share on revenues of $67.55 million, up 33.9% from a year ago. Analysts were expecting EPS of $0.17 on revenues of $62.40 million. Q4 gross margin was 84%, up from 79.9% a year earlier. The company’s net income for the period came in at $98.87 million, or $2.24 per diluted share, from $3.62 million, or $0.09 per diluted share, a year earlier.

“This quarter and fiscal year, Abiomed executed and achieved high growth, regulatory approvals, sustainable profitability and is positioned to address a substantial clinical need as Impella becomes the standard of care,” stated Michael R. Minogue, Chairman, President and Chief Executive Officer, Abiomed.

On March 23, Abiomed and the FDA announced that the Impella 2.5 had received FDA approval for elective and urgent high risk percutaneous coronary intervention (PCI) procedures, making it the only FDA-approved percutaneous hemodynamic support device determined to be safe and effective for the high risk PCI indication.

For full fiscal year 2016, ABMD provided revenue guidance of $285 – $295 million, compared to the consensus revenue estimate of $266.79 million.

On valuation measures, Abiomed Inc. shares, which currently have an average 3-month trading volume of 553,942.00 shares, trade at a trailing-12 P/E of 148.38, a forward P/E of 116.32 and a P/E to growth ratio of 7.52. The median Wall Street price target on the name is $68.50 with a high target of $89.00. Currently ticker boasts 4 ‘Buy’ endorsements, compared to 5 ‘Holds’ and no ‘Sell’.

Liquidity: As of March 31, 2015 cash, cash equivalents, short and long-term marketable securities totaled $146 million. The $2.60 billion market cap company has no debt.

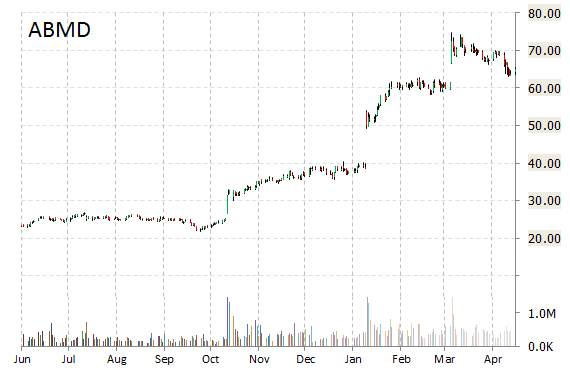

ABMD currently prints a one year return of 186.83% and a year-to-date return of 71.15%.

The chart below shows where the equity has traded over the last 52 weeks.

The Walt Disney Company (DIS) reported second quarter EPS of $1.23 before the opening bell Tuesday, compared to the consensus estimate of $1.11. Revenues increased 7% from $11.6 billion last year to $12.46 billion. Analysts expected revenues of $12.25 billion. Net income for the the quarter ended March 28 was $2.108 billion, or $1.23 a share, up from $1.917 billion, or $1.08 a share, in the year-earlier period.

“Our second quarter performance, marked by increased revenue, net income and EPS of $1.23, demonstrates the incredible ability of our strong brands and quality content to drive results,” said in a statement Robert A. Iger, chairman and chief executive officer of The Walt Disney Company. “The power of this winning combination is once again reflected in the phenomenal worldwide success of Marvel’s Avengers: Age of Ultron, which has opened at number one in every market so far.”

Profitability-wise, DIS has a t-12 profit and operating margin of 15.72% and 24.22%, respectively. The $188.70 billion market cap company reported $3.74 billion in cash in its most recent quarter.

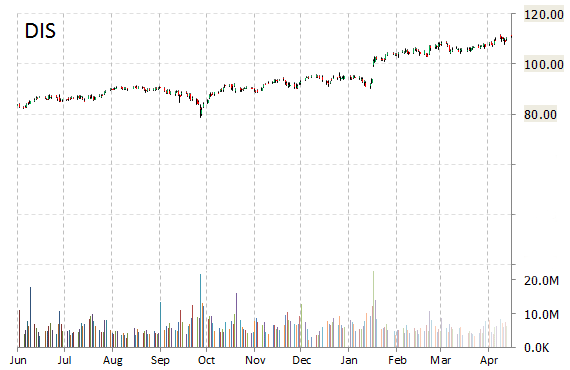

DIS currently prints a one year return of about 40% and a year-to-date return of around 18%.

The stock is currently up $2.57 to $113.60.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply