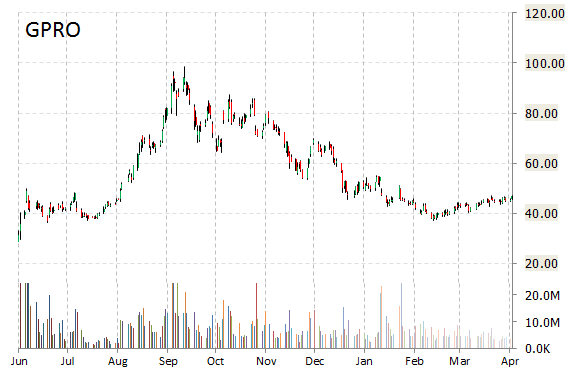

Analysts at Dougherty & Company are out with a report this morning raising their GoPro, Inc. (GPRO) target to $65 from $55. The firm believes Tuesday’s earnings report delivered the desired results and added to their conviction. Northland Capital also raised their GPRO 12-month base case estimate to $76 from $70. They believe the market opportunity is significantly larger than investors currently understand.

GoPro Inc. shares are currently priced at 57.26x this year’s forecasted earnings, compared to the industry’s 12.72x earnings multiple. Ticker has a forward P/E of 31.17 and t-12 price-to-sales ratio of 4.35. EPS for the same period is $0.92.

In the past 52 weeks, shares of San Mateo, California-based company have traded between a low of $28.65 and a high of $98.47 and are now at $52.74. Shares are down 25.62% year-to-date.

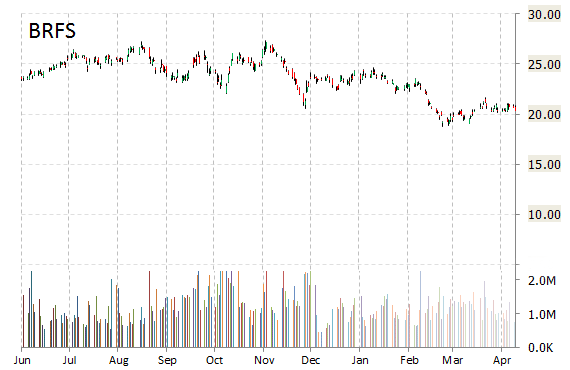

Analysts at BofA/Merrill (BAC) upgraded their rating on the shares of BRF S.A. (BRFS). In a research note published on Wednesday, the banking giant lifted the name with a ‘Buy‘ from ‘Neutral‘ rating.

On valuation measures, BRF S.A. ADS shares are currently priced at 25.89x this year’s forecasted earnings compared to the industry’s 23.12x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.50 and 6.07, respectively. Price/Sales for the same period is 1.81 while EPS is $0.84. Currently there are 6 analysts that rate BRFS a ‘Buy‘, 5 rate it a ‘Hold‘. 2 analysts rate it a ‘Sell‘. BRFS has a median Wall Street price target of $23.97 with a high target of $28.00.

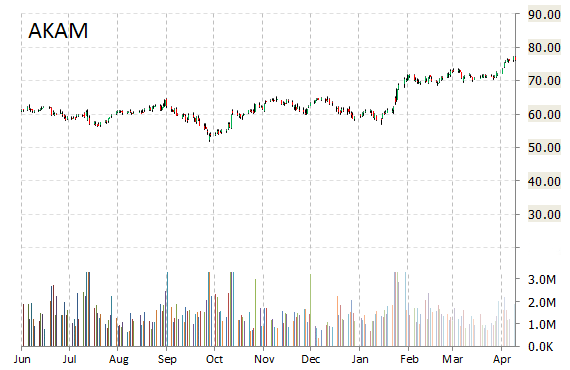

Akamai Technologies, Inc. (AKAM) was raised to ‘Buy‘ from ‘Hold‘ and it was given a $79 from $73 price target at Deutsche Bank (DB) on Wednesday.

AKAM is down $1.59 at $74.48 on heavy volume. Midway through trading Wednesday, 3.66 million shares of Akamai Technologies Inc. have exchanged hands as compared to its 3-month average daily volume of 1.31 million shares. The stock ranged in a price between $73.00-$75.00 after having opened the day at $73.64 as compared to the previous trading day’s close of $76.07.

In the past 52 weeks, shares of Cambridge, Massachusetts-based cloud services provider have traded between a low of $51.10 and a high of $77.31. Shares are up 48.75% year-over-year and 20.82% year-to-date.

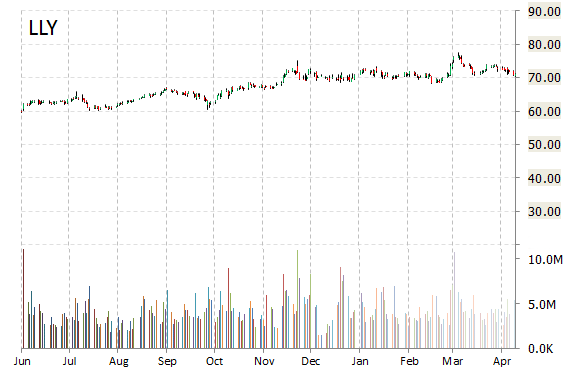

Eli Lilly and Company (LLY) was upgraded to ‘Buy‘ from ‘Neutral‘ by Citigroup (C) analysts on Wednesday. The New York-based investment bank also raised its price target on the stock to $100 from $66, implying 52% expected return.

LLY is currently printing a higher than average trading volume with the issue trading 4.66 million shares, compared to the average volume of 4.51 million. The stock began trading this morning at $71.86 to currently trade 1.53% higher from the prior days close of $71.18. On an intraday basis it has gotten as low as $71.85 and as high as $72.82.

Eli Lilly & Co. shares are priced at 32.40x this year’s forecasted earnings, compared to the industry’s 1.97x earnings multiple. The company’s current year and next year EPS growth estimates stand at 13.70% and 11.40% compared to the industry growth rates of 1.10% and 27.00%, respectively. LLY has a t-12 price-to-sales ratio of 3.85. EPS for the same period registers at $2.23.

LLY shares have declined 3.26% in the last 4 weeks and less than one percent in the past three months. Over the past 5 trading sessions the stock has lost 1.43%. The Indianapolis, Indiana-based company, which is currently valued at $76.64 billion, has a median Wall Street price target of $74.00 with a high target of $95.00. Eli Lilly & Co. is up 24.46% year-over-year, compared with a 12.25% gain in the S&P 500.

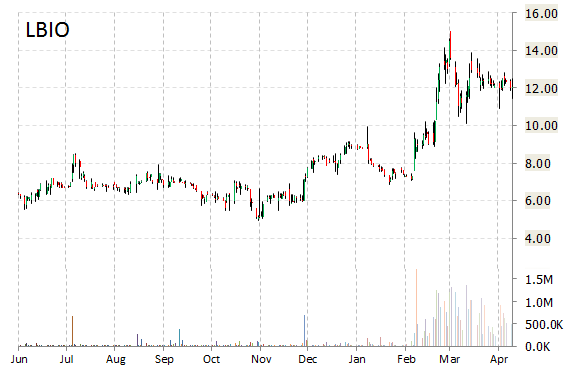

Investment analysts at Chardan Capital Markets initiated coverage on shares of Lion Biotechnologies, Inc. (LBIO) in a note issued to investors on Wednesday. The firm set a ‘Buy‘ rating and a $30 price target on the stock. The firm’s 12-month case base estimate would suggest a potential upside of 146% from the stock’s current pps of $12.21.

Lion Biotechnologies Inc., currently valued at $546.78 million, has a median Wall Street price target of $19 with a high target of $21. Approximately 493K shares have already changed hands, compared to the stock’s average daily volume of 708K shares a day.

In the past 52 weeks, shares of Woodland Hills, Calif.-based company have traded between a low of $4.97 and a high of $15.03 with the 50-day MA and 200-day MA located at $12.33 and $8.57 levels, respectively. Additionally, shares have a Relative Strength Index (RSI) and MACD indicator of 56.07 and -0.14, respectively.

Lion Biotechnologies Inc. currently prints a year-to-date return of around 54%.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply