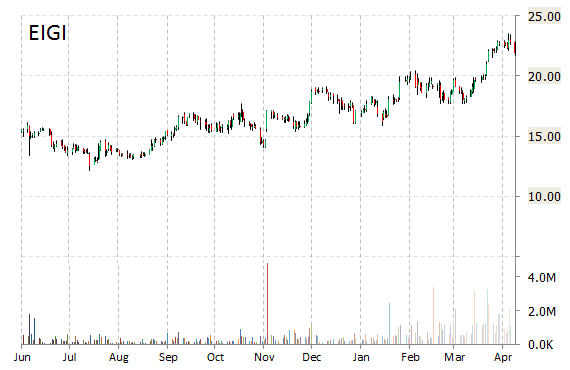

Shares of Endurance Int’l Group Holdings, Inc (EIGI) plunged nearly 20% to $18.23 in early trading Tuesday, following a report from Gotham City Research suggesting EIGI shares will go to zero. The report also notes that “40%-100%+ of EIGI’s reported profits are suspect” and that “the management team (including the CEO) recently sold 30% of their stake” in the provider of cloud-based platform solutions. Ticker’s trading volume jumped on the report with the issue currently trading more than 4.3 million shares, compared to the average volume of 1 million shares a day.

Fundamentally, EIGI shows the following financial data:

- $32.38 million in cash in most recent quarter

- $1.75 billion t-12 total assets

- $205.04 million total equity

- $629.84 million t-12 revenue

- ($42.84) million annual net income

- $118.99 million free cash flow

On valuation measures, Endurance International Group Holdings Inc. shares have a T-12 price/sales ratio of 4.61 and a price/book for the same period of 16.47. EPS is ($0.34). The name has a market cap of $2.43 billion and a median Wall Street price target of $23.00 with a high target of $28.00. Currently there are 6 analysts that rate EIGI a ‘Buy’, 2 rate it a ‘Hold’. No analyst rates it a ‘Sell’.

In terms of share statistics, Endurance International Group Holdings Inc. has a total of 132.37 million shares outstanding with 10.08% held by insiders and 85.70% held by institutions. The stock’s short interest currently stands at 9.02%, bringing the total number of shares sold short to 6.76 million.

Shares of Burlington, Massachusetts-based company are up 40% year-over-year ; down about 5% year-to-date.

Update: Endurance International Group today released a statement in response to a report released by Gotham City Research. The company said, “The claims in this ‘report’ are baseless and not rooted in reality. The reality is, since going public, Endurance has beat expectations every quarter, showing consistent growth throughout the company. Endurance senior executives still own a significant stake in the company and are deeply invested in its future success.”

To read the full release click here.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply