The Container Store Group, Inc. (TCS) shares are down nearly 25% to $16.35 in after-hours trading Monday after the company reported its fourth quarter earnings results.

The retailer reported earnings of $0.24 per share on revenues of $224 million, up 3.3% from a year ago. Analysts were expecting EPS of $0.31 on revenues of $233.58 million.

For the current quarter, net income was $224.3 million, up 3.4% as compared to $216.8 in the fourth quarter of fiscal 2013. Comparable store sales fell 1.4% in Q4. For full fiscal year 2014, net sales were $781.9 million, up 4.5% yoy from $748.5 million.

For Q1/15, TCS provided EPS guidance of ($0.19)-($0.11) versus consensus of ($0.05) per share.

Profitability-wise, TCS has a t-12 profit and operating margin of 3.61% and 5.49%, respectively. The $1.04 billion market cap company reported $25 million in cash vs. $334.9 million in debt in its most recent quarter.

TCS currently prints a one year loss of about 30% and a year-to-date return of 12.23%.

The chart below shows where the equity has traded over the last 52 weeks.

Amkor Technology, Inc. (AMKR) reported first quarter non-GAAP EPS of $0.12 after the closing bell Monday, compared to the consensus estimate of $0.10. Revenues increased 6.7% from last year to $742.88 million. Analysts expected revenues of $745.1 million. Net income was $28.7 million, or $0.12 per share, compared with net income of $20.6 million, or $0.09/shr in the first quarter of 2014.

“First quarter results met our expectations,” said in a statement Steve Kelley, Amkor’s president and chief executive officer. “Sales grew 7% year-on-year driven by strong demand for our advanced packaging and test technologies. We saw a corresponding increase in earnings per share of $0.03 year-on-year.”

For Q2/15, AMKR provided EPS guidance of $0.05 – $0.15 versus consensus of $0.19 per share. The company also issued revenue projection of $725 – $775 million, compared to the consensus revenue estimate of $801.43 million.

The stock is currently down $0.98 to $6.96 on 2.44 million shares.

Apple Inc. (AAPL) gained $1.62 to $134.27 in after-hours trading after it reported fiscal-second quarter earnings.

The tech giant handed in earnings of $2.33 per share on revenue of $58.01 billion, beating Wall Street estimates of $2.16 per share on revenue of $56.10 billion. Gross profit margin in the quarter was 40.8%, above expectations.

As for its devices, the iPhone is still the main engine behind Apple’s success. The company said that it sold 61.2 million iPhones in the quarter, compared to Wall Street estimates of 57.26 million. iPad sales came in at 12.6 million, compared to expectations of 13.94 million. Mac units sales were 4.6 million compared to a 4.64 million estimate.

“We are thrilled by the continued strength of iPhone, Mac and the App Store, which drove our best March quarter results ever,” Apple CEO Tim Cook said in an press release.

“We’re seeing a higher rate of people switching to iPhone than we’ve experienced in previous cycles, and we’re off to an exciting start to the June quarter with the launch of Apple Watch,” he added.

Apple said in a separate release, that it would buy back $140 billion worth of its shares by the end of March 2017, up from a prior $90 billion plan. The company boosted its dividend 11% to $0.52 per share, payable on May 14, 2015 to shareholders of record as of the close of business on May 11, 2015.

Cook commented, “We believe Apple has a bright future ahead, and the unprecedented size of our capital return program reflects that strong confidence. While most of our program will focus on buying back shares, we know that the dividend is very important to many of our investors, so we’re raising it for the third time in less than three years.”

For Q3/15, Cupertino provided revenue guidance of $46 – $48 billion, compared to the consensus revenue estimate of $47.09 billion.

On valuation measures, Apple Inc. shares, which currently have an average 3-month trading volume of 41.69 million shares, trade at a trailing-12 P/E of 17.96, a forward P/E of 14.13 and a P/E to growth ratio of 1.14. The median Wall Street price target on the name is $145.00 with a high target of $185.00. Currently ticker boasts 32 ‘Buy’ endorsements, compared to 14 ‘Holds’ and 2 ‘Sell’.

Profitability-wise, AAPL has a t-12 profit and operating margin of 22.25% and 29.67%, respectively. The $772.65 billion market cap company, which needless to say, dominates the S&P 500 index as no other company has in 30 years, said its massive cash horde has hit a record $194 billion. Last quarter that figure came in at $178 billion.

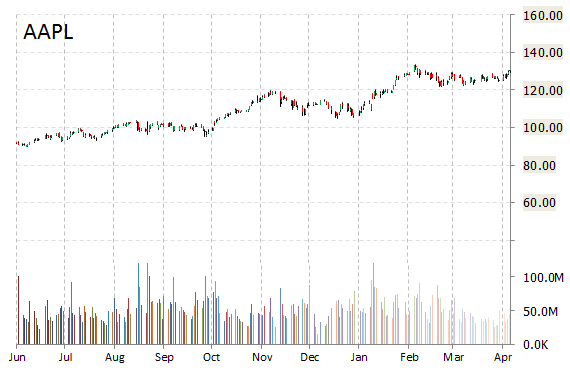

AAPL currently prints a one year return of about 64% and a year-to-date return of 18.49%.

The chart below shows where the equity has traded over the last 52 weeks.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply