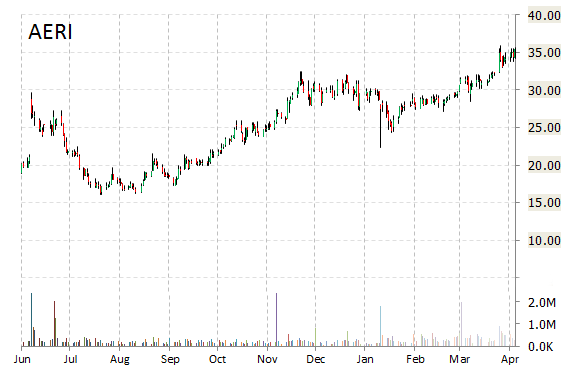

Analysts at Canaccord Genuity downgraded Aerie Pharmaceuticals, Inc. (AERI) from ‘Buy‘ to ‘Hold‘ in a research report issued to clients on Friday.

The target price for AERI is lowered from $40 to $12, implying 70% expected downside.

Shares of the $327.83 million market cap company are up 118.32% year-over-year and 21.24% year-to-date.

Aerie Pharmaceuticals Inc dropped $21.77 to $13.62 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

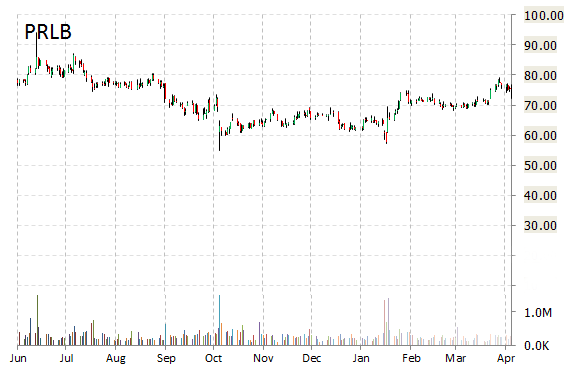

Proto Labs, Inc. (PRLB) was downgraded from ‘Buy‘ to ‘Hold‘ at Craig Hallum.

Shares have traded today between $71.46 and $75.60 with the price of the stock fluctuating between $54.97 to $94.23 over the last 52 weeks.

Proto Labs Inc. shares are currently changing hands at 45.29x this year’s forecasted earnings, compared to the industry’s 21.39x earnings multiple. Ticker has a t-12 price/sales ratio of 9.33. EPS for the same period registers at $1.60.

Shares of PRLB have lost $3.13 to $72.47 in mid-day trading on Friday, giving it a market cap of roughly $1.9 billion. The stock traded as high as $94.23 in July 1, 2014.

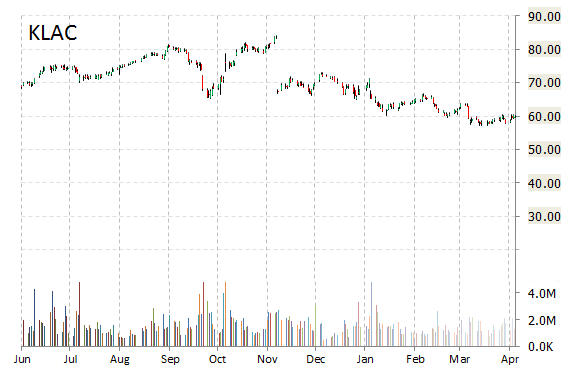

Citigroup (C) reported on Friday that they have lowered their rating for KLA-Tencor Corporation (KLAC). The firm has downgraded KLAC from ‘Buy‘ to ‘Neutral‘ and lowered its price target to $66 from $80. Citi’s new PT represents expected downside of 26% from the stock’s current price.

KLA-Tencor Corp. recently traded at $59.00, a loss of $0.85 over Thursday’s closing price. The name has a current market capitalization of $9.60 billion.

As for passive income investors, the company pays shareholders $2.00 per share annually in dividends, yielding 3.40%. Five year average dividend yield currently stands at 2.60%.

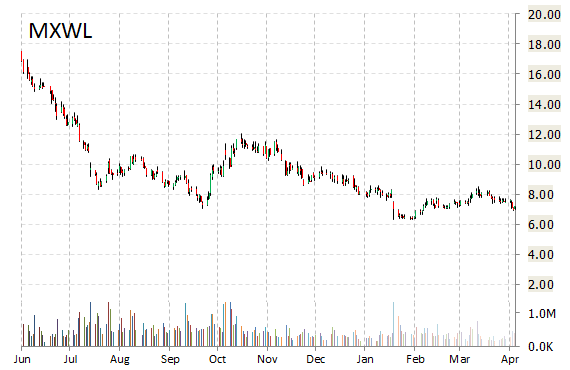

Maxwell Technologies, Inc. (MXWL) was downgraded by Canaccord Genuity from a ‘Buy‘ rating to a ‘Hold‘ rating in a research report issued to clients on Friday. They currently have a $7 price objective on the stock, 2 points lower from their previous price target.

MXWL closed at $7.18 on Thursday and is currently trading down $0.78.

In the past 52 weeks, shares of the company have traded between a low of $5.84 and a high of $18.43 and are now trading at $6.40. Shares are down 54.47% year-over-year and 21.27% year-to-date.

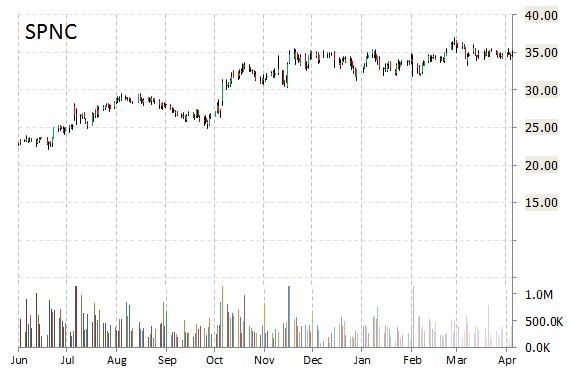

Shares of Spectranetics Corporation (SPNC) are down nearly 25% in mid-day trading after Stifel reiterated its ‘Buy’ rating while lowering its 12-month base case estimate on the name by 4 points to $34 a share.

SPNC shares recently lost $8.66 to $26.04. In the past 52 weeks, shares of Colorado Springs, Colorado-based company have traded between a low of $20.07 and a high of $37.04. Shares are up 41.23% year-over-year and 0.35% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply