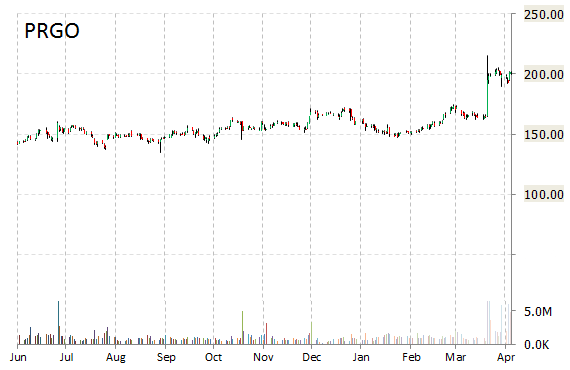

Perrigo Company plc shares (PRGO) are down 1.29% to $199.02 in early trading Friday, after Mylan N.V. (MYL) announced a non-binding proposal to acquire Perrigo for $205 in a combination of cash and Mylan stock for each Perrigo share.

Under the terms of the offer, Perrigo shareholders will receive $60 in cash and 2.2 Mylan shares (trading at about $74 on Friday morning) for each Perrigo ordinary share. Mylan, which is based in Pennsylvania, expects the combination will result in at least $800 million of annual pre-tax operational synergies by the end of year four following the consummation of the offer.

Mylan’s Executive Chairman Robert J. Coury commented, “Mylan has today begun a legally-binding process under the Irish Takeover Rules to commence its offer for Perrigo, demonstrating our commitment to making this compelling combination a reality.”

Perrigo shares are currently priced at 77.16x this year’s forecasted earnings. Ticker has a PEG and forward P/E ratio of 2.27 and 23.23, respectively. Price/sales for the same period is 6.73 while EPS is $2.57. Currently there are 8 analysts that rate PRGO a ‘Buy’, 7 rate it a ‘Hold’. No analyst rates it a ‘Sell’. PRGO has a median Wall Street price target of $203.00 with a high target of $225.00.

In the past 52 weeks, shares of the $29.64 billion market cap Dublin, Ireland-based company have traded between a low of $125.37 and a high of $215.73. Shares are up 34.88% year-over-year and 20.72% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply