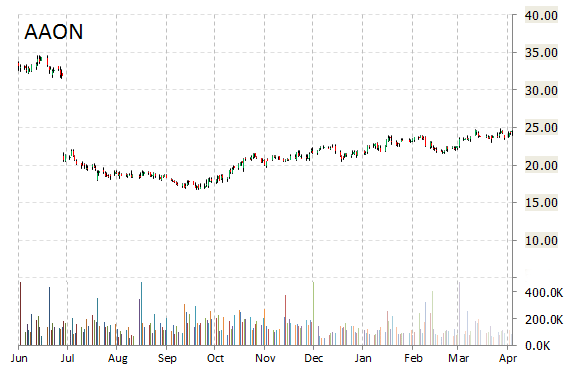

Shares of AAON Inc. (AAON) hit a new 52-week high on Thursday, printing the tape at $25.17. That’s a 50% increase, or $8.39 per share from the 52-week low of $16.78 set in Oct. 8, 2014.

The stock closed at $24.52 at the end of Wednesday’s trading session, printing a one-year return of about 35% and year-to-date return of around 9.50%.

About 99K AAON shares, currently trading up 2.52% at $25.14, have exchanged hands as of 2:58 p.m. ET today, compared to its average trading volume of about 132K shares a day. The average volume of shares traded over the last three months was roughly 126K.

The chart below shows where AAON has traded over the past year.

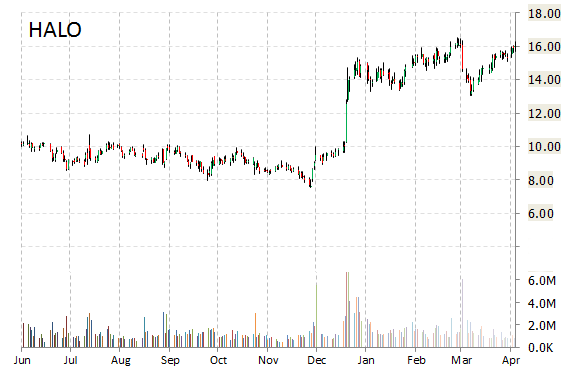

Shares of Halozyme Therapeutics, Inc. (HALO) surged 6% to hit a new 52-week high of $17.00 on Thursday on higher-than-average volume. More than 1.54 million shares of the stock have already changed hands, well above the average of 1.43 million for a full session over the past month.

Stock reaction: HALO shares have performed well over the last year, rising 104.73%. The company’s stock is up nearly 147.09% from the 52-week-low of $6.88 it reached on Apr 28, 2014.

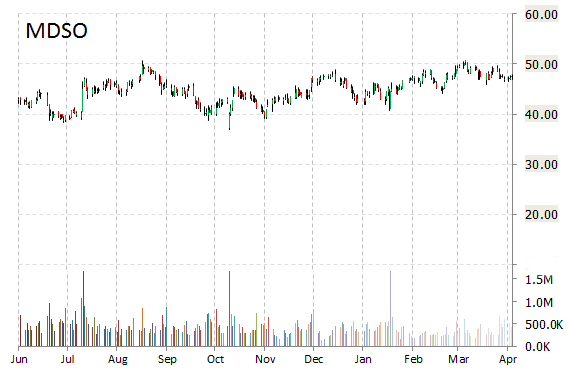

Medidata Solutions, Inc. (MDSO) climbed 20.44% to a 52-week high of $57.40 on Thursday. The move comes on a big volume too with the issue currently trading 2.3 million shares, compared to the average volume of 379K shares.

The surge came after the research software maker posted 1Q profit results that beat Wall Street estimates.

Shares of MDSO rose 18.61% to $56.53 in afternoon trading. The 52-week range for the stock is now $32.10 to $57.40. Shares of the 3.00 billion market cap company have risen 17.07% year-over-year and 0.19% year-to-date.

The chart below shows where MDSO has traded over the past 12 months.

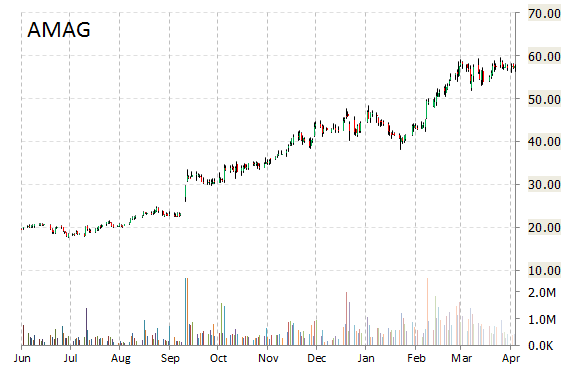

AMAG Pharmaceuticals, Inc. (AMAG) shares hit one-year high of $60.72 in today’s trading session. The stock has risen 209.77% this year and is continuing its upward trend.

More than 597,671.00 shares have changed hands, which dwarfs the average volume of 769,510.00. At current price next resistance is at $99. Support is at $88.98.

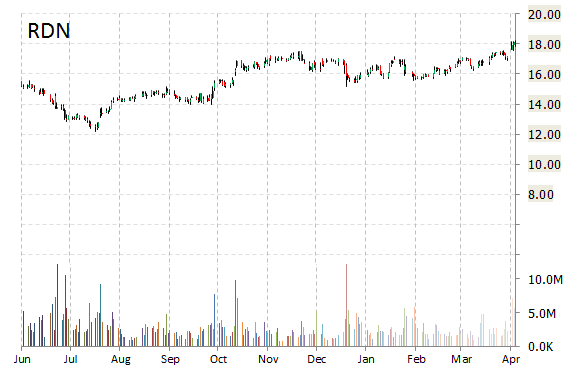

Shares of Radian Group Inc. (RDN) gained 2.21% to hit a new 52-week high of $18.50 on Thursday on lower-than-average volume. More than 2.08 million shares of the stock have already changed hands, below the average of 2.71 million for a full session over the past 3 months.

The new highs being attributed to news the mortgage-insurer will broaden some mortgage-insurance policies to provide relief when borrowers lose their jobs.

RDN shares have performed well over the last year, rising 25.18%. The company’s stock is up nearly 51.89% from the 52-week-low of $12.18 it reached on August 4, 2014.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply