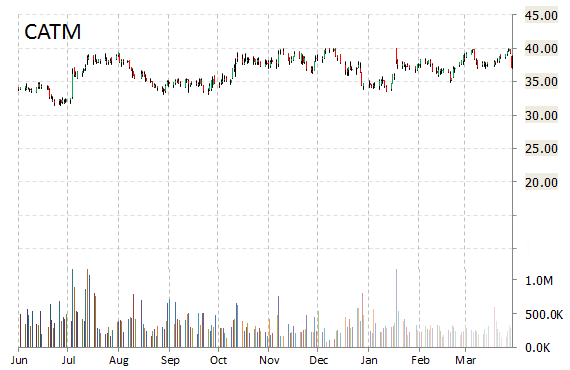

Cardtronics Inc. (CATM) gained nearly 4% in Friday’s extended session to $38.34. The move came on a strong volume too with the issue trading more than 930K shares, well above the average of 313K for a full session over the past 3 months. CATM plunged more than two points, or 5.88%, to $37 before the closing bell on a day it issued no news.

On valuation measures, CATM shares are currently priced at 44.85x this year’s forecasted earnings. The company’s current year and next year EPS growth estimates stand at 15.40% and 13.30% compared to the industry growth rates of 23.60% and 36.60%, respectively. The Houston, Texas-based provider of automated teller machines has a t-12 price/sales ratio of 1.67. EPS for the same period registers at $0.83.

Cardtronics shares have declined 4.61% in the last 4 weeks while advancing 7.22% in the past three months. Over the past 5 trading sessions the stock has lost 4.49%. Shares of Cardtronics Inc. are down more than 4% this year.

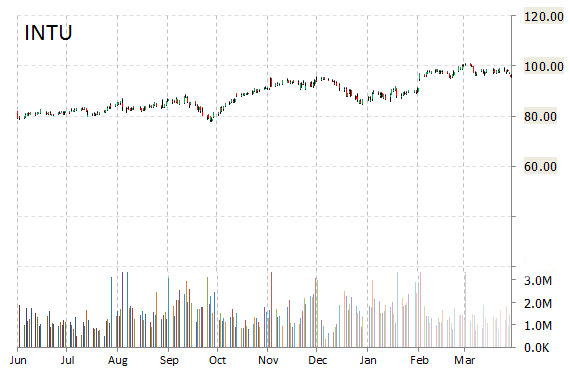

Intuit Inc. (INTU) shares rallied more than 2% to $95.87 in the extended session Friday on no apparent news. The provider of business and financial management solutions lost nearly $1.81, or 1.86%, in the regular trading hours.

During Friday’s Nasdaq session, INTU printed an intraday range of $95.33 to $96.71 with its 52-week range being $73.50 to $100.88.

Fundamentally, the name shows the following financial data:

- $1.37 billion in cash in most recent quarter

- $5.2 billion t-12 total assets

- $3.08 billion total equity

- $4.58 billion t-12 revenue

- $861 million annual net income

- $1.26 billion free cash flow

Offering a dividend yield of 1.05%, shares of Mountain View, California-based company are up 30.09% year-over-year and 4.24% year-to-date.

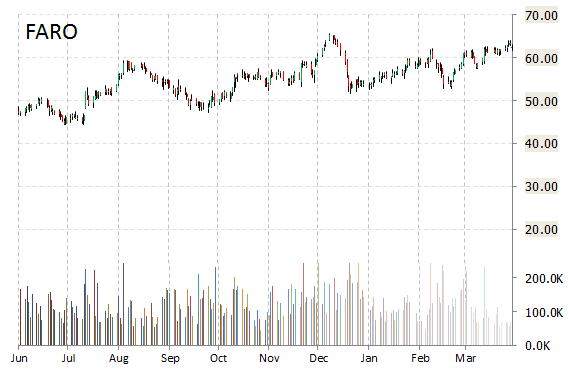

Faro Technologies Inc. (FARO) tumbled more than 8% to $57 in after-hours trading Friday, after the 3D imaging and measuring systems maker guided Q1/15 revenues of $70 million, as compared to analysts’ expectations of $85.29 million, a decrease of approximately 5% from the same quarter last fiscal year.

“Foreign exchange rates and macro-economic industrial weakness especially in Japan and Brazil created strong headwinds for our top line growth in the first quarter of 2015,” said in a statement Jay Freeland, FARO’s President and CEO.

FARO is currently valued at $1.08 billion. The Lake Mary, Florida-based company has a median Wall Street price target of $67.00 with a high target of $73.00. Ticker is up 28.52% year-over-year and 0.72% year-to-date.

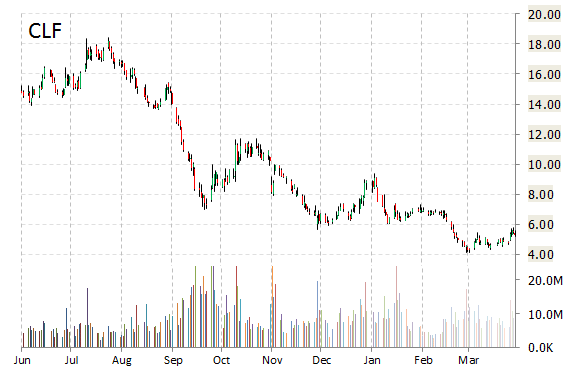

Cliffs Natural Resources Inc. (CLF) fell around 4% to $5.29 in the extended session Friday. The plunge could be attributed to Rio Tinto (RIO) mining iron ore even more cheaply at $17 a ton amid the slump in iron ore prices.

In the past 52 weeks, shares of Cleveland, Ohio-based iron ore company have traded between a low of $4.12 and a high of $18.84. Shares are down about 71% year-over-year and 26% year-to-date.

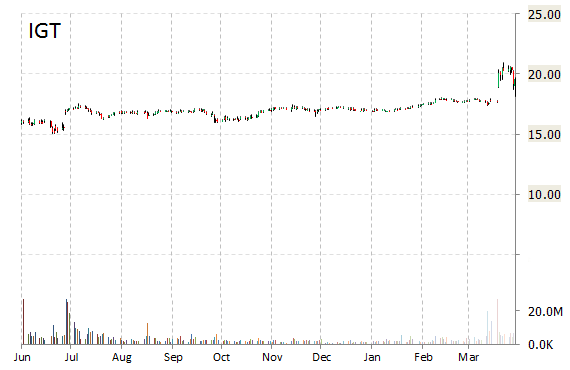

International Game Technology (IGT) fell 3.88% to $18.81 in after-hours trade on no news from the company. The move came on a strong volume too with the issue trading more than 4.6 million shares, compared to the average volume of 4.4 million.

IGT is up 44% year-over-year and has gained roughly 14.15% year-to-date. In the past 52 weeks, shares of Las Vegas, Nevada-based gaming company have traded between a low of $12.14 and a high of $20.95.

International Game Technology closed Friday at $19.57 The name has a total market cap of $4.87 billion.

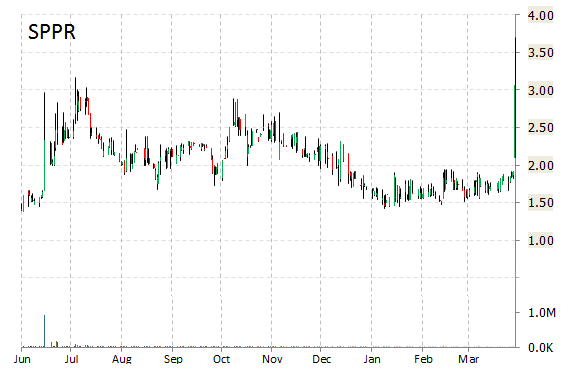

Supertel Hospitality, Inc. (SPPR) declined 3.60% to $2.96 after the bell following a 60.73% gain in the regular session. The real estate investment trust announced that it closed on the sale of two Savannah Suites hotels on April 1, 2015. The 172-room Savannah Suites located in Augusta, Georgia, sold for $3.4 million, and the 120-room Savannah Suites in Chamblee, Georgia, sold for $4.4 million. The REIT said it applied $4.1 million of the proceeds to the GE Capital mortgage note that matures in December 2015.

In the past 52 weeks, shares of Norfolk, Nebraska-based firm have traded between a low of $1.17 and a high of $3.70. Shares are up 78.49% year-over-year and 32.90% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply