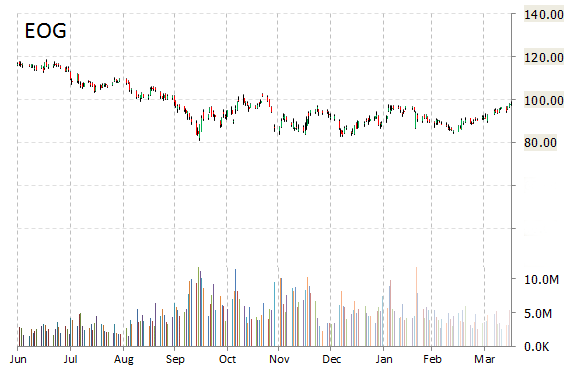

Analysts at Credit Agricole downgraded EOG Resources, Inc. (EOG) from ‘Outperform‘ to ‘Underperform‘ in a research report issued to clients on Friday.

On valuation measures, EOG Resources Inc. stock it’s trading at a forward P/E multiple of 54.84x, and at a multiple of 18.23x this year’s estimated earnings. The t-12-month revenue at EOG Resources is $16.69 billion. EOG ‘s ROE for the same period is 17.60%.

Shares of the $53.20 billion market cap company are down 2.41% year-over-year ; up 6.84% year-to-date.

EOG Resources Inc., currently with a median Wall Street price target of $101.50 and a high target of $117.00, dropped $1.00 to $97.01 in recent trading.

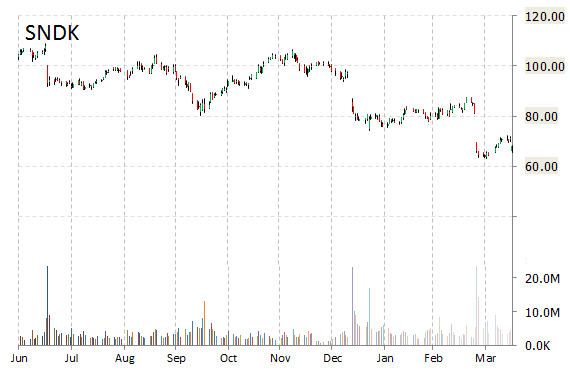

The chart below shows where the equity has traded over the past 52-weeks.

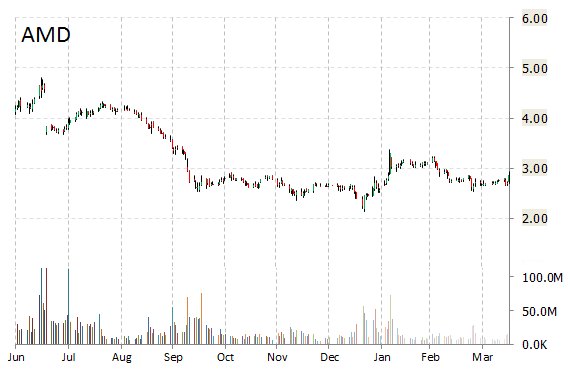

Advanced Micro Devices, Inc. (AMD) was reiterated a ‘Hold’ by Canaccord Genuity analysts on Friday. The broker also cut its price target on the stock to $2 from $2.50.

Fundamentally, AMD shows the following financial data:

- $1.04 billion in cash in most recent quarter

- $3.77 billion t-12 total assets

- $187 million total equity

- $5.51 billion t-12 revenue

- ($403) million annual net income

- ($193) million free cash flow

On valuation measures, Advanced Micro Devices Inc. shares have a market cap of $2.27 billion and a median Wall Street price target of $2.45 with a high target of $4.50. Currently there are 3 analysts that rate AMD a ‘Buy’, 15 rate it a ‘Hold’. 7 analysts rate it a ‘Sell’.

In terms of share statistics, Advanced Micro Devices Inc. has a total of 777.74 million shares outstanding with 18.90% held by insiders and 38.60% held by institutions. The stock’s short interest currently stands at 16.34%, bringing the total number of shares sold short to 103.24 million.

Shares of the Sunnyvale California-based company are down 24.27% year-over-year ; up 7.49% year-to-date.

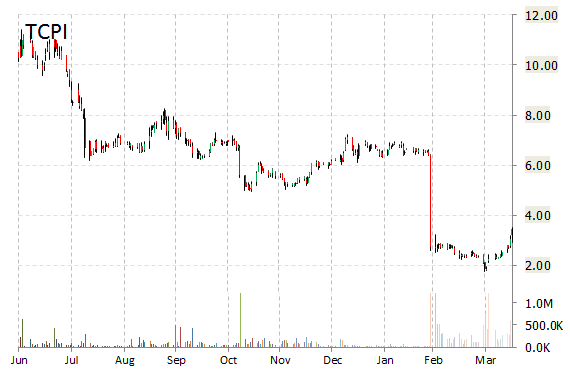

TCP International Holdings Ltd. (TCPI) was reiterated as ‘Buy’ with a $8 from $13 price target on Friday by Deutsche Bank (DB).

TCPI shares recently gained $0.58 to $4.03. In the past 52 weeks, shares of Cham, Switzerland-based company have traded between a low of $1.76 and a high of $11.40. Shares are down 43.90% year-to-date.

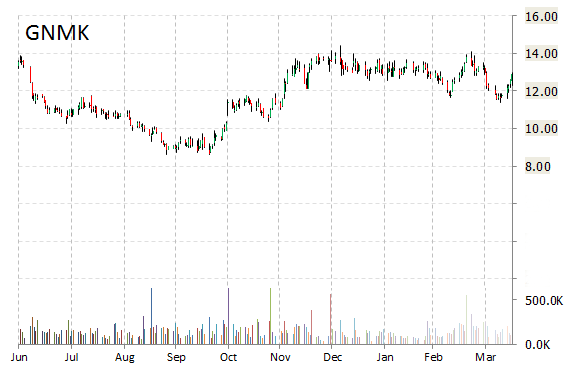

GenMark Diagnostics, Inc. (GNMK) rating of ‘Buy’ was reiterated today at Canaccord Genuity with a price target decrease of $16 from $17 (versus a $12.88 previous close).

GNMK shares recently lost 2.02 to $10.87. The stock is up more than 38% year-over-year and has lost roughly 5% year-to-date. In the past 52 weeks, shares of the Charlotte, North Carolina-based company have traded between a low of $8.48 and a high of $14.40.

GenMark Diagnostics, Inc. closed Thursday at $12.88. The name has a total market cap of $455.04 million.

Shares of SanDisk Corp. (SNDK) are down 1.33% at $67.01, after Argus this morning lowered its price target on the shares to $80 from $86, and reiterated a ‘Buy’ rating.

SanDisk Corp. shares are currently priced at 15.84x this year’s forecasted earnings, compared to the industry’s 26.92x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.35 and 14.31, respectively. Price/sales for the same period is 2.18 while EPS is $4.23. Currently there are 13 analysts that rate SNDK a ‘Buy’, 20 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. SNDK has a median Wall Street price target of $75.00 with a high target of $90.00.

In the past 52 weeks, shares of Milpitas, California-based company have traded between a low of $63.00 and a high of $108.77. Shares are down 8.68% year-over-year and 30.43% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply