The Goldman Sachs Group, Inc. (GS) reported first quarter EPS of $5.94 before the opening bell Thursday, compared to the consensus estimate of $4.27. Revenues increased 13.9% from last year to $10.62 billion, the highest quarterly result in four years. Analysts expected revenues of $9.39 billion. Revenues from trading fixed income, currencies and commodities rose 10% to $3.13 billion.

“We are pleased with our results this quarter and the fact that all of our major businesses contributed,” said in a statement Lloyd C. Blankfein, Chairman and Chief Executive Officer. “Given more normalized markets and higher levels of client activity, we remain encouraged about the prospects for continued growth.”

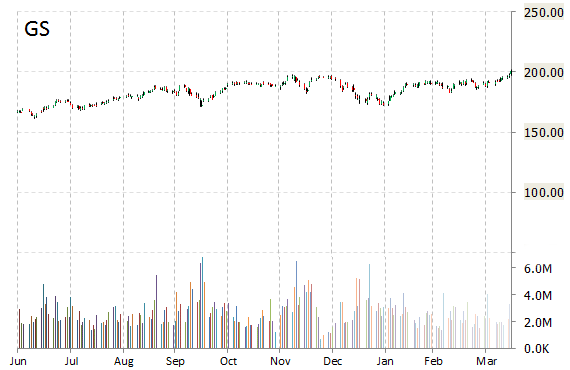

On valuation measures, Goldman Sachs Group Inc. shares, which currently have an average 3-month trading volume of 2.33 million shares, trade at a trailing-12 P/E of 11.78, a forward P/E of 10.88 and a P/E to growth ratio of 1.52. The median Wall Street price target on the name is $195.50 with a high target of $225.00. Currently ticker boasts 5 ‘Buy’ endorsements, compared to 19 ’Holds’ and 2 ‘Sell’.

Profitability-wise, GS has a t-12 profit and operating margin of 24.55% and 39.02%, respectively. As of March 31, 2015, the $90.81 billion market cap firm reported a total capital of $248.81 billion, consisting of $85.13 billion in total shareholders’ equity (common shareholders’ equity of $75.93 billion and preferred stock of $9.20 billion) and $163.68 billion in unsecured long-term borrowings.

GS currently prints a one year return of about 31.64% and a year-to-date return of around 4.08%. The stock is currently up $1.80 to $202.90.

The chart below shows where the equity has traded over the last 52 weeks.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply