Netflix, Inc. (NFLX) reported first quarter EPS of $0.77 after the closing bell Wednesday, compared to the consensus estimate of $0.63. Revenues increased 23.9% from last year to $1.57 billion. Analysts expected revenues of $1.57 billion. The stock is currently up $58.04 to $533.50 on 4.84 million shares.

The online video-streaming service, said it achieved several major milestones in Q1/15: surpassing 40 million members in the US; 20 million internationally; and 60 million in total. It also said it added a record 4.9 million new subscribers globally in the quarter, up from the 4.1 million analysts had expected.

The company posted net income of $24 million, or $0.38 a share, from $53.1 million, or $0.86 a year earlier, as the strong dollar trimmed revenue and contributed to losses outside the U.S.

On valuation measures, Netflix Inc. shares, which currently have an average 3-month trading volume of 2.35 million shares, trade at a trailing-12 P/E of 110.06, a forward P/E of 89.88 and a P/E to growth ratio of 6.10. The median Wall Street price target on the name is $483.00 with a high target of $600.00. Currently ticker boasts 21 ‘Buy’ endorsements, compared to 16 ’Holds’ and 2 ‘Sell’.

Profitability-wise, NFLX has a t-12 profit and operating margin of 4.85% and 7.32%, respectively. The $28.76 billion market cap company reported $3 billion in cash in its most recent quarter.

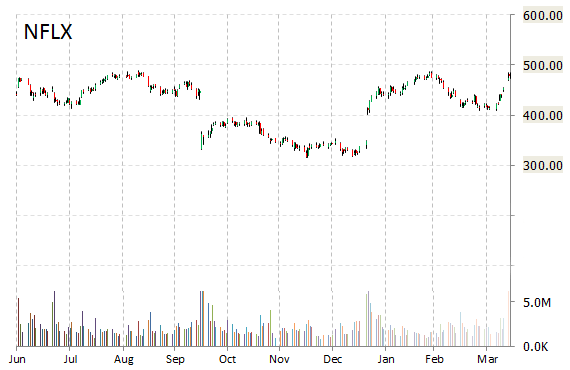

NFLX currently prints a one year return of 46.52% and a year-to-date return of around 40%.

The chart below shows where the equity has traded over the last 52 weeks.

Netflix Inc. engages in the Internet delivery of TV shows and movies directly on TVs, computers, and mobile devices in the United States and internationally. The company was founded in 1997 and is headquartered in Los Gatos, California.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply