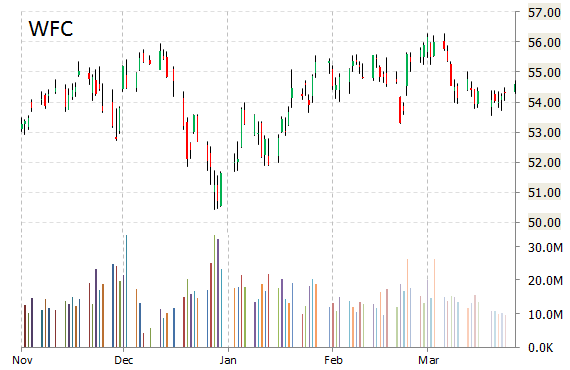

Shares of Wells Fargo & Company (WFC) are down $0.67 to $53.92 after the company released its earnings results on Tuesday. The banking giant reported Q1’15 EPS of $1.04 per share vs. $0.98 consensus on $21.30 billion in revenue, up 3.3% from a year ago, but below analysts expectations of $21.36 billion. Despite beating analysts’ expectations, Wells 1Q EPS were still a penny less than a year earlier. The third largest U.S. bank by assets also said its net income for the January-to-March period fell to $5.5 billion, compared with $5.6 billion a year earlier.

On valuation measures, Wells Fargo & Co. shares, which currently have an average 3-month trading volume of 14.73 million shares, trade at a trailing-12 P/E of 13.31, a forward P/E of 11.97 and a P/E to growth ratio of 1.35. The median Wall Street price target on the name is $56.50 with a high target of $65.00. Currently ticker boasts 10 ‘Buy’ endorsements, compared to 18 ’Holds’ and 3 ‘Sell’.

Profitability-wise, WFC has a t-12 profit and operating margin of 27.80% and 43.66%, respectively. The $281.26 billion market cap company said assets under management in its most recent quarter were $1.73 trillion, compared to $1.68 trillion from the prior year.

“Capital levels remained strong, and we were pleased to receive a non-objection to our 2015 Capital Plan, which included a proposed increase in our dividend rate to $0.375 per common share in second quarter 2015, subject to Board approval,” said Wells Fargo CEO John Stumpf in a statement.

WFC currently prints a one year return of 17.57% and a year-to-date return of around 0.25%.

Wells Fargo & Company provides retail, commercial, and corporate banking services to individuals, businesses, and institutions. The company was founded in 1852 and is headquartered in San Francisco, California.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply