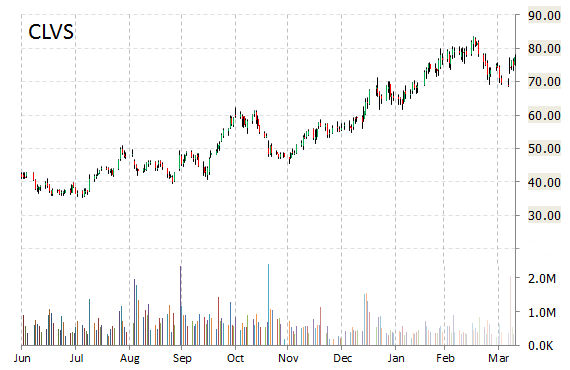

Analysts at Goldman Sacsh (GS) are out with a report this morning upgrading shares of Clovis Oncology, Inc. (CLVS) with a ‘Buy‘ from ‘Neutral‘ rating.

CLVS shares recently gained $9.86 to $87.26. In the past 52 weeks, shares of Boulder, Colorado-based biopharmaceutical company have traded between a low of $35.33 and a high of $89.98 and are now at $87.13. Shares are up 15.99% year-over-year and 38.21% year-to-date.

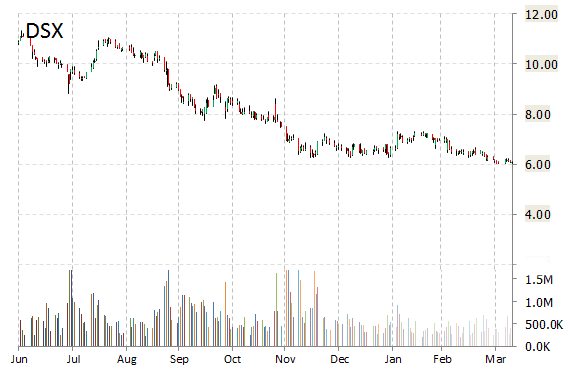

Analysts at Deutsche Bank (DB) upgraded their rating on the shares of Diana Shipping Inc. (DSX). In a research note published on Monday, the firm lifted the name with a ‘Buy‘ from ‘Hold‘ rating and set a 12-month base case estimate of $8 per share.

On valuation measures, Diana Shipping Inc. shares have a PEG ratio of (2.30). Price/Sales for the same period is 2.75 while EPS is ($0.19). Currently there are 6 analysts that rate DSX a ‘Buy’, 12 rate it a ‘Hold’. 2 analyst rate it a ‘Sell’. DSX has a median Wall Street price target of $7.75 with a high target of $11.50.

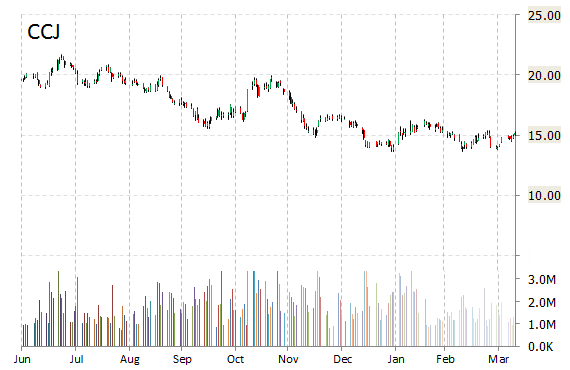

Cameco Corporation (CCJ) was raised to ‘Buy‘ from ‘Neutral‘ at BofA/Merrill (BAC) on Monday.

CCJ is up $0.35 at $15.56 on heavy volume. Midway through trading Monday, 1.81 million shares of Cameco Corp. have exchanged hands as compared to its average daily volume of 1.53 million shares. The stock ranged in a price between $15.47-$15.69 after having opened the day at $15.69 as compared to the previous trading day’s close of $15.21.

In the past 52 weeks, shares of Saskatchewan, Canada-based company have traded between a low of $13.62 and a high of $23.60. Shares are down 34.16% year-over-year and 6.80% year-to-date.

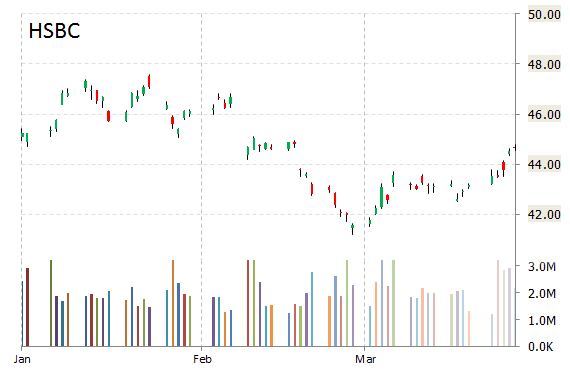

HSBC Holdings plc (HSBC) was upgraded to ‘Equal-Weight‘ from ‘Underweight‘ by Morgan Stanley (MS) analysts on Monday.

HSBC is currently printing a higher than average trading volume with the issue trading 2.65 million shares, compared to the average volume of 2.19 million. The stock began trading this morning at $45.31 to currently trade 1.12% higher from the prior days close of $44.69. On an intraday basis it has gotten as low as $45.11 and as high as $45.41.

HSBC Holdings PLC ADS shares are priced at 13.09x this year’s forecasted earnings, compared to the industry’s 19.27x earnings multiple. HSBC has a t-12 price-to-sales ratio of 2.99. EPS for the same period registers at $3.45.

HSBC shares have advanced 6.28% in the last 4 weeks and declined 0.25% in the past three months. Over the past 5 trading sessions the stock has gained 3.57%.

The London-based company, which is currently valued at $172.86 billion, has a median Wall Street price target of $47.41 with a high target of $60.21. HSBC Holdings PLC is down 9.24% year-over-year, compared with a 14.83% gain in the S&P 500.

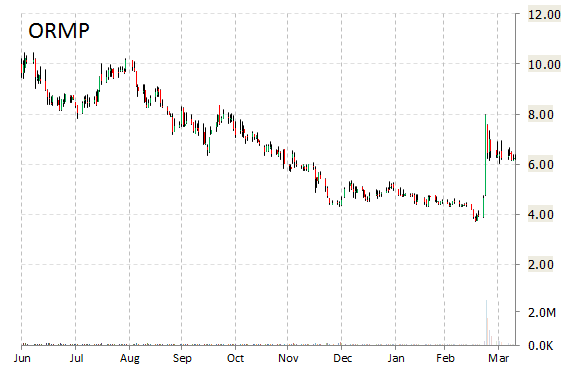

Oramed Pharmaceuticals Inc. (ORMP) coverage was resumed on Monday by MLV & Co. with a ‘Buy’ rating and a $30 from $27 price target.

ORMP shares recently gained $3.15 to $9.38. The stock is down more than 49% year-over-year and has gained roughly 36.62% year-to-date. In the past 52 weeks, shares of Jerusalem, Israel-based company have traded between a low of $3.71 and a high of $14.80.

Oramed Pharmaceuticals Inc. closed Friday at $6.23. The name has a total market cap of $101.51 million.

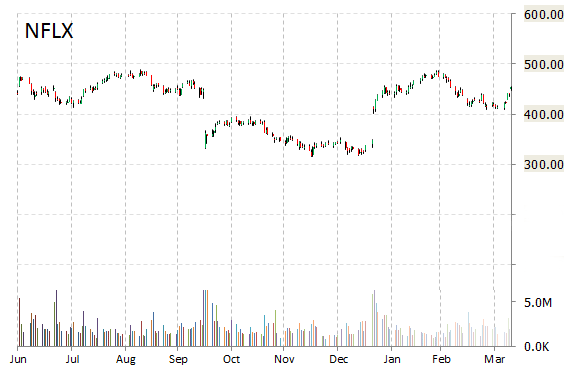

UBS’s Doug Mitchelson upgraded shares of Netflix (NFLX) to ‘Buy’ from ‘Neutral’ and lifted his price target to $565 from $370 in a research report issued to clients and investors on Monday.

“Despite growing concerns media studios/networks will start pulling back from selling content to Netflix, after reviewing the media landscape, including discussions with each of our media companies over time, we firmly believe Netflix will sustain sufficient access to content,” Mitchelson wrote [via MW] in his note.

Mitchelson’s new price target points to a potential upside of 18.24% from the stock’s current price of $477.82.

Netflix is scheduled to report Q1 results after the close on April 15.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply