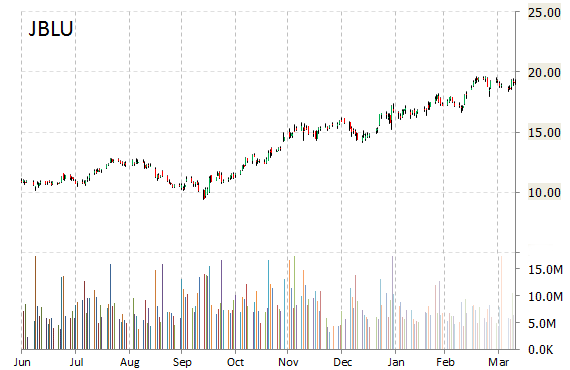

JetBlue Airways Corporation (JBLU) had a potent breakout of its 4-day ascending channel over 4-week range highs this morning. The stock, which had a reasonable 2-week trading range prior to breaking out, is clearly trending strongly upwards and breaking above its pivot at $19.13, which shows commitment as it prints a new 52-wkh. We are not seeing any news or rumors to account for the move, which suggests the pps move is a technical breakout. A close above $20.05 could send the equity higher towards the next rez level located at $20.61.

About 5 million shares of JetBlue were traded by 11 a.m. EDT Monday, below the company’s average trading volume of about 7.3 million shares a day. The stock began trading this morning at $19.31 to currently trade 6% higher from Friday’s close of $19.05. On an intraday basis it has gotten as low as $19.16 and as high as $20.23.

On valuation measures, JBLU shares are currently priced at 17.00x this year’s forecasted earnings, which makes them relatively inexpensive compared to the industry’s 47.14x earnings multiple. The company’s current year and next year EPS growth estimates stand at 142.90% and 5.90% compared to the industry growth rates of 42.80% and 21.30%, respectively. JBLU has a t-12 price/sales ratio of 1.02. EPS for the same period registers at $1.19.

JBLU’s shares have advanced 11.14% in the last 4 weeks and 28.02% in the past three months. Over the past 5 trading sessions the stock has gained 0.74%. Shares of the $6.28 billion market cap air carrier are up 138.43% year-over-year and 26.73% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply