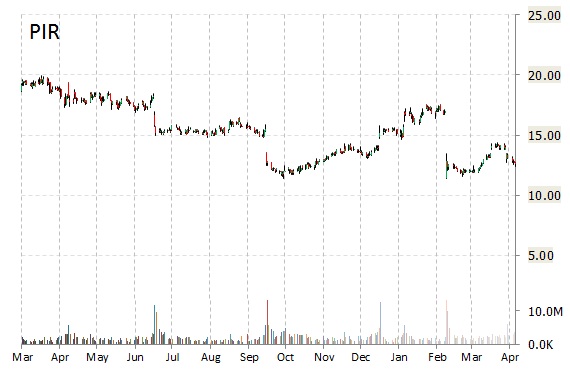

Analysts at Wedbush are out with a report this morning upgrading shares of Pier 1 Imports, Inc. (PIR) with an ‘Outperform‘ from ‘Neutral‘ rating.

Pier 1 Imports Inc. shares are currently priced at 16.19x this year’s forecasted earnings, compared to the industry’s 22.57x earnings multiple. Ticker has a forward P/E of 13.59 and t-12 price-to-sales ratio of 0.62. EPS for the same period is $0.88.

In the past 52 weeks, shares of Fort Worth Texas-based company have traded between a low of $11.38 and a high of $19.39 and are now at $14.18. Shares are down 27.05% year-over-year and 17.54% year-to-date.

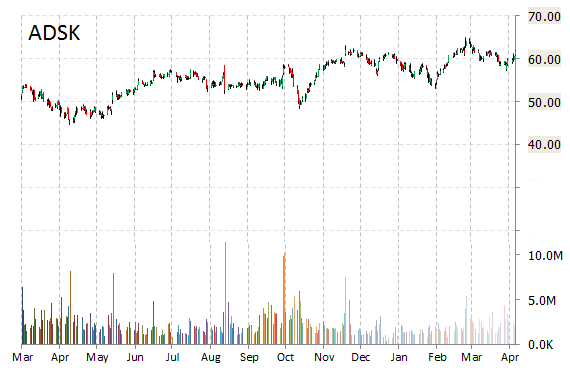

In a report published Thursday, Berenberg analysts initiated coverage on Autodesk, Inc. (ADSK) with a ‘Buy’ rating and $75 price target.

Autodesk, Inc. shares are currently priced at 179.17x this year’s forecasted earnings compared to the industry’s 35.31x earnings multiple. Ticker has a PEG and forward P/E ratio of 6.56 and 42.09, respectively. Price/Sales for the same period is 5.59 while EPS is $0.35. Currently there are 14 analysts that rate ADSK a ‘Buy’, 4 rate it a ‘Hold’. No analyst rates it a ‘Sell’. ADSK has a median Wall Street price target of $73.00 with a high target of $81.00.

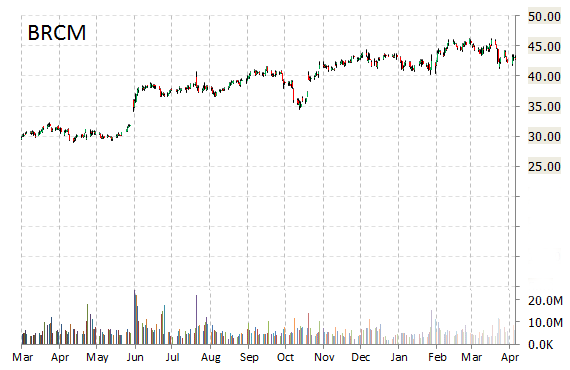

Investment analysts at Ladenburg Thalmann initiated coverage on shares of Broadcom Corp. (BRCM) in a note issued to investors on Thursday. The firm set a ‘Buy’ rating and a $51 price target on the stock. The firm’s price target would suggest a potential upside of about 17% from the stock’s current price of $43.67.

Broadcom Corp., currently valued at $26.17 billion, has a median Wall Street price target of $50 with a high target of $55. Approximately 4.37 million shares have already changed hands, compared to the stock’s average daily volume of 5.58 million.

In the past 52 weeks, shares of Irvine, Calif.-based company have traded between a low of $28.86 and a high of $46.31 with the 50-day MA and 200-day MA located at $44.37 and $42.18 levels, respectively. Additionally, shares of BRCM trade at a P/E ratio of 1.40 and have a Relative Strength Index (RSI) and MACD indicator of 50.98 and -0.16, respectively.

BRCM currently prints a one year return of about 42% and a year-to-date loss of less than one percent.

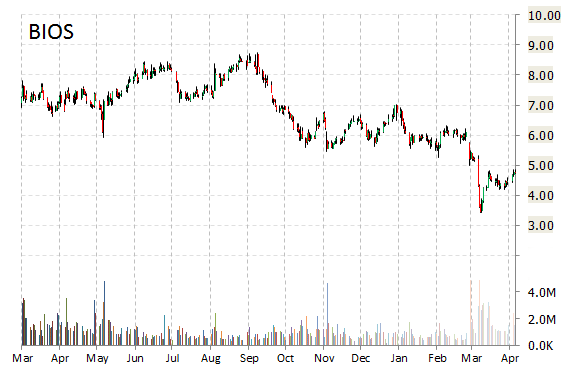

Shares of BioScrip, Inc. (BIOS) are up $0.37, or 7.76%, at $5.14, after Craig Hallum analysts today initiated coverage of the name, giving it a ‘Buy’ rating and price target of $7.00.

On valuation measures, BioScrip, Inc. shares have a PEG and forward P/E ratio of -15.90 and 85.17, respectively. Price/Sales for the same period is 0.33 while EPS is ($2.15). Currently there are 4 analysts that rate BIOS a ‘Buy’. No analyst rates it ‘Hold’ or a ‘Sell’. BIOS has a median Wall Street price target of $7.00 with a high target of $8.00.

In the past 52 weeks, shares of home care services provider have traded between a low of $3.41 and a high of $8.75 and are now at $5.14. Shares are down 29.85% year-over-year and 31.76% year-to-date

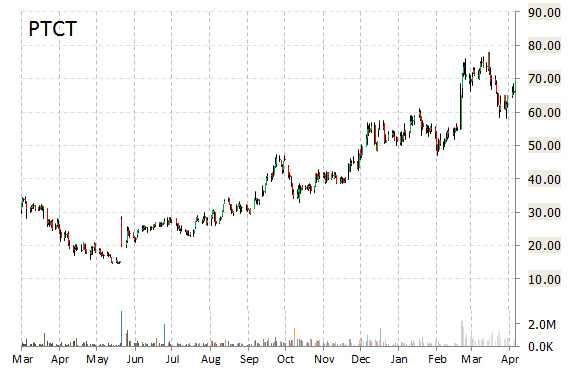

PTC Therapeutics, Inc. (PTCT) was reiterated a ‘Buy’ by Deutsche Bank (DB) analysts on Thursday. The broker also raised its price target on the stock to $115 from $75, implying 53% expected upside.

PTCT shares recently lost $0.28 to $69.21. In the past 52 weeks, shares of South Plainfield, New Jersey-based biopharmaceutical company have traded between a low of $14.51 and a high of $78.72. Shares are up 196.71% year-over-year and 34.23% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply