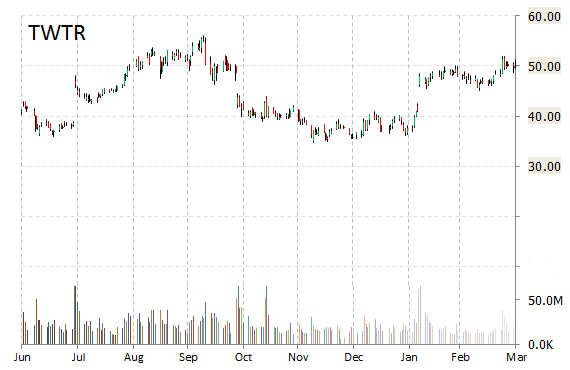

Analysts at Jefferies initiated coverage on Twitter, Inc. (TWTR) with a ‘Buy’ rating and a $65 price target in a research report issued to clients on Wednesday. The firm’s 12-month case base estimate implies 28% upside to the $65 price target.

On valuation measures, Twitter, Inc. shares currently trade at a PEG and forward P/E ratio of 1.76 and 62.73, respectively. Price/Sales for the same period is 22.75 while EPS is ($0.96). Currently there are 20 analysts that rate TWTR a ‘Buy’, 1 rates it a ‘Hold’. No analyst rates it a ‘Sell’. TWTR has a median Wall Street price target of $52.00 with a high target of $67.00.

In the past 52 weeks, shares of San Francisco, California-based company have traded between a low of $29.51 and a high of $55.99 and are now at $50.81. Shares are up 7.31% year-over-year and 39.62% year-to-date.

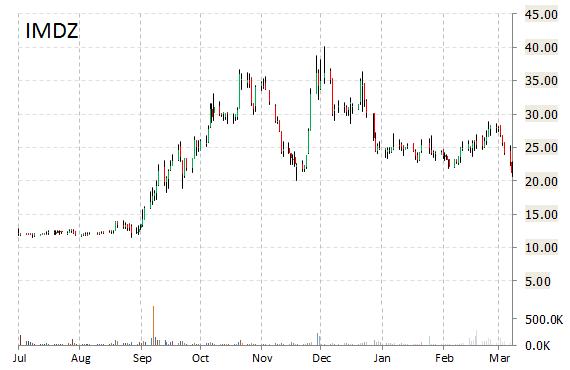

Jefferies is out with a report this morning initiating coverage of Immune Design Corp. (IMDZ) with a ‘Buy’ rating.

IMDZ shares recently gained $5.40 to $26.51. In the past 52 weeks, shares of Seattle, Washington-based clinical-stage immunotherapy company have traded between a low of $11.51 and a high of $40.13. Shares are up 118% year-over-year ; down 14.56% year-to-date.

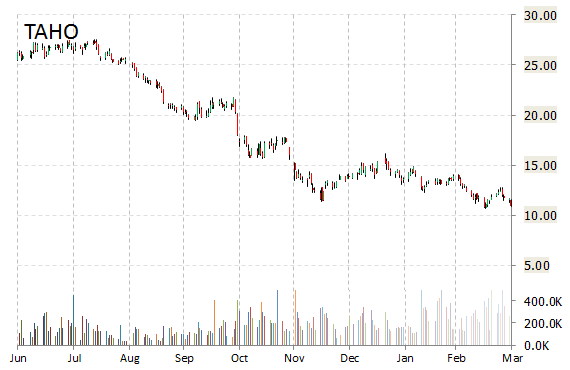

Raymond James initiated coverage on Tahoe Resources Inc. (TAHO) today with an ‘Outperform’ from ‘Market Perform’ rating. Right now, the stock is sitting at $11.82, a 7.85% gain. Approximately 1.7 million shares have already changed hands, compared to the stock’s average daily volume of 280K shares.

Tahoe Resources Inc. closed Tuesday at $10.96. The name has a total market cap of $1.75 billion.

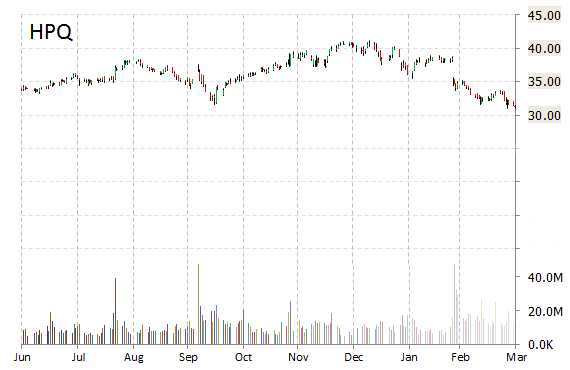

Jefferies initiated coverage of Hewlett-Packard Company (HPQ) with a ‘Buy’ from ‘Hold’ rating and a $41 from $37 price target, which represents expected upside of 31% to the stock’s current price of $31.39.

On trading measures, Hewlett-Packard Company, currently valued at $57.08 billion, has a median Wall Street price target of $40.00 with a high target of $45.00. Approximately 9.75 million shares have already changed hands, compared to the stock’s average daily volume of 13.65 million.

In the past 52 weeks, shares of Palo Alto, California-based company have traded between a low of $31.03 and a high of $41.10 with the 50-day MA and 200-day MA located at $34.57 and $36.57 levels, respectively. Additionally, shares of HPQ trade at a P/E ratio of 3.10 and have a Relative Strength Index (RSI) and MACD indicator of 31.91 and -0.97, respectively.

HPQ currently prints a one year loss of about 2% and a year-to-date loss of around 22%.

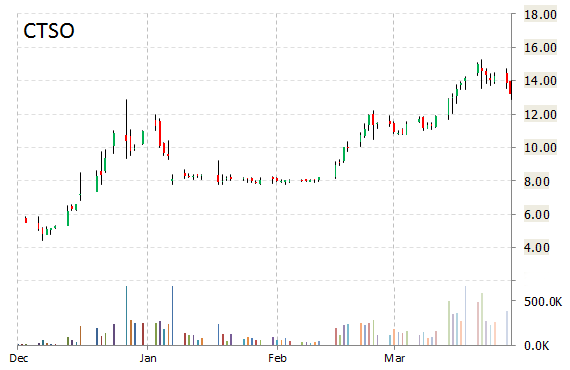

Cytosorbents Corporation (CTSO) was reiterated as ‘Buy’ with a $30 from $28 price target on Wednesday by MLV & Co.

CTSO shares recently lost $3.94 to $9.25. In the past 52 weeks, shares of Monmouth Junction, New Jersey-based development stage company have traded between a low of $4.40 and a high of $15.24. Cytosorbents Corp. Shares are up 32.56% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply