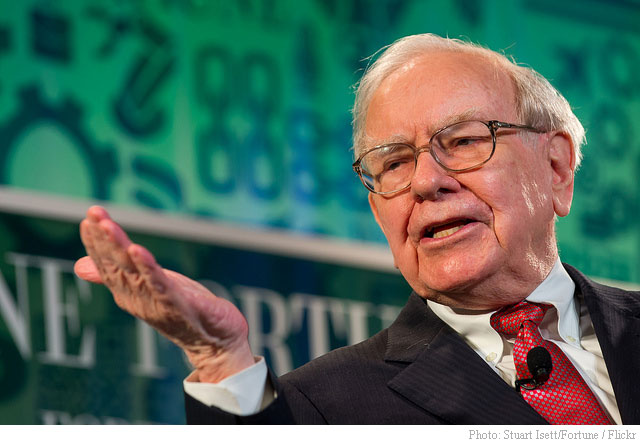

Shares of Kraft Foods Group, Inc. (KRFT) are up $15.94, or 26%, at $77.26 in the pre-market session Wednesday after it and Warren Buffett’s HJ Heinz announced a merger agreement to create The Kraft Heinz Co.

The deal, which would combine the 5th largest food and beverage company in the world, was engineered by Buffett’s Berkshire Hathaway (BRK.A), (BRK.B) and the company that owns Heinz, Brazilian investment firm 3G Capital.

Under the terms of the deal, Kraft shareholders will receive stock in the combined company and a special cash dividend of approximately $10 billion, or $16.50 per share. Heinz, which was taken private in 2013 after being bought by 3G and Buffett, will return to the public market with a 51% ownership of Kraft. Current Kraft stockholders, including Buffett’s Berkshire, will own 49% of the firm.

The combined company will have revenue of about $28 billion with eight $1+ billion brands and five brands between $500 million – $1 billion each, the companies said. Annual cost savings estimated to be $1.5 billion are expected to be booked by the end of fiscal 2017.

“This is my kind of transaction,” said Buffett in a printed statement. “Uniting two world-class organizations and delivering shareholder value. I’m excited by the opportunities for what this new combined organization will achieve.”

The boards of both companies have unanimously approved the deal. It is expected to close in the second half of this year.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply