Analysts at Barclays are out with a report this morning upgrading shares of Netflix, Inc. (NFLX) with an ‘Equal Weight‘ rating. The firm raised its price target for the company to $450 from $400. Although the firm said it increased its PPS on the name as it’s expecting higher pricing, it noted an increase in spending could depress margins and slow U.S. subscribes to limit share upside.

On valuation measures, Netflix Inc. shares are currently priced at 101.96x this year’s forecasted earnings, which makes them quite expensive compared to the industry’s 36.57x earnings multiple. Ticker has a forward P/E of 80.51 and t-12 price-to-sales ratio of 4.67. EPS for the same period is $4.32.

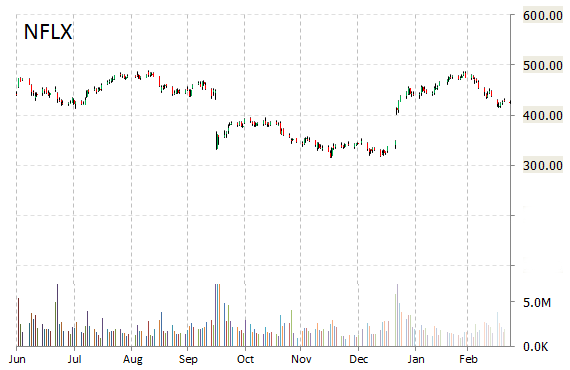

In the past 52 weeks, shares of Los Gatos California-based Internet television network have traded between a low of $299.50 and a high of $489.29 and are now at $440.48. Shares are up 4.68% year-over-year and 24.41% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply