Shares of Ariad Pharmaceuticals Inc. (ARIA) are up 3.62% to $8.88 in pre-market trading Tuesday following an announcement from the Israeli Ministry of Health granting the company and Medison Pharma regulatory approval for Iclusig (ponatinib) in Israel.

ARIAD submitted its application for Iclusig to the Israeli Ministry of Health in June 2014. Commercial launch of Iclusig is expected to occur in the second quarter of 2015.

“Iclusig is an important addition to the treatment armamentarium,” said Professor Arnon Nagler, head of hematology and the Bone Marrow Transplant Division at the Chaim Sheba Medical Center in Israel, and chairman of the Israeli Bone Marrow Transplant Association. Dr. Nagler added, “Patients in Israel have an excellent health care system, and having this potent and promising drug is an important addition to the national health basket.”

“The swift approval by the Ministry of Health in Israel speaks to the importance of this new therapy to appropriate patients in Israel. We look forward to continued success working with ARIAD and fulfilling Medison’s vision to provide innovative and unique treatments to patients in Israel,” said Meir Jakobsohn, chief executive officer and founder of Medison Pharma.

Fundamentally, ARIA shows the following financial data:

- $352.69 million in cash in most recent quarter

- $603.87 million t-12 total assets

- $80.8 million total equity

- $105.41 million t-12 revenue

- ($162.6) million annual net income

- ($57.79) million free cash flow

On valuation measures, Ariad Pharmaceuticals Inc. shares have a T-12 price/sales ratio of 15.45 and a price/book for the same period of 20.15. EPS is ($0.87). The name has a market cap of $1.61 billion and a median Wall Street price target of $8.00 with a high target of $14.00. Currently there are 6 analysts that rate ARIA a ‘Buy’, 7 rate it a ‘Hold’. 2 analyst rates it a ‘Sell’.

In terms of share statistics, Ariad Pharmaceuticals Inc. has a total of 187.21 million shares outstanding with 8.03% held by insiders and 58.30% held by institutions. The stock’s short interest currently stands at 28.49%, bringing the total number of shares sold short to 51.52 million.

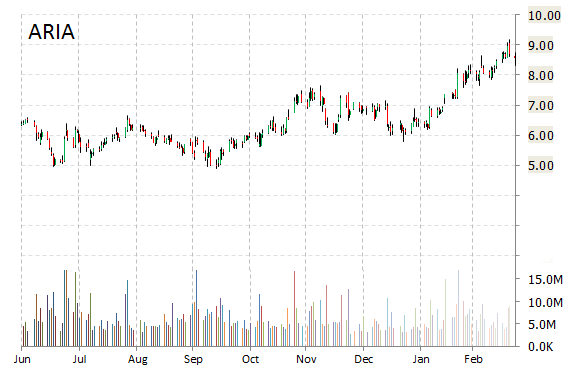

Shares of the Cambridge Massachusetts-based company are up 9.31% year-over-year and 24.75% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply