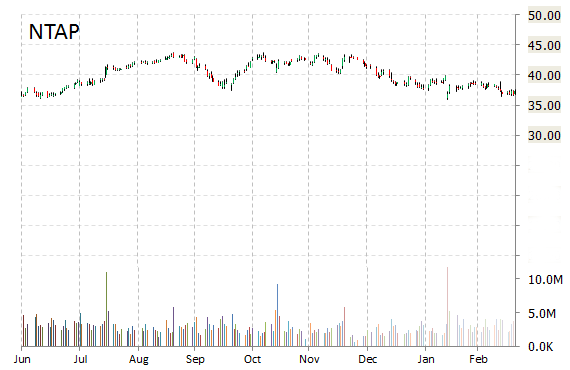

Analysts at Piper Jaffray downgraded NetApp, Inc. (NTAP) from ‘Overweight‘ to ‘Neutral‘ in a research report issued to clients on Monday.

The target price for NTAP is lowered from $42 to $36.

On valuation measures, NetApp Inc. stock it’s trading at a forward P/E multiple of 12.51x, and at a multiple of 19.27x this year’s estimated earnings. The t-12-month revenue at NetApp Inc. is $6.23 billion. NTAP ‘s ROE for the same period is 16.76%.

Shares of the $11.41 billion market cap company are up 2.30% year-over-year ; down 9.59% year-to-date.

NetApp Inc., currently with a median Wall Street price target of $40.00 and a high target of $48.00, dropped $0.70 to $36.615 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

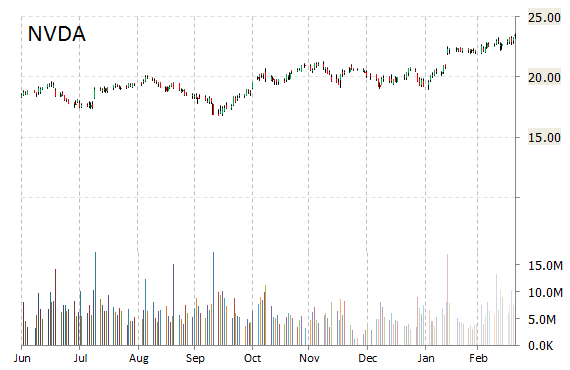

Nvidia Corporation (NVDA) was downgraded from ‘Neutral‘ to ‘Sell‘ at Goldman (GS).

Shares have traded today between $22.70 and $23.07 with the price of the stock fluctuating between $16.77 to $23.61 over the last 52 weeks.

Nvidia Corp. shares are currently changing hands at 20.40x this year’s forecasted earnings, compared to the industry’s 7.28x earnings multiple. Ticker has a t-12 price/sales ratio of 2.76. EPS for the same period registers at $1.12.

Shares of NVDA have lost $0.62 to $22.85 in mid-day trading on Monday, giving it a market cap of roughly $12.56 billion. The stock traded as high as $23.61 in March 20, 2015.

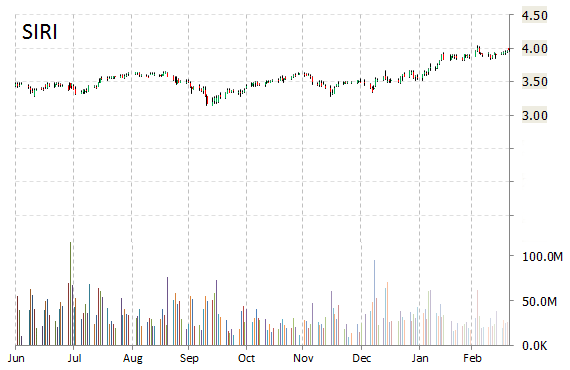

Shares of Sirius XM Holdings Inc. (SIRI) are down 1.13% to $3.93 in mid-day trading Monday after the company’s coverage was resumed by Goldman Sachs (GS) with a ‘Neutral’ rating and a 12-month case base estimate of $4.00.

Fundamentally, SIRI shows the following financial data:

- $147.72 million in cash in most recent quarter

- $8.38 billion t-12 total assets

- $1.31 billion total equity

- $4.18 billion t-12 revenue

- $493.24 million annual net income

- $1.13 billion free cash flow

On valuation measures, Sirius XM Holdings Inc. shares have a T-12 price/sales ratio of 5.31 and a price/book for the same period of 17.16. EPS is $0.31. The name has a market cap of $25.97 billion and a median Wall Street price target of $4.25 with a high target of $5.00. Currently there are 11 analysts that rate SIRI a ‘Buy’, 6 rate it a ‘Hold’. No analyst rates it a ‘Sell’.

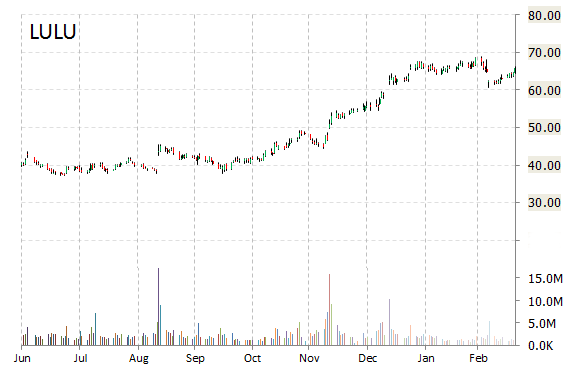

Lululemon Athletica Inc. (LULU) was reiterated a ‘Hold’ by Canaccord Genuity analysts on Monday. The broker also cut its price target on the stock to $55 from $58 while lowering their 2015 EPS estimate to $1.96 from $2.08. The firm noted the Vancouver, Canada-based company has kicked off this year considerably slower than its peers.

Lululemon Athletica Inc, currently valued at $9.09 billion, has a median Wall Street price target of $68.00 with a high target of $85.00. Approximately 2.48 million shares have already changed hands, compared to the stock’s average daily volume of 2.10 million.

In the past 52 weeks, shares of the athletic-wear manufacturer have traded between a low of $36.26 and a high of $68.99 with the 50-day MA and 200-day MA located at $65.27 and $52.24 levels, respectively. Additionally, shares of LULU trade at a P/E ratio of 2.18 and have a Relative Strength Index (RSI) and MACD indicator of 47.39 and +0.96, respectively.

LULU currently prints a one year return of about 35% and a year-to-date return of 17.83%.

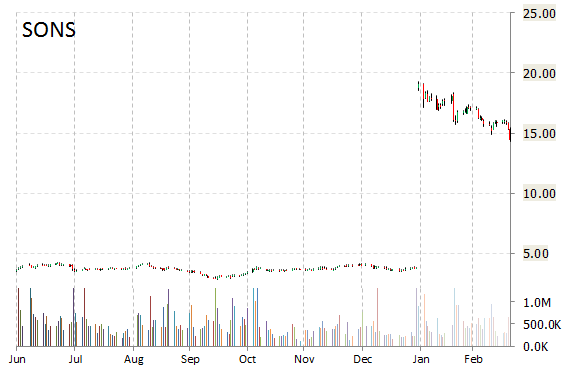

Sonus Networks, Inc. (SONS) was reiterated as ‘Buy’ with a $17 from $22 price target on Monday by Wunderlich.

SONS shares recently lost $1.07 to $13.37. In the past 52 weeks, shares of Westford, Massachusett-based company have traded between a low of $13.30 and a high of $21.25. Shares are down 20.66% year-over-year and 27.25% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply