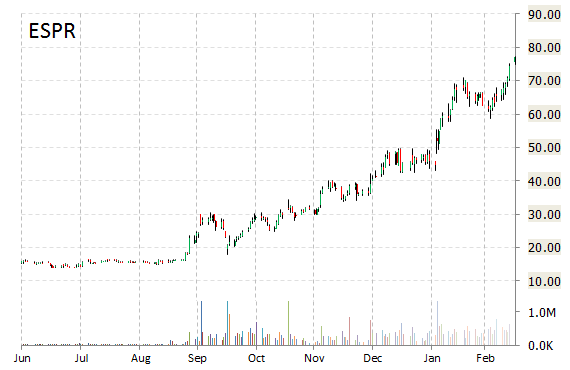

Esperion Therapeutics, Inc. (ESPR) is trading at unusually high volume Tuesday with 2.1 million shares changing hands. It is currently at more than 5x its average daily volume and trading up 18% at $90.73. The company today announced positive top-line results from ETC-1002-009, a Phase 2b study evaluating the efficacy and safety of ETC-1002 (bempedoic acid) compared with placebo in patients with hypercholesterolemia on stable statin therapy.

Esperion said top-line results showed the 12-week study met its primary endpoint of greater LDL-cholesterol lowering from baseline with ETC-1002 compared with placebo.

“ETC-1002 has once again demonstrated impressive incremental LDL-cholesterol lowering. Importantly, ETC-1002 was observed to be safe and well-tolerated when added to stable statin therapy, and may be an appropriate addition to existing therapy in these patients,” said in a statement Tim M. Mayleben, president and CEO of Esperion.

Esperion Therapeutics, Inc. is a Michigan-based emerging pharmaceutical company focused on the development and commercialization of oral and low-density lipoprotein cholesterol lowering therapies for the treatment of patients. Its stock has a 52-week trading range of $12.75 to $90.08.

The T-12 return on assets at Esperion is (20.43%). The name‘s return on equity for the same period is (35.04%).

Shares in the $1.85 billion company are up 487% year-over-year, and 125% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply