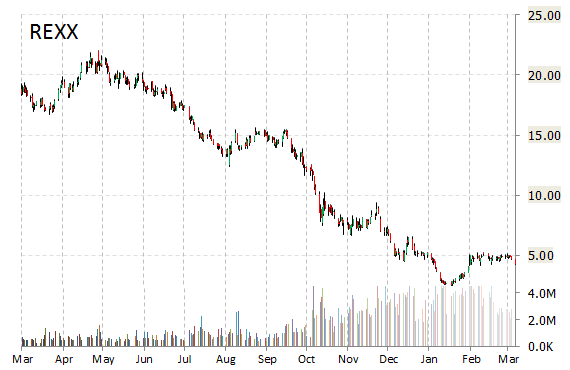

In a report published Tuesday, Macquarie analysts initiated coverage on Rex Energy Corporation (REXX) with a ‘Neutral’ rating.

On valuation measures, Rex Energy Corporation shares have a PEG ratio of (0.11). Price/Sales for the same period is 0.75 while EPS is ($0.92). Currently there are 8 analysts that rate REXX a ‘Buy’, 10 rate it a ‘Hold’. No analyst rates it a ‘Sell’. REXX has a median Wall Street price target of $6.25 with a high target of $13.00.

In the past 52 weeks, shares of State College, Pennsylvania-based independent oil company have traded between a low of $2.47 and a high of $22.00 and are now at $3.99. Shares are down 76.74% year-over-year and 16.67% year-to-date.

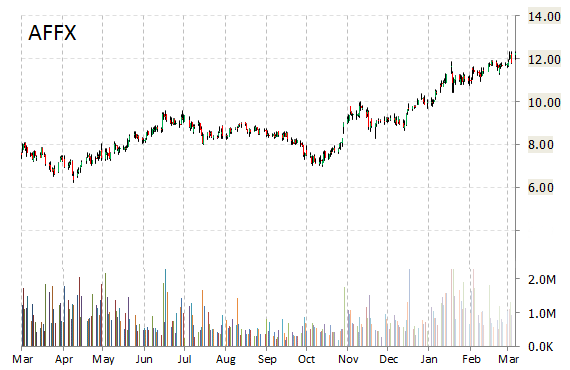

Investment analysts at UBS initiated coverage on shares of Affymetrix Inc. (AFFX) in a note issued to investors on Tuesday. The firm set an ‘Neutral’ rating and a $13.00 price target on the stock. The firm’s price target would suggest a potential upside of about 7% from the stock’s current price of $12.18.

Affymetrix Inc., currently valued at $909.28 million, has a median Wall Street price target of $12.00 with a high target of $14.00. Approximately 542K shares have already changed hands, compared to the stock’s average daily volume of 1.11 million.

In the past 52 weeks, shares of the life science products provider have traded between a low of $6.25 and a high of $12.35 with the 50-day MA and 200-day MA located at $11.46 and $9.50 levels, respectively. Additionally, shares of AFFX trade at a P/E ratio of 1.18 and have a Relative Strength Index (RSI) and MACD indicator of 63.16 and +0.25, respectively.

AFFX currently prints a one year return of about 62% and a year-to-date return of around 24.50%.

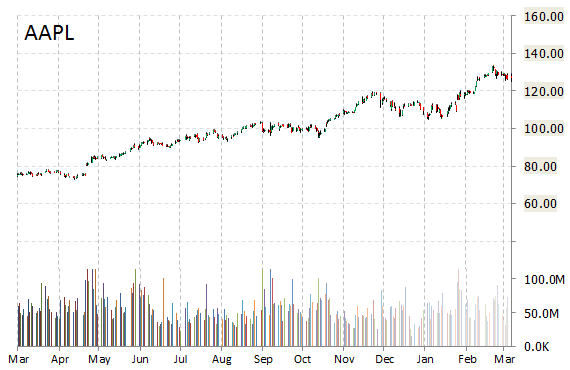

Apple Inc. (AAPL) was reiterated a ‘Buy’ by Monness Crespi & Hardt analysts on Tuesday. The broker also raised its price target on the stock to $145 from $125.

AAPL shares recently lost $2.44 to $124.70. The stock is up more than 70.96% year-over-year and has gained roughly 15.63% year-to-date. In the past 52 weeks, shares of the iPhone maker have traded between a low of $73.05 and a high of $133.60.

Apple closed Monday at $127.14. The name has a total market cap of $726.35 billion.

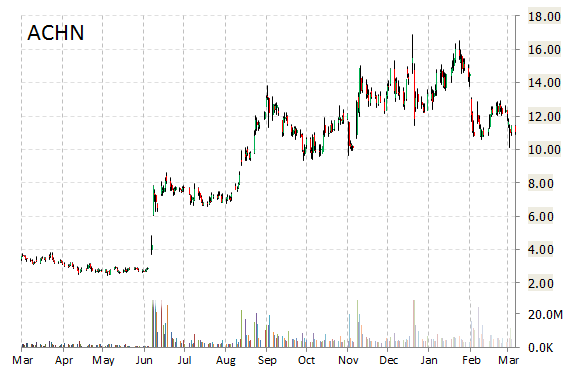

Achillion Pharmaceuticals, Inc. (ACHN) was reiterated as ‘Buy’ with a $19 from $22 price target on Tuesday by Maxim Group.

ACHN recently gained $0.19 to $11.26. In the past 52 weeks, shares of New Haven, Connecticut-based biopharmaceutical company have traded between a low of $2.45 and a high of $16.87. Shares are up 224.49% year-over-year ; down 9.67% year-to-date.

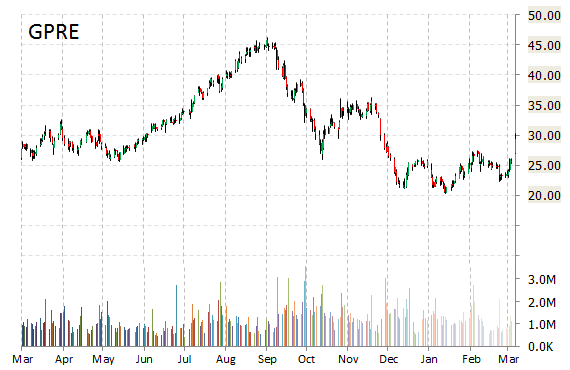

Green Plains Inc. (GPRE) rating of ‘Neutral’ was reiterated today at Credit Suisse with a price target increase of $34 from $30 (versus a $29.41 previous close).

GPRE shares recently lost $1.29 to $28.12. Credit Suisse’s target price suggests a potential upside of about 21% from the company’s current stock price.

In the past 52 weeks, shares of Omaha, Nebraska-based ethanol producer have traded between a low of $20.31 and a high of $46.28. Shares are up 6.71% year-over-year and 18.68% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply