Urban Outfitters Inc. (URBN) shares are up $0.99, or 2.51%, to $40.50 in after-hours trading Monday after the company reported its fourth quarter earnings results.

The lifestyle specialty retail company reported earnings of $0.60 per share on revenues of $1.01 billion, up 11.6% from a year ago. Analysts were expecting EPS of $0.57 on revenues of $998.36 million.

For the full-year ended January 31, 2015, Urban Outfitters reported net income of $232 million, or $1.68 per share. Net sales increased 8% over the prior year to a record $3.3 billion with comparable retail and wholesale segment net sales increasing 2% and 27%, respectively.

“We are pleased to report our first billion dollar quarter, fueled by positive retail segment `comps` at all of our brands, “said in a statement Richard A. Hayne, CEO. “It is encouraging to see this sales trend continue into Q1,” finished Mr. Hayne.

On valuation measures, Urban Outfitters Inc. shares, which currently have an average 3-month trading volume of 1.18 million shares, trade at a trailing-12 P/E of 23.36, a forward P/E of 20.06 and a P/E to growth ratio of 1.61. The median Wall Street price target on the name is $38.50 with a high target of $45.00. Currently ticker boasts 11 ‘Buy’ endorsements, compared to 22 ’Holds’ and no ‘Sell’.

Profitability-wise, URBN has a t-12 profit and operating margin of 7.48% and 11.51%, respectively. The $5.20 billion market cap company reported $154.5 million in cash in its most recent quarter.

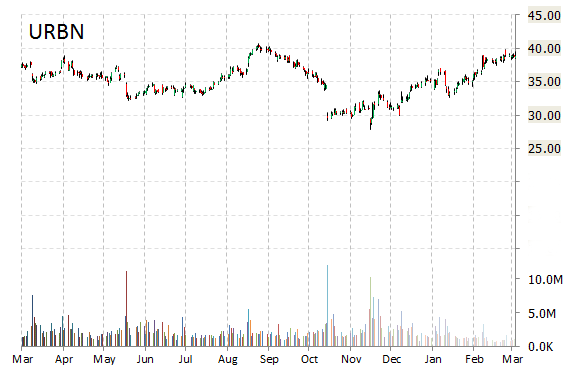

URBN currently prints a one year return of about 5.15% and a year-to-date return of around 11%.

The chart below shows where the equity has traded over the last 52 weeks.

Urban Outfitters Inc. is a lifestyle specialty retail company which was founded in 1970 and is based in Philadelphia, Pennsylvania.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply