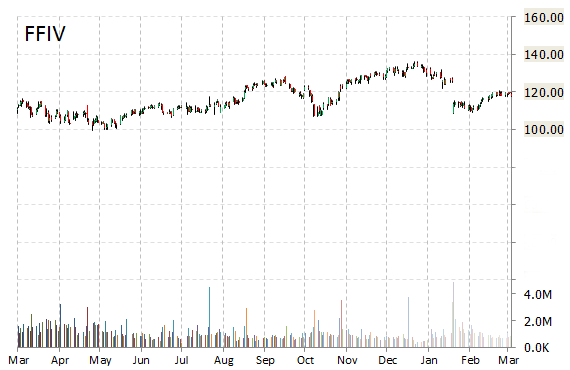

Analysts at Barclays downgraded F5 Networks, Inc. (FFIV) from ‘Equal Weight‘ to ‘Underweight‘ in a research report issued to clients on Monday.

The target price for FFIV is lowered to $114.

On valuation measures, F5 Networks Inc. stock it’s trading at a forward P/E multiple of 15.88x, and at a multiple of 26.00x this year’s estimated earnings. The t-12-month revenue at F5 Networks Inc. is $1.79 billion. FFIV ‘s ROE for the same period is 23.65%.

Shares of the $8.31 billion market cap company are up 2.78% year-over-year ; down 9.59% year-to-date.

F5 Networks Inc., currently with a median Wall Street price target of $129.00 and a high target of $153.00, dropped $2.72 to $115.24 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

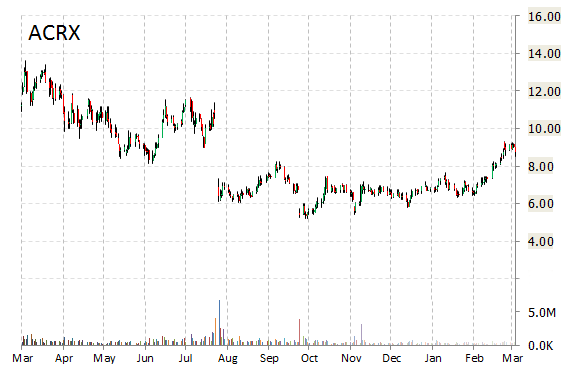

AcelRx Pharmaceuticals, Inc. (ACRX) was downgraded from ‘Buy‘ to ‘Neutral‘ and the price target was cut to $5.59 from $14 at Mizuho.

Shares have traded today between $5.07 and $6.14 with the price of the stock fluctuating between $5.07 to $13.40 over the last 52 weeks.

AcelRx Pharmaceuticals Inc. shares have a t-12 price/sales ratio of 11.72. EPS for the same period registers at ($0.23).

Shares of ACRX have lost $3.09 to $5.65 in mid-day trading on Monday, giving it a market cap of roughly $246.94 million. The stock traded as high as $13.40 in March 21, 2014.

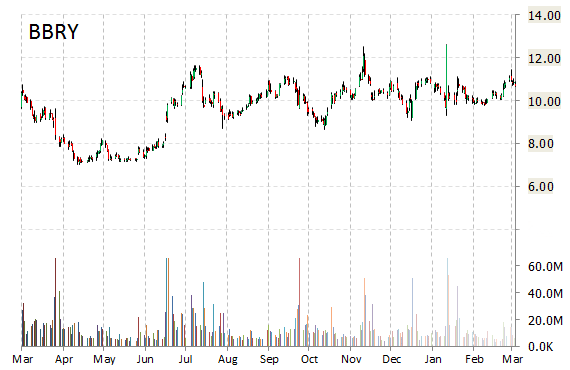

Goldman (GS) reported on Monday that they have lowered their rating for BlackBerry Limited (BBRY). The firm has downgraded BBRY from ‘Neutral‘ to ‘Sell‘ and lowered its price target to $9 from $10.

BlackBerry Ltd. recently traded at $9.90, a loss of $0.77 over Friday’s closing price. The name has a current market capitalization of $5.17 billion.

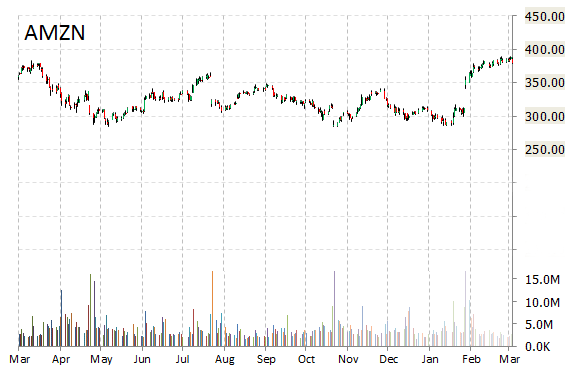

Amazon.com Inc. (AMZN) had its rating lowered from ‘Buy‘ to ‘Neutral‘ by analysts at Sun Trust Rbsn Humphrey on Monday. Currently there are 22 analysts that rate AMZN a ‘Buy’, no analysts rate it a ‘Sell’, and 18 rate it a ‘Hold’.

AMZN was down $3.45 at $376.64 in mid-day trade, moving within a 52-week range of $284.00 to $389.37. The name, valued at $174.91 billion, opened at $378.36.

On valuation measures, Amazon.com Inc. shares are currently priced at 170x next year’s forecasted earnings. Ticker has a t-12 price/sales ratio of 1.98. EPS for the same period registers at ($0.52).

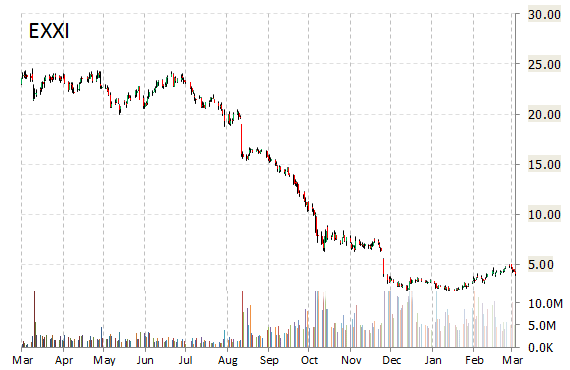

Energy XXI Ltd. (EXXI) was downgraded by KLR Group from a ‘Buy‘ rating to a ‘Hold‘ rating in a research report issued to clients on Monday.

EXXI closed at $4.05 on Friday and is currently trading down $0.32.

In the past 52 weeks, shares of Houston, Texas based oil company have traded between a low of $2.30 and a high of $24.58 and are now trading at $3.73. Shares are down 82.77% year-over-year ; up 24.23% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply