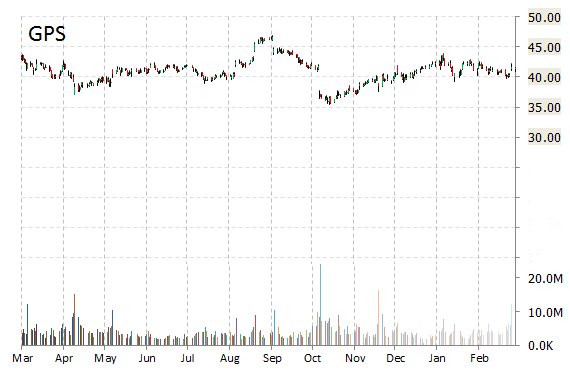

Analysts at FBR Capital upgraded their Gap, Inc. (GPS) rating to ‘Outperform’ from ‘Market Perform’ and set a price target of $48.00 from $39.00 in a research report issued to clients on Tuesday.

The Gap, Inc., currently valued at $17.72 billion, has a median Wall Street price target of $43.00 with a high target of $51.00. Approximately 4.13 million shares have already changed hands, compared to the stock’s average daily volume of 3.94 million.

In the past 52 weeks, shares of the apparel retail company have traded between a low of $35.46 and a high of $46.85 with the 50-day MA and 200-day MA located at $41.32 and $41.03 levels, respectively. Additionally, shares of GPS trade at a P/E ratio of 1.39 and have a Relative Strength Index (RSI) and MACD indicator of 55.84 and +0.73, respectively.

GPS currently prints a one year loss of about 3.40% and a year-to-date loss of 1.15%.

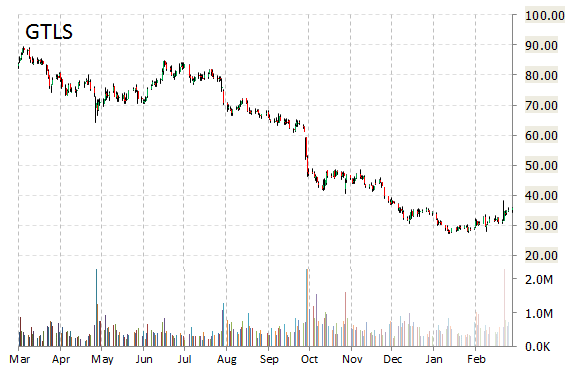

Chart Industries Inc. (GTLS) was upgraded to ‘Overweight’ from ‘Neutral‘ at Piper Jaffray.

On valuation measures, Chart Industries Inc. shares are currently priced at 14.11x this year’s forecasted earnings compared to the industry’s 5.33x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.84 and 16.58, respectively. Price/Sales for the same period is 0.91 while EPS is $2.67. Currently there are 7 analysts that rate GTLS a ‘Buy’, 7 rate it a ‘Hold’. No analyst rates it a ‘Sell’. GTLS has a median Wall Street price target of $40.00 with a high target of $52.00.

In the past 52 weeks, shares of Garfield Heights, Ohio-based company have traded between a low of $27.34 and a high of $89.49. Shares are down 57.37% year-over-year ; up 4.15% year-to-date.

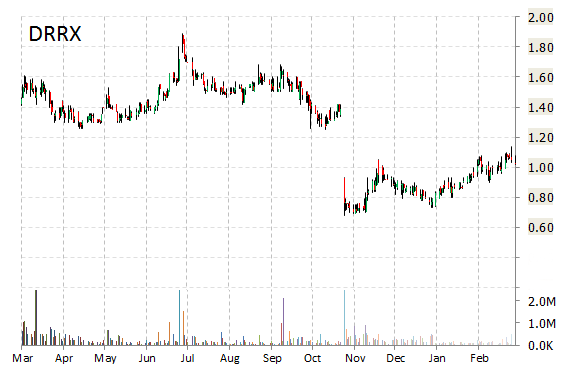

Durect Corporation (DRRX) was raised to ‘Buy’ from ‘Hold’ at Cantor Fitzgerald on Tuesday.

DRRX shares recently gained $0.17 to $1.20. The stock is down more than 25% year-over-year and has gained roughly 31% year-to-date. In the past 52 weeks, shares of Cupertino, California-based pharmaceutical company have traded between a low of $0.68 and a high of $1.89.

Durect Corporation closed Monday at $1.03. The name has a total market cap of $135.84 million.

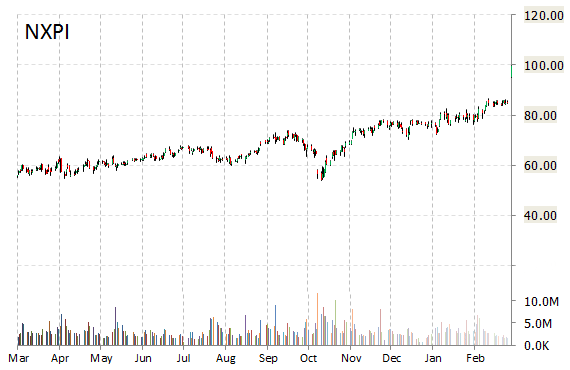

NXP Semiconductors NV (NXPI) was upgraded to ‘Neutral’ from ‘Sell’ at Goldman Sachs (GS) on Tuesday. NXPI shares recently lost $0.43 to $99.13.

In the past 52 weeks, shares of the Eindhoven, the Netherlands-based firm have traded between a low of $53.81 and a high of $100.09. Shares are up 77.06% year-over-year and 30.31% year-to-date.

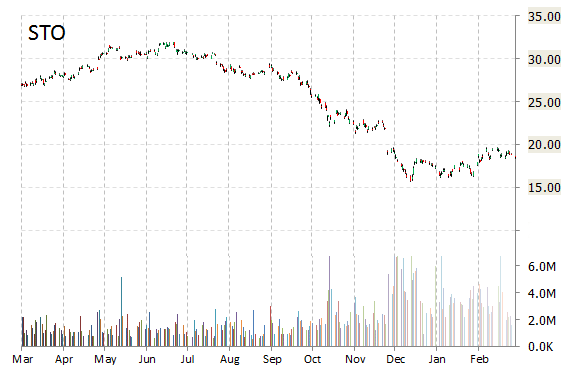

Statoil ASA (STO) had its rating upgraded to ‘Buy’ from ‘Accumulate’ by analysts at Tudor Pickering on Tuesday.

On valuation measures, Statoil ASA shares are currently priced at 20.81x this year’s forecasted earnings compared to the industry’s 12.39x earnings multiple. Ticker has a PEG and forward P/E ratio of 11.72 and 11.88, respectively. Price/Sales for the same period is 0.74 while EPS is $0.90. Currently there are 5 analysts that rate STO a ‘Buy’, 18 rate it a ‘Hold’. 12 analysts rates it a ‘Sell’. STO has a median Wall Street price target of $18.02 with a high target of $28.79.

Statoil recently traded at $18.67, a 0.81% gain over Monday’s closing price.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply