Horizon Pharma plc (HZNP) shares are up $1.78, or 9.7%, to $20.85 in pre-market trading Friday after the company reported its fourth quarter earnings results.

The specialty pharmaceutical firm reported earnings of $0.27 per share on revenues of $103.8 million, up a staggering 244.9% from a year ago. Analysts were expecting EPS of $0.21 on revenues of $95.54 million. Total net sales for fiscal 2014 were $297 million, compared with $74 million for fiscal 2013.

“We continued our strong momentum in the fourth quarter of 2014 and ended up exceeding our latest net sales and adjusted EBITDA guidance for the year,” said in a statement Timothy P. Walbert, chairman, president and CEO Horizon Pharma plc.

For full-year 2015, Horizon provided revenue projection of $450-$475 million, compared to the consensus revenue estimate of $461.17 million.

On valuation measures, Horizon Pharma PLC shares, which currently have an average 3-month trading volume of 1.9 million shares, trade at a forward P/E of 17.50 and a P/E to growth ratio of 1.30. The median Wall Street price target on the name is $22.00 with a high target of $31.00. Currently ticker boasts 5 ‘Buy’ endorsements, compared to 1 ’Hold’ and no ‘Sell’.

Profitability-wise, HZNP has a t-12 profit and operating margin of (150.03%) and 6.36%, respectively. The $2.27 billion market cap company reported $218.80 million in cash – an increase of $138.3 million from Dec. 31, 2013 – versus $361 million in debt in its most recent quarter.

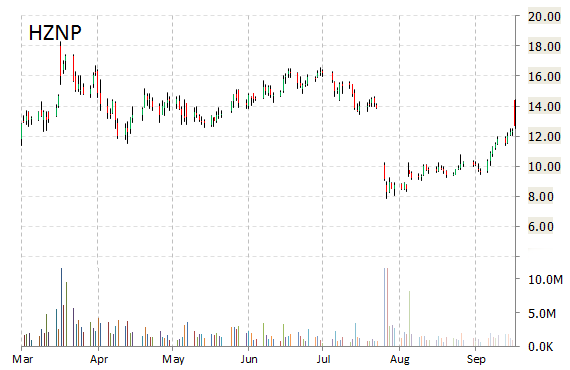

HZNP currently prints a one year return of about 59% and a year-to-date return of around 48%.

The chart below shows where the equity has traded over the last 52 weeks.

Horizon Pharma PLC is a specialty pharmaceutical company that develops and commercializes medicines for the treatment of arthritis, pain, and inflammatory diseases. The company was founded in 2005 and is headquartered in Dublin, Ireland.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply