Aruba Networks, Inc. (ARUN) reported second quarter 2015 non-GAAP EPS of $0.30 after the bell Thursday, compared to the consensus estimate of $0.27. Revenues increased 20.7% from last year to $212.93 million. Analysts expected revenues of $210.33 million. GAAP net income for Q2’15 was $5.7 million, or $0.05 per share, compared with a GAAP net loss of $10.7 million, or a loss of $0.10 per share, in Q2’14.

“We are pleased to report solid results for the second quarter, reflecting continued execution on our strategic plan,” said Dominic Orr, president and chief executive officer, Aruba Networks.

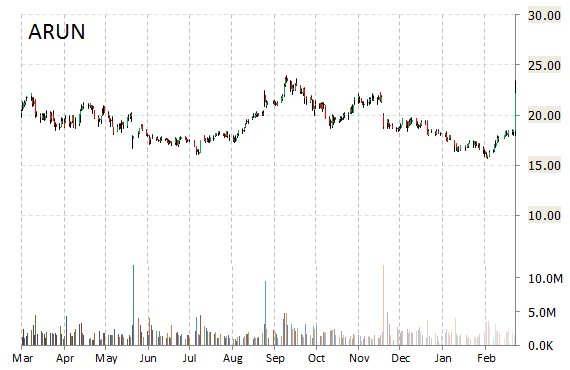

On valuation measures, Aruba Networks Inc. shares, which currently have an average 3-month trading volume of 2.13 million shares, trade at a forward P/E of 17.53 and a P/E to growth ratio of 1.08. The median Wall Street price target on the name is $22.00 with a high target of $29.00. Currently ticker boasts 16 ‘Buy’ endorsements, compared to 11 ’Holds’ and no ‘Sell’.

Profitability-wise, ARUN has a t-12 profit and operating margin of (2.37%) and 3.34%, respectively. The $2.48 billion market cap company reported $151.95 million in cash vs. $0.00 in debt in its most recent quarter.

ARUN currently prints a one year return of about 6.60% and a year-to-date return of around 22.33%. The stock is currently up $0.18 to $22.79 on 14.9 million shares.

The chart below shows where the equity has traded over the last 52 weeks.

Aruba Networks Inc. is a provider of next-gen network access solutions for the mobile enterprise. The company was founded in 2002 and is headquartered in Sunnyvale, California.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply