First Solar, Inc. (FSLR) reported fourth quarter EPS of $1.89 after the bell Tuesday, compared to the consensus estimate of $0.75. Revenues increased 31.3% from last year to $1.01 billion. Analysts expected revenues of $1.27 billion. The stock is now up $0.03 to $54.78 on 17,216,320 shares.

The company also provided guidance for Q1’15 as follows: net sales of $550 to $650 million. Loss of ($0.25) to ($0.35) per fully diluted share.

On valuation measures, First Solar Inc. shares, which currently have an average 3-month trading volume of 2.6 million shares, trade at a trailing-12 P/E of 20.55, a forward P/E of 12.13 and a P/E to growth ratio of (25.6). The median Wall Street price target on the name is $59.00 with a high target of $83.00. Currently ticker boasts 6 ‘Buy’ endorsements, compared to 9 ’Holds’ and 2 ‘Sell’.

Profitability-wise, FSLR has a t-12 profit and operating margin of 8.57% and 9.84%, respectively. The $5.49 billion market cap company reported $2 billion in cash and marketable securities, an increase of $876 million compared to the prior quarter, vs. $220.02 million in debt in its most recent quarter.

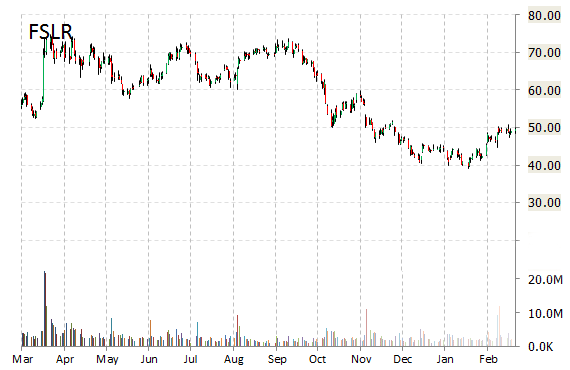

FSLR currently prints a one year loss of 11.25%, and a year-to-date return of around 11.30%.

The chart below shows where the equity has traded over the last 52 weeks.

First Solar Inc. provides solar energy solutions worldwide. The company was founded in 1999 and is headquartered in Tempe, Arizona.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply