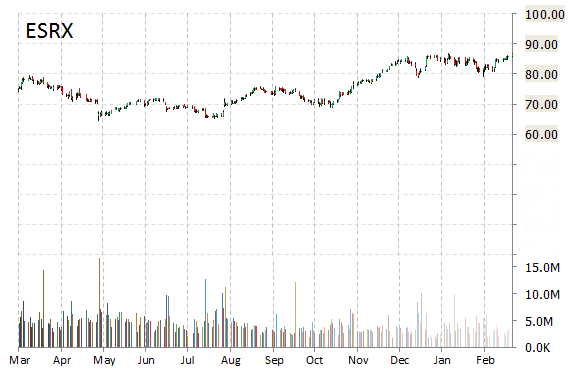

Express Scripts Holding Company (ESRX) was reiterated a ‘Buy’ by Maxim Group analysts on Tuesday. The broker also increases its price target on the stock to $109 from $90.

Express Scripts Holding Company, currently valued at $64.49 billion, has a median Wall Street price target of $90.00 with a high target of $102.00. Approximately 4.50 million shares have already changed hands, well above the average of 3.84 million for a full session over the past month.

In the past 52 weeks, shares of the clinical-stage biopharmaceutical company have traded between a low of $64.64 and a high of $88.83 with the 50-day MA and 200-day MA located at $83.85 and $78.36 levels, respectively. Additionally, shares of ESRX trade at a P/E ratio of 1.21 and have a Relative Strength Index (RSI) and MACD indicator of 67.49 and +2.50, respectively.

ESRX currently prints a one year return of 17.17%, and a year-to-date return of around 2.40%.

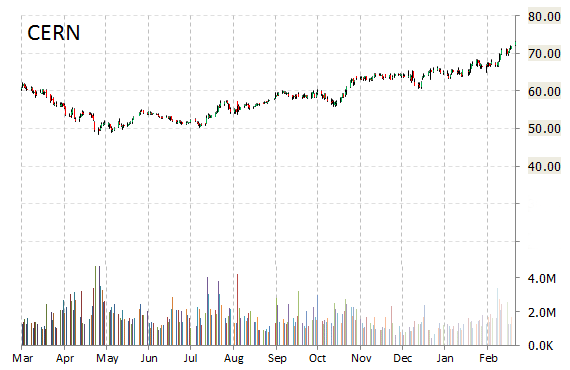

Cerner Corporation (CERN) was reiterated as ‘Outperform’ with a $75 from $70 price target on Tuesday by FBR Capital.

On valuation measures, Cerner Corporation shares are currently priced at 48.23x this year’s forecasted earnings compared to the industry’s 21.66x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.61 and 28.59, respectively. Price/sales for the same period is 7.56 while EPS is $1.50. Currently there are 21 analysts that rate CERN a ‘Buy’, 4 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. CERN has a median Wall Street price target of $75.00 with a high target of $85.00.

In the past 52 weeks, shares of North Kansas City, Missouri-based company have traded between a low of $48.39 and a high of $73.20 and are now at $72.34. Shares are up 17.72% year-over-year, and 13.02% year-to-date.

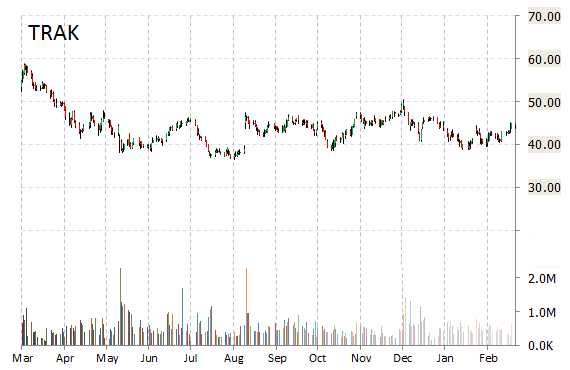

Dealertrack Technologies, Inc. (TRAK) rating of ‘Underweight’ was reiterated today at Barclays with a price target decrease of $43 from $47 (versus a $44.68 previous close).

Dealertrack shares recently lost $4.46 to $40.22. In the past 52 weeks, shares of Lake Success, New York-based web-based software solutions provider have traded between a low of $36.43 and a high of $58.84. Shares are down 18.36% year-over-year ; up 0.84% year-to-date.

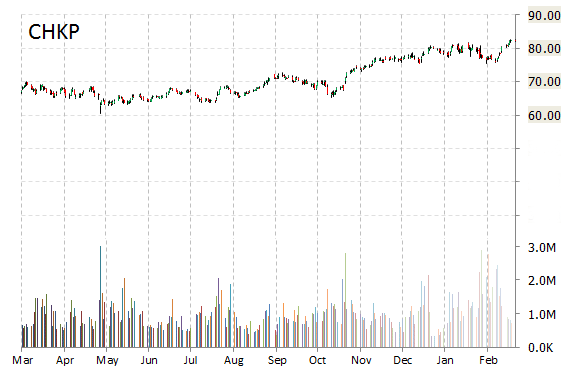

Shares of Check Point Software Technologies Ltd. (CHKP) are up $0.60 to $82.99 in mid-day trading after FBR Capital reiterated its ‘Outperform’ rating and increased its 12-month base case estimate on the name by 8 points to $93 a share.

Check Point shares recently gained $0.52 to $82.91. The stock is up more than 22.24% year-over-year and has gained roughly 4.86% year-to-date. In the past 52 weeks, shares of Tel Aviv, Israel-based company have traded between a low of $60.50 and a high of $83.23.

Check Point Software Technologies Ltd. closed Monday at $82.39. The name has a total market cap of $15.32 billion.

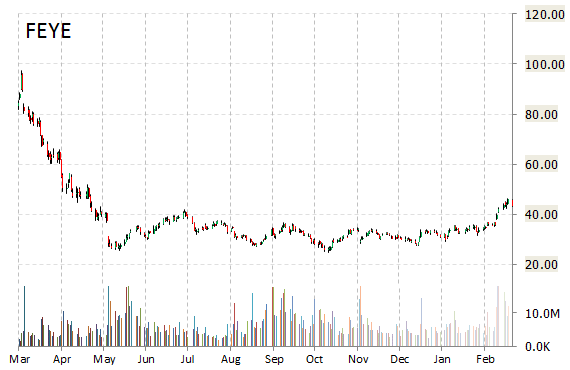

FireEye, Inc. (FEYE) was reiterated as ‘Outperform’ and the price target was increased to $53 from $45 at FBR Capital.

FEYE shares recently gained $0.05 to $43.40. FBR’s target price suggests a potential upside of about 24% from the company’s current stock price.

In the past 52 weeks, shares of Milpitas, California-based firm have traded between a low of $24.81 and a high of $97.35. Shares are down 40.35% year-over-year ; up 37.27% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply