Rigel Pharmaceuticals, Inc. (RIGL) is a big mover this pre-market session, as its shares are up nearly 44%. The surge came after the company announced a collaboration agreement with Bristol-Myers Squibb for the discovery, development and commercialization of cancer immunotherapies based on Rigel’s extensive portfolio of small molecule TGF beta receptor kinase inhibitors.

Under the terms of the agreement, Bristol-Myers Squibb will obtain exclusive, worldwide rights to develop and commercialize small molecule therapeutics derived from Rigel’s TGF beta library, including those approved to treat cancer. Bristol-Myers Squibb will pay $30 million upfront and Rigel will be eligible to receive development and regulatory milestones that could total more than $309 million for a successful compound approved in multiple indications. Rigel will also be eligible to receive tiered royalties on the net sales of any products from the collaboration.

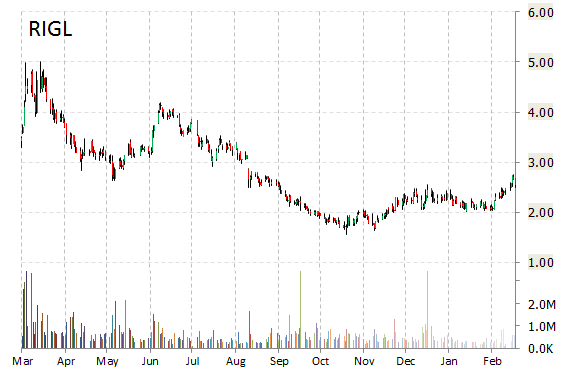

RIGL shares recently gained $1.15 to $3.70. The stock is down more than 21% year-over-year and has gained roughly 12% year-to-date. In the past 52 weeks, shares of South San Francisco, Calif.-based clinical-stage drug development co. have traded between a low of $1.56 and a high of $5.00.

Rigel Pharmaceuticals, Inc. closed Friday at $2.55. The name has a total market cap of $223.87 million.

Shares of Celldex Therapeutics, Inc. (CLDX) are spiking 14% in early pre-market trading Monday, after the company announced that the FDA has granted rindopepimut (Rintega(R)) Breakthrough Therapy Designation for the treatment of adult patients with EGFRvIII-positive glioblastoma (GBM).

“The FDA’s decision to grant Breakthrough Designation underscores rindopepimut’s therapeutic potential for patients with glioblastoma,” said Anthony Marucci, Co-founder, President and CEO of Celldex Therapeutics. “These patients have extremely limited treatment options, with only three new drugs approved in more than twenty years…”

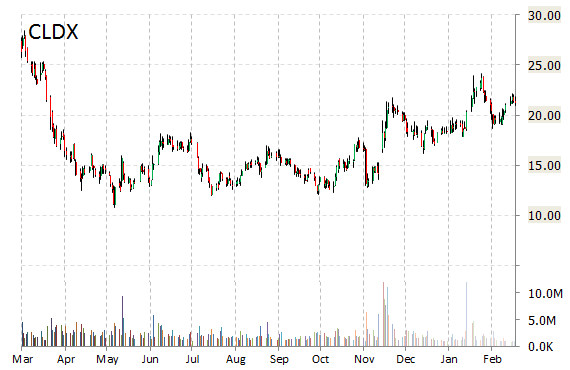

CLDX shares recently gained $2.80 to $23.99. In the past 52 weeks, shares of Hampton, New Jersey-based biopharmaceutical company have traded between a low of $10.76 and a high of $33.33. Shares are down 26.25% year-over-year ; up 16.22% year-to-date.

Shares of Tower Semiconductor Ltd. (TSEM) jumped more than 8% in premarket after the Israeli chipmaker said its 4th-quarter profit doubled. The company reported noon-GAAP EPS of $0.83, compared with $0.40 per share on a yoy-basis. Revenue grew 75% to a record $235.3 million.

For the year, the company reported net income of $4.3 million, or EPS of $0.07 on revenue of $828 million.

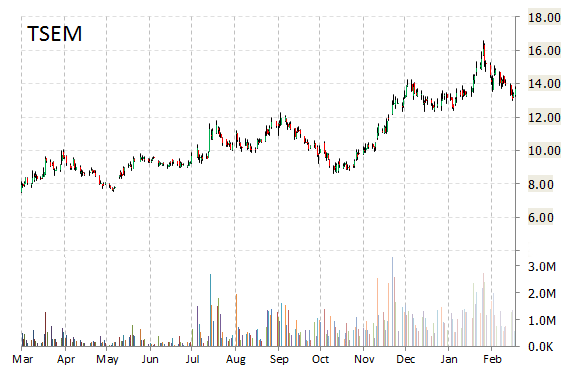

On valuation measures, Tower Semiconductor Ltd. shares currently have a PEG and forward P/E ratio of 0.48 and 5.66, respectively. Price/sales for the same period is 1.00 while EPS is ($0.53). Currently there are 4 analysts that rate TSEM a ‘Buy’, 0 rate it a ‘Hold’. 0 analysts rate it a ‘Sell’. TSEM has a median Wall Street price target of $16.00 with a high target of $20.00.

In the past 52 weeks, shares of the company have traded between a low of $6.90 and a high of $16.59 and are now at $14.70. Shares are up 97.26% year-over-year, and 2.70% year-to-date.

Digital Ally Inc. (DGLY) is a big mover this pre-market session, as its shares are up nearly 18.66%. The surge came after news the company has been awarded GSA Status by the U.S. General Services Administration, the procurement arm of the federal government.

Digital said the five-year contract allows federal, state and local governmental customers to efficiently purchase a wide range of Digital Ally video evidence collection and management products and services.

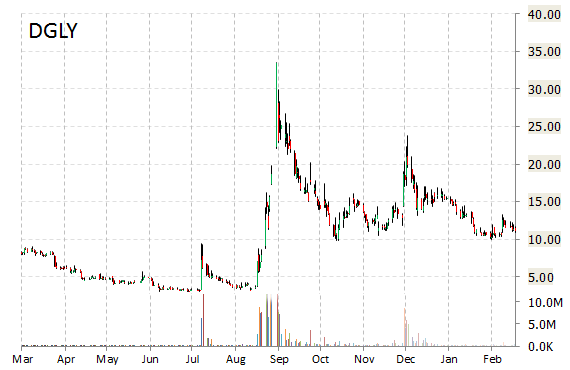

DGLY is up $1.99 in recent trading to $13.03 after closing $11.04 on Friday.

In the past 52 weeks, shares of Lenexa, Kansas-based digital video imaging and storage products producer have traded between a low of $3.03 and a high of $33.59. Shares are up 31.12% year-over-year ; down 28% year-to-date.

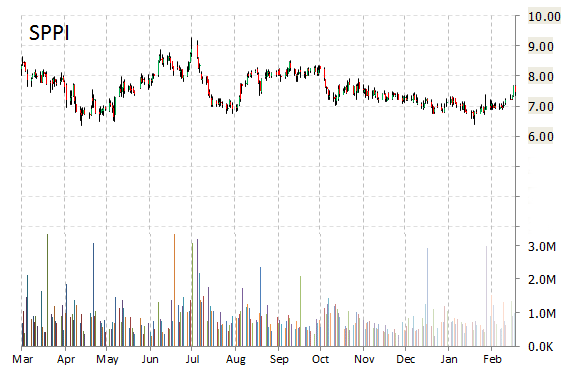

Spectrum Pharmaceuticals, Inc. (SPPI) is under heavy pressure Monday, down 25.60% to $6.00, after the company confirmed it has received an unfavorable ruling in the matter entitled Spectrum Pharmaceuticals, Inc. et al v. Sandoz Inc. Spectrum Pharmaceuticals Inc. that was presented in a Nevada District Court.

Following the news, Spectrum was downgraded to ‘Neutral’ from ‘Buy’ at ROTH Capital with a 12-month base case estimate of $7 from $15.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply