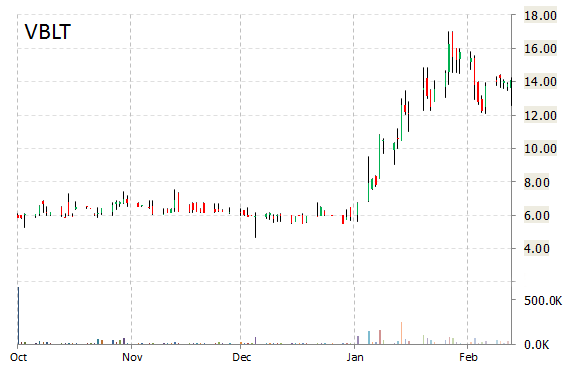

Vascular Biogenics Ltd. (VBLT) is seeing a notable downward move in pre-market trading after the company announced that its phase 2 studies of VB-201 in patients with psoriasis and Ulcerative Colitis did not meet primary endpoints. Biogenics said it does not plan to continue development of VB-201 in these indications.

“We are disappointed by the outcome of these Phase 2 studies in psoriasis and ulcerative colitis. Immune-inflammatory conditions are difficult-to-treat diseases with a limited array of effective treatments”, commented Dror Harats, M.D., CEO of VBL Therapeutics.

Vascular Biogenics recently traded at $7.70, down $45.43 percent.

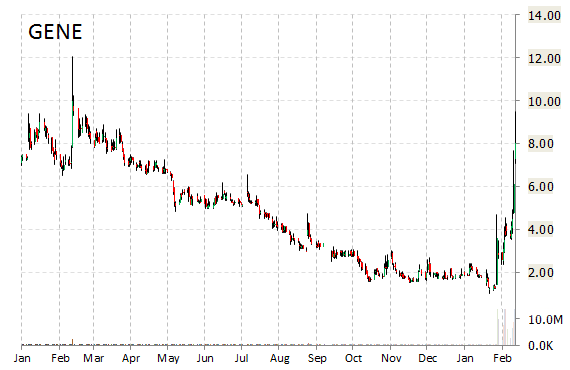

Genetic Technologies Limited (GENE) shares are up nearly 18% to $9.48 in early market trading Tuesday. Not seeing any news or rumors to account for the move.

Genetic Technologies is a Fitzroy, Australia-based genetic testing provider. Its stock has a median consensus analyst price target of $12.50, and a 52-week trading range of $1.04 to $9.65. The T-12 profit margin at Genetic Technologies is (221.84%). GENE‘s revenue for the same period is $3.54 million.

Genetic Technologies has market cap of $35.81 million.

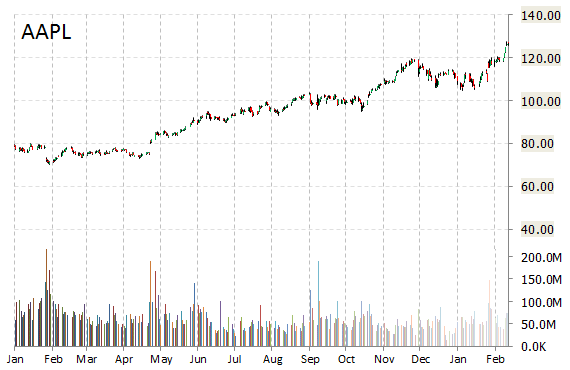

Apple Inc. (AAPL) – According to The WSJ, the iPhone maker is recruiting automotive technology and vehicle design experts to work on an Apple-branded minivan-like electric vehicle. A team of 1,000 has been assembled by the tech giant to build the vehicle. Separately, Greenlight Capital Inc., the hedge-fund firm run by David Einhorn, announced in its latest 13-D filing that it trimmed holdings in AAPL and Aetna (AET), and dissolved its stake in Cigna Corp (CI). David Tepper’s Appaloosa Management is another hedge fund that also dissolved its stake in Apple.

Apple Inc. shares are currently priced at 17.21x this year’s forecasted earnings compared to the industry’s 25.88x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.16 and 13.87, respectively. Price/Sales for the same period is 3.70 while EPS is $7.39. Currently there are 32 analysts that rate AAPL a ‘Buy’, 11 rate it a ‘Hold’. 2 analysts rate it a ‘Sell’. AAPL has a median Wall Street price target of $135.00 with a high target of $165.00.

In the past 52 weeks, shares of Cupertino have traded between a low of $73.05 and a high of $127.48 and are now at $127.82. Shares are up 66.49% year-over-year, and 15.58% year-to-date.

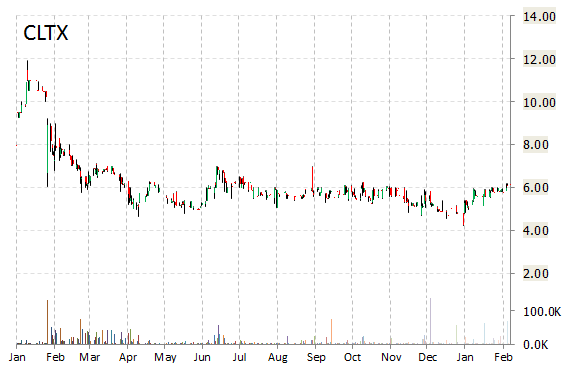

Celsus Therapeutics Plc (CLTX) slumped 82% in premarket trading after the company announced that the Phase II trial of MRX-6 cream 2% in Pediatric Atopic Dermatitis did not teach primary endpoint.

“We are disappointed in the results of the trial, where there was a lack of change in the IGA score from baseline compared to vehicle and surprised by the high placebo response,” commented Dr. Gur Roshwalb, CEO of Celsus Therapeutics.

CLTX shares recently lost $5.09 to $1.10. In the past 52 weeks, shares of London-based company have traded between a low of $4.25 and a high of $8.00. Shares are down 20.90% year-over-year ; up 28.54% year-to-date.

Leave a Reply