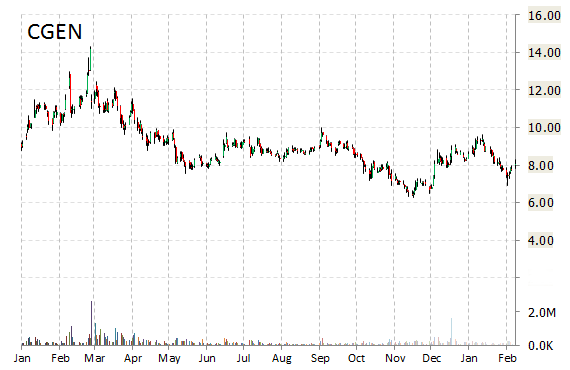

Shares of Compugen Ltd. (CGEN) are up nearly 7% to $8.61 in Tuesday’s pre-market trading session despite the company posting a 4Q loss of $1.5 million. The Tel Aviv, Israel-based therapeutic product discovery firm said it had a loss of 3 cents per share, compared with a net loss of $2.9 million, or 9 cents per share, in the comparable period of 2013. For the year, Compugen reported that its loss narrowed to $11.1 million, or 23 cents per share, compared with a net loss of $14.1 million, or 36 per share on a yoy basis. Revenue was reported as $12.4 million.

As of Dec. 31, 2014, cash, cash related accounts, short-term and long-term bank deposits totaled $107.7 million vs. $46.8 million at December 31, 2013.

CGEN currently prints a one year loss of about 30%, and a year-to-date loss of 3.24%. In the past 52 weeks, shares of Compugen have traded between a low of $6.27 and a high of $14.32.

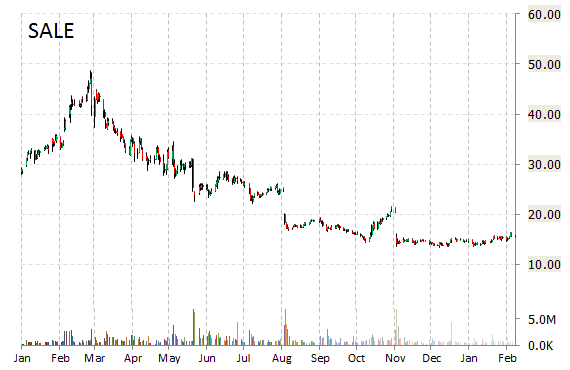

Shares of RetailMeNot, Inc. (SALE) fell around 8.60% in pre-market trading after the company reported fourth quarter & FY14 financial results.

The Austin, Texas-based firm reported earnings of $0.43 per share on revenues of $87.4 million, up 11.3% from a year ago. Analysts were expecting EPS of $0.32 on revenues of $86.1 million.

For Q1’15, RetailMeNot Inc guided revenue below consensus, saying net rev are expected to be in the range of $57.00 – $60.00 million, or a decline of 5% at the mid-point.

In other SALE news this morning, the company today announced that its board of directors authorized a stock repurchase program of up to $100 million of the company’s outstanding Series 1 common stock, effective immediately. The stock repurchase program is expected to be completed over the next 24 months.

SALE shares recently lost $1.75 to $13.72. In the past 52 weeks, shares of the company have traded between a low of $13.29 and a high of $48.73. Shares are down 59.87% year-over-year ; up 5.81% year-to-date.

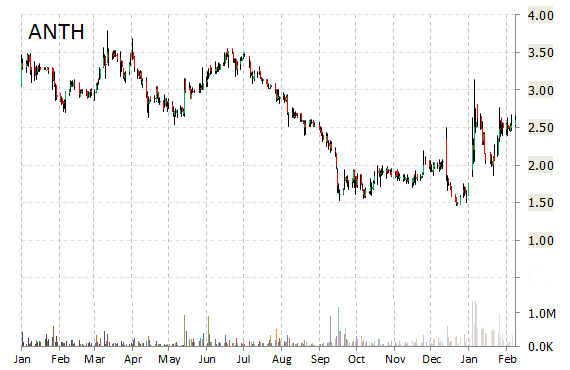

Anthera Pharmaceuticals, Inc. (ANTH) stock is surging by more than 25% Tuesday after the company announced the successful completion of an interim analysis of its Phase 3 trial (CHABLIS-SC1) of blisibimod in patients with Systemic Lupus Erythematosus and that the study should continue to completion as planned.

Dr. Colin S. Hislop, Anthera’s Chief Medical Officer said that “while the results of the CHABLIS-SC1 interim futility analysis remain blinded to Anthera, we are very pleased that the study has passed this critical milestone and now look forward to finishing enrollment later this year.”

ANTH shares recently gained $0.88 to $3.48. The stock is down more than 12% year-over-year and has gained roughly 65% year-to-date. In the past 52 weeks, shares of Hayward, California-based biopharmaceutical company have traded between a low of $1.46 and a high of $3.79.

Anthera Pharmaceuticals, Inc. closed Monday at $2.60. The name has current total market cap of $79.83M.

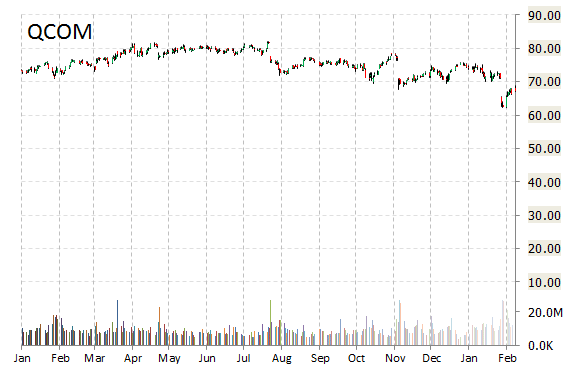

Qualcomm Incorporated (QCOM) – The chip maker will pay China a $975 million fine to settle a 14-month long probe into alleged anti-competitive practices. The deal also requires Qualcomm to lower its royalty rates on patents used in China. Because of the $975 million dollar fine, the U.S. chipmaker cut its full-year earnings estimates.

The fine is the largest in China corporate history.

Shares of Qualcomm gained 4.09 percent to $69.94 at 9:47 a.m. in New York.

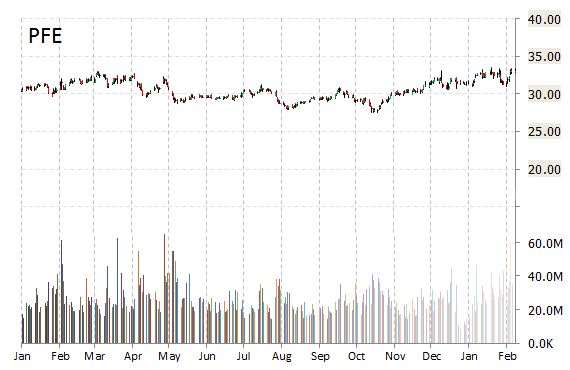

Pfizer (PFE) – The drug maker said it entered into a $5 billion accelerated stock buyback agreement with Goldman Sachs (GS). This agreement is part of Pfizer’s existing share repurchase authorization under which an additional $11 billion of authority was announced in October 2014. Pfizer said the accelerated buy back program was assumed in the forecast for the full year it provided last month.

PFE recently traded at $33.66, up 1.76 percent. Shares of the New York-based company closed at $33.06 on the NYSE on Monday.

Leave a Reply