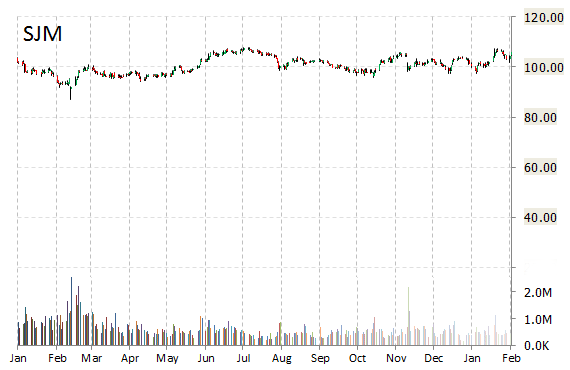

The J. M. Smucker Company (SJM) gained nearly 6% in midday trading today. About 5.2 million shares of the Orrville, Ohio-based manufacturer of branded food products worldwide were traded as of 3:14 p.m. est, compared to the normal trading volume of 554K shares a day. Smucker today announced plans to buy Big Heart Pet Brands in a $5.8 billion deal, including $2.6 billion of existing Big Heart debt. After the news, Moody’s (MCO) placed a A3 senior unsecured debt ratings on the name.

Shares of SJM are trading up $6.33 to $112.21 in midday trading.

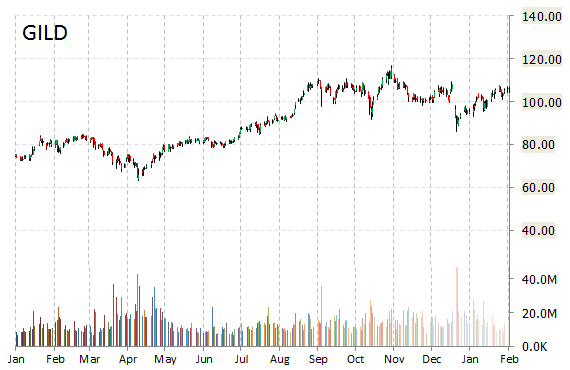

Gilead Sciences Inc. (GILD) shares plunged 7.76% in midday trading Wednesday. The move comes on a big volume too with the issue currently trading more than 53.5 million shares, well ahead of its three month daily average of 17.1 million shares. The Foster City, Calif.- based biopharmaceutical firm today said its hit hepatitis C drug Sovaldi, will come down in price. The drug maker could increase discounts to average of 46% this year, up from 22% in 2014.

Gilead shares plunged more than 8 points in recent action to $99.08.

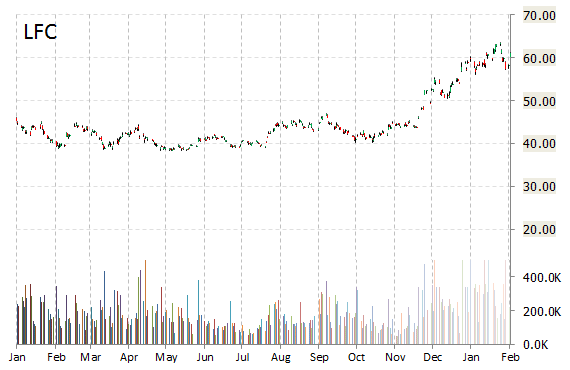

China Life Insurance Co. Ltd. (LFC) is trading at unusually high volume Wednesday with 436K shares changing hands. It is currently 420% higher its average daily volume and trading up 2% at $62.46. The stock is up more than 57.97% year-over-year and has gained roughly 4.29% year-to-date. In the past 52 weeks the company has traded between a low of $38.30 and a high of $63.54.

China Life Insurance has a total market cap of $118.90B.

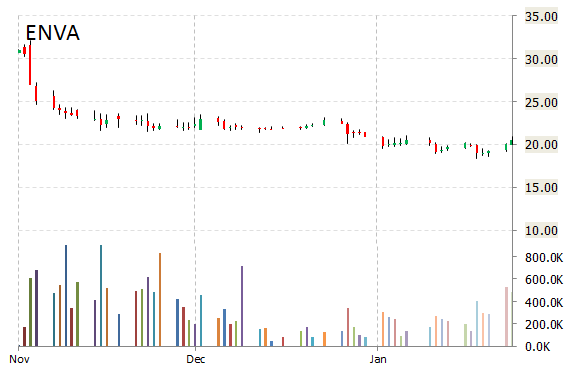

Enova International, Inc. (ENVA) shares surged 8.34% to $22.26. The move comes on a big volume too with the issue currently trading more than 672K shares, which dwarfs the average volume of 342K shares.

Enova International, Inc., currently valued at $732.93M, has a median Wall Street price target of $35.50 with a high target of $36.00. In the past 52 weeks, shares of the company have traded between a low of $18.37 and a high of $32.10 with the 50-day MA and 200-day MA located at $20.90 and $21.78 levels, respectively. Additionally, shares have a Relative Strength Index (RSI) and MACD indicator of 63.24 and +0.95, respectively.

ENVA currently prints a one year loss of about 21%, and a year-to-date loss of less than one percent.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply