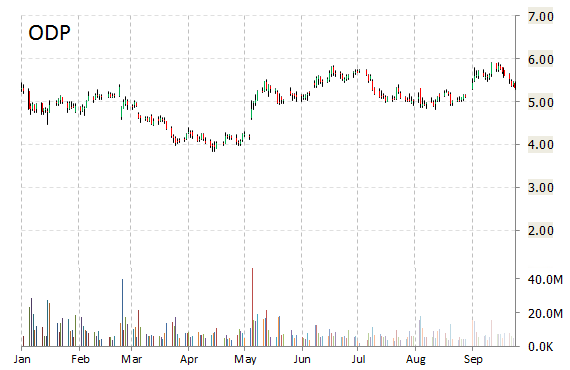

Office Depot, Inc. (ODP) shares are currently printing a large uptick, gaining nearly 16% from the previous close, after The Wall Street Journal reported the company is in advance talks to merge with Staples (SPLS).

Starboard Value L.P,a hedge fund that owns almost 6% of Staples and 10% of Office Depot, had urged the two companies to combine in January.

The price and structure of the possible deal could not be learned and there is no guarantee that a deal will be reached, sources told the publication.

The companies’ combined market cap is $15.1 billion, as of Monday’s close.

ODP shares recently gained $1.34 to $8.97. The stock is up more than 56.03% year-over-year and has lost roughly 11% year-to-date. In the past 52 weeks, shares of Boca Raton, Florida-based company have traded between a low of $3.84 and a high of $8.91.

Office Depot, Inc. closed Monday at $7.63. SPLS closed at $17.14. Ticker was $19.04 a share in early trading Tuesday.

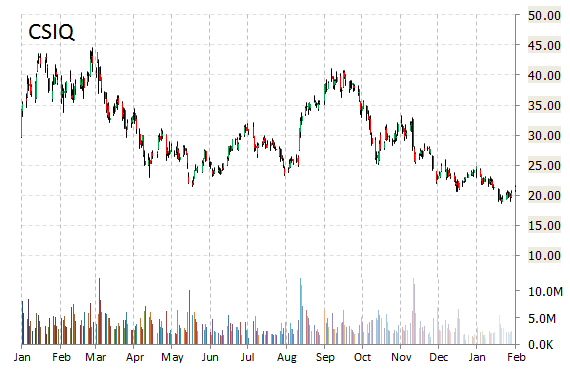

Shares of Canadian Solar Inc. (CSIQ) are up 17% in early trading after the company announced that it will sell its Recurrent solar operation to a U.S. unit of Canadian Solar Inc. for $265 million, or 13% less than it paid five years ago.

On valuation measures, Canadian Solar Inc., currently valued at $1.35B, has a median Wall Street price target of $45.00 with a high target of $56.00. In the past 52 weeks, shares of West Guelph, Canada-based solar wafers manufacturer have traded between a low of $18.68 and a high of $44.50 with the 50-day MA and 200-day MA located at $21.72 and $28.56 levels, respectively. Additionally, shares of CSIQ trade at a P/E ratio of 0.52 and have a Relative Strength Index (RSI) and MACD indicator of 50.33 and +0.11, respectively.

CSIQ currently prints a one year loss of about 46%, and a year-to-date loss of around 12%.

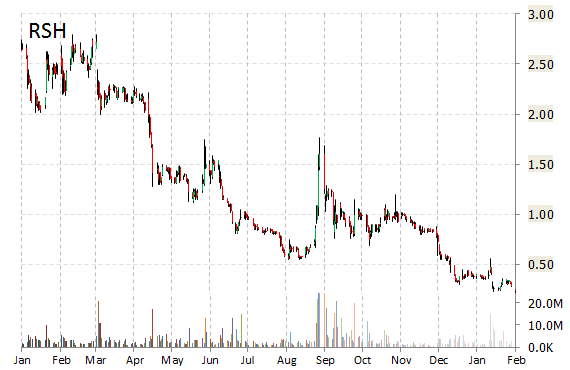

RadioShack (RSH) shares tumbled 33.39% to $0.16 in early trade Tuesday. The electronics retailer will be delisted by the NYSE, which has suspended trading in the company’s shares. RadioShack has been struggling with weak sales that have rendered it unprofitable. Separately, Bloomberg reports the company may sell some of its stores to Sprint (S).

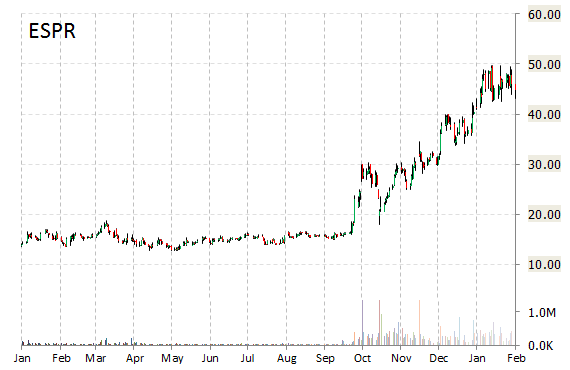

Esperion Therapeutics, Inc. (ESPR) shares are trading higher by 13% to $50.60 in early trading, following news that the FDA has removed the peroxisome proliferator-activated receptor (PPAR) partial clinical hold on ETC-1002. The action by the FDA will now allow Esperion to conduct clinical trials exceeding six months in duration.

“We are pleased to receive a positive and rapid response from the FDA following our submission in early January of a complete response to the PPAR partial clinical hold,” said Tim M. Mayleben, president and CEO of Esperion. “The removal of the PPAR partial clinical hold is an important milestone on the path toward initiation of our Phase 3 clinical program for ETC-1002 later this year.”

Following the news, Esperion Therapeutics had its price target raised to $100 from $41, and to $93 from $75 at Credit Suisse and JMP Securities, respectively.

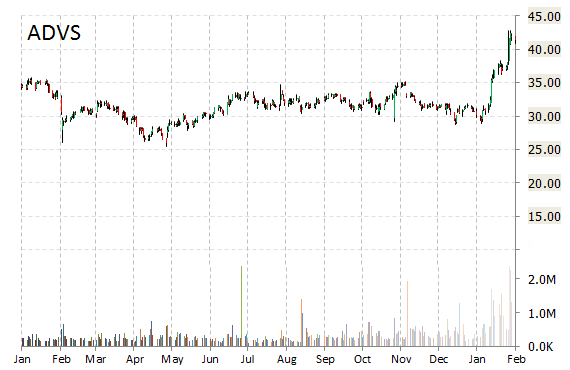

Advent Software, Inc. (ADVS) shares are up 5.58% to $43.70 in early trading. The move comes after the company announced an agreement wherein SS&C Technologies Holdings, will acquire Advent for an enterprise value of approximately $2.7 billion in cash, equating to $44.25 per share plus assumption of debt. Advent’s stock is trading on heavy volume with 7.7 million shares changing hands in the first hour of trading, well ahead of its three month daily average of 638K shares.

Separately, Advent Software shares were upgraded to ‘Market Perform’ from ‘Underperform’ at Raymond James.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply