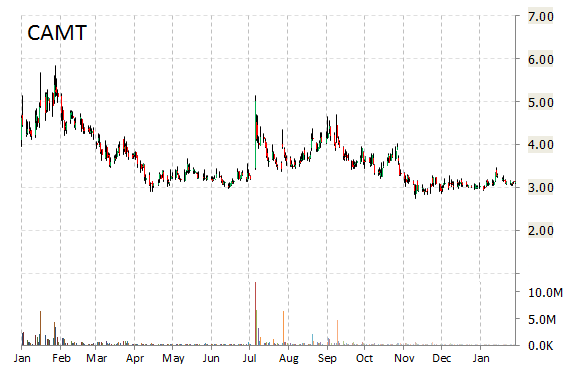

Camtek Ltd. (CAMT) is a big mover this session, as its shares are up nearly 15% to $3.86. The move comes after the company announced a purchase order from Bay Area Circuits Inc. for a Gryphon system. Camtek said that this is a milestone event, marking the first customer purchase order for the Gryphon following the successful conclusion of the beta-testing phase of the system.

Camtek Ltd., currently valued at $95.71M, has a median Wall Street price target of $5.00. In the past 52 weeks, shares of Israeli-based company have traded between a low of $2.75 and a high of $5.18 with the 50-day MA and 200-day MA located at $3.10 and $3.44 levels, respectively. Additionally, shares of CAMT trade at a P/E ratio of 1.40 and have a Relative Strength Index (RSI) and MACD indicator of 53.07 and -0.04, respectively.

CAMT currently prints a one year loss of about 40%, and a year-to-date return of 4.32%.

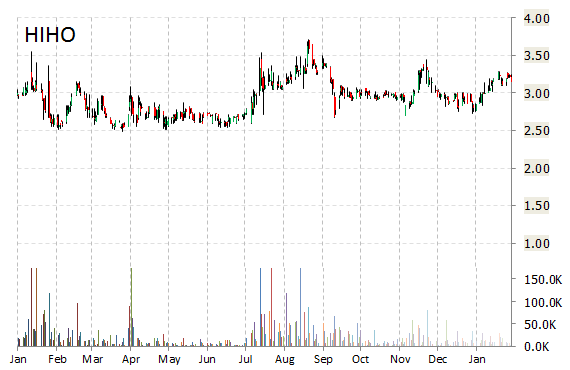

Shares of thinly traded Highway Holdings Limited (HIHO) have moved 21% higher in early trading, after the company reported results for its fiscal third quarter ended December 31, 2014. Highway Holdings said its Q3 net income increased to $361K, or $0.10 per diluted share, from $149K, or $0.04 per diluted share in prior year. Net sales were $6.0 million compared to $5.8 million year-over-year. Meanwhile, net income for the nine-month period of fiscal 2015 more than doubled to $989K, or $0.26 per diluted share.

Roland Kohl, HIHO’s president and chief executive officer said the company’s balance sheet remains very strong. Highway Holdings’ total cash position at December 31, 2014 was $8.7 million, or approximately $2.29 per share compared with $6.06 million at March 31, 2014, despite several dividend payments since April 2014.

HIHO shares recently gained $0.62 to $3.75. The stock is up more than 27% year-over-year and has gained roughly 12.50% year-to-date. In the past 52 weeks, shares of Hong Kong-based firm have traded between a low of $2.49 and a high of $3.71.

Highway Holdings Limited closed Friday at $3.15. The name has a total market cap of $11.90 million.

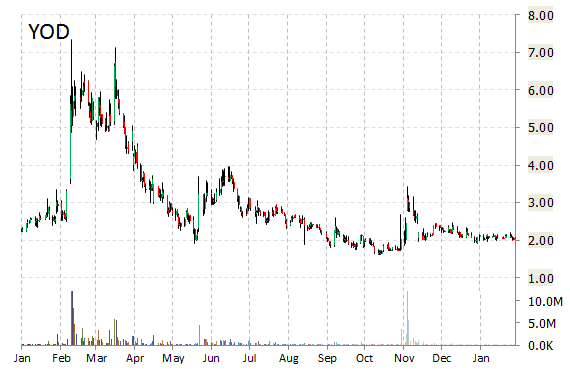

YOU On Demand Holdings, Inc. (YOD) has gained 46% in early trade following the company’s agreement with Twentieth Century Fox Television Distribution for subscription video on demand in China.

YOD said it has entered into a licensing agreement with FoxA for the SVOD rights in China to a broad selection of library feature films. The titles will be available to subscribers of YOU On Demand’s Subscription VOD (SVOD) platform and service, via mobile, Over-the-Top (OTT), digital cable and IPTV.

YOD shares recently gained $1.12 to $3.17. The stock is down more than 32% year-over-year and has lost less than one percent year-to-date. In the past 52 weeks, shares of New York-based company have traded between a low of $1.61 and a high of $7.35.

YOU On Demand Holdings, Inc. has a current market cap of $75.12 million.

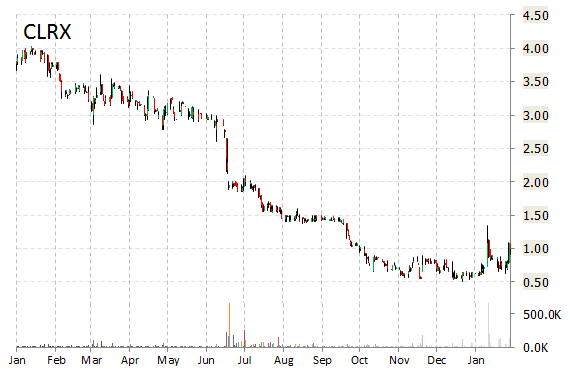

CollabRx, Inc. (CLRX) shares are up 44.39% to $1.44 in early trading Monday. The move comes on a big volume too with the issue currently trading more than 266K shares, which dwarfs the average volume of 64K. Not seeing any news or rumors to account for the move.

CollabRx, Inc. is a San Francisco, Calif.-based cloud expert system provider related to healthcare decision-making. Its stock has a median consensus analyst price target of $1.85, and a 52-week trading range of $0.51 to $3.79. The T-12 price/sales at CollabRx is 7.77. CLRX‘s revenue for the same period is $377,000.

CollabRx, Inc. has market cap of $4.25 million.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply