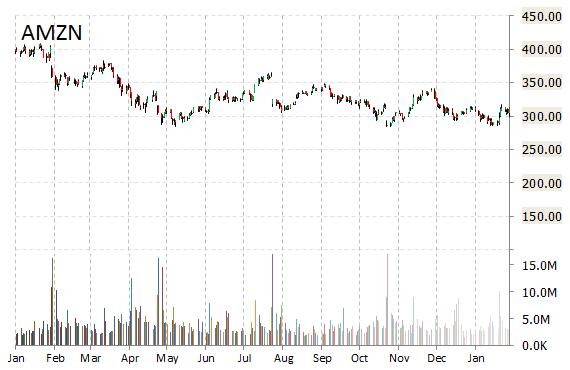

Amazon.com Inc. (AMZN) ran up 12.86% to $351.88 in premarket trade Friday, after the e-commerce giant crushed earnings forecasts for the fourth quarter of 2014. The company reported EPS of $0.45 per share, beating analysts’ predictions by $0.28 per share. Amazon had lost money in the prior two quarters. Surging sales, however, fell short of expectations with Q4 revs increasing 15% to $29.33 billion vs. $25.59 billion in the fourth quarter of 2013. Wall Street analysts were, on average, forecasting $29.67 billion in sales for the quarter. The company also guided Q1 below consensus. However, much of that came from an unfavorable impact from foreign exchange rates.

Following the earnings release, Amazon has it price target raised to $420 from $400 at Piper Jaffray with an ‘Overweight’ rating.The name was also raised to $410 from $389, and to $420 from $400 at Credit Suisse and Piper Jaffray, respectively.

On valuation measures, Amazon.com shares have a PEG and forward P/E ratio of 25.53 and 115.47, respectively. Price/Sales for the same period is 1.65 while EPS is ($0.47). Currently there are 25 analysts that rate AMZN a ‘Buy’, 17 rate it a ‘Hold’. No analyst rates it a ‘Sell’. AMZN has a median Wall Street price target of $350.00 with a high target of $450.00.

In the past 52 weeks, shares of Seattle-based firm have traded between a low of $284.00 and a high of $383.11. Shares are down 18.85% year-over-year, and 0.46% year-to-date.

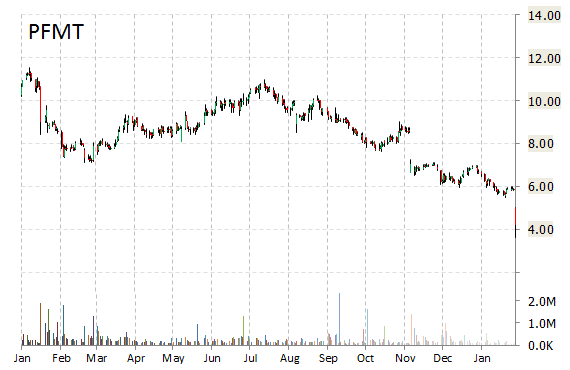

Performant Financial Corporation (PFMT) stock is exploding higher by more than 14% Friday following the company’s decision to withdraw its proposed public offerings of convertible senior notes and common stock. Proceeds of the financings were intended to fund the purchase price for the acquisition of Premier Healthcare Exchange, Inc. (PHX).

Performant CEO Lisa Im stated, “We continue to believe that Premiere Healthcare Exchange is an exceptional company, the acquisition has very compelling merits, and fits within our strategy of growing in healthcare technology. However, we are not going forward with the previously announced capital raise at levels that are not in the best interests of our stockholders.”

PFMT shares recently gained $0.60 to $4.81. The stock is down more than 51% year-over-year and has lost roughly 37% year-to-date. In the past 52 weeks, shares of Livermore, California-based analytics services company have traded between a low of $3.65 and a high of $10.97.

Performant Financial Corporation closed Thursday at $4.21. The name has currently a total market cap of $207.65M.

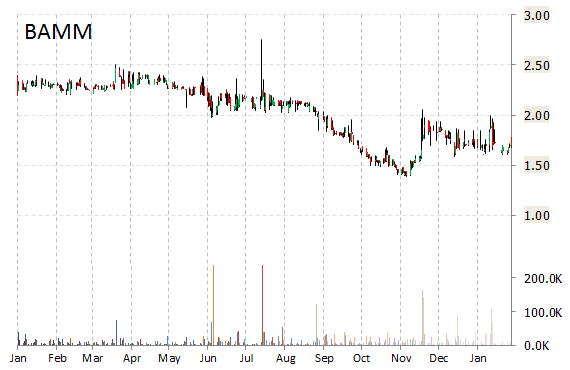

Books-A-Million Inc (BAMM) has been a solid gainer in pre-market trading, up more than 54% to $2.60 from Thursday’s close of $1.68. The gains have been aided by a non-binding proposal from Clyde B. Anderson, Executive Chairman of the Company, on behalf of the Anderson family, to acquire certain outstanding shares of the common stock of Books-A-Million, Inc., at a cash purchase price of $2.75 per share. In the proposed potential transaction, the Anderson family would acquire all of the outstanding shares of common stock of the BAMM not currently owned by the Anderson family through a merger of the company with a newly formed acquisition vehicle that the Anderson family would control. Books-A-Million said it intends to promptly review the proposal.

In the past 52 weeks, shares of Birmingham, Alabama-based book retailer have traded between a low of $1.39 and a high of $2.75. Shares are down 27.04% year-over-year, and 4.66% year-to-date. BAMM has currently a total market cap of $23.37M.

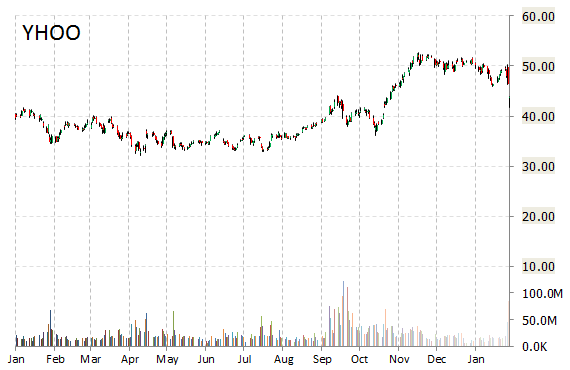

Analysts at Evercore upgraded their rating on the shares of Yahoo! Inc. (YHOO) this morning to ‘Buy’ from ‘Hold’. The investment firm said the higher rating is based on the value inherent in the spinoff of Yahoo’s Alibaba (BABA) stake into a separate company.

Yahoo shares have surged 15.35% over the past 52 weeks, while the S&P 500 index has gained 13.39% in the same period.

The stock is lower by 0.02% to $43.72 in pre-market trading Friday.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply