Shares of VMware, Inc. (VMW) are down $4.29 to $76.32 in mid-day trading today, following a modest beat of Q4 results but with a disappointing outlook. UBS lowered the price target for VMW shares to $97 from $106. The firm currently has a ‘Buy’ rating on the stock. VMware was also downgraded to ‘Hold’ from ‘Buy’ at Needham citing disappointing guidance.

In the past 52 weeks, shares of the Palo Alto, California-based company have traded between a low of $75.05 and a high of $112.89 with the 50-day MA and 200-day MA located at $80.81 and $89.65 levels, respectively. Additionally, shares of VMW trade at a P/E ratio of 1.24 and have a Relative Strength Index (RSI) and MACD indicator of 34.43 and -0.24, respectively.

VMW currently prints a one year loss of about 13.42% and a year-to-date loss of 2.31%.

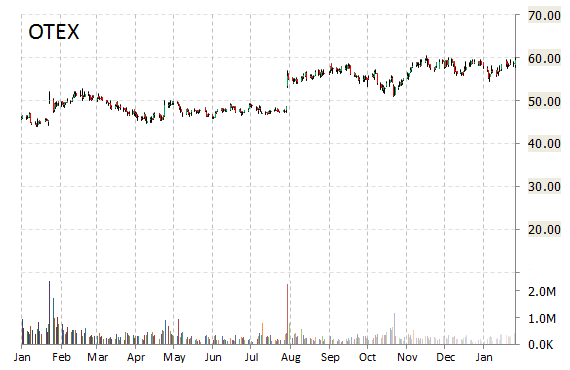

Analysts at Credit Suisse are out with a report this morning downgrading shares of Open Text Corporation (OTEX) with a ‘Neutral’ from ‘Outperform’ rating. OTEX lost $4.47 to $55.12 in mid-day trading today. Approximately 1.50M shares have already changed hands, compared to the stock’s average daily volume of 239.57K shares.

OTEX currently prints a one year return of about 26.65%, and a year-to-date return of 2.28%.

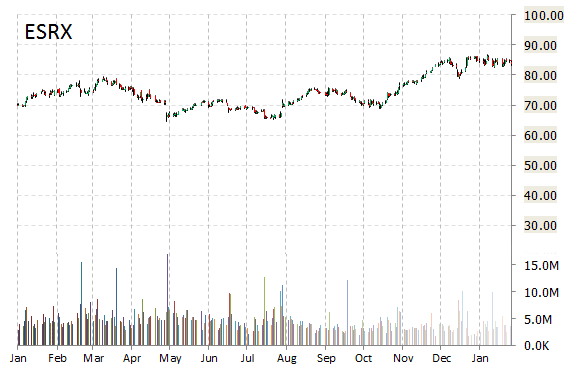

Express Scripts Holding Company (ESRX) was downgraded to ‘Market Perform’ from ‘Outperform’ at FBR Capital on Wednesday. ESRX shares are currently priced at 33.07x this year’s forecasted earnings compared to the industry’s 27.49x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.29 and 15.08, respectively. Price/Sales for the same period is 0.61 while EPS is $2.49. Currently there are 15 analysts that rate ESRX a ‘Buy’, 10 rate it a ‘Hold’. No analyst rates it a ‘Sell’. Express Scripts has a median Wall Street price target of $89.00 with a high target of $102.00.

In the past 52 weeks, shares of the St. Louis, Missouri-based company have traded between a low of $64.64 and a high of $86.64 and are now at $82.24. Shares are up 14.07% year-over-year ; down 1.18% year-to-date.

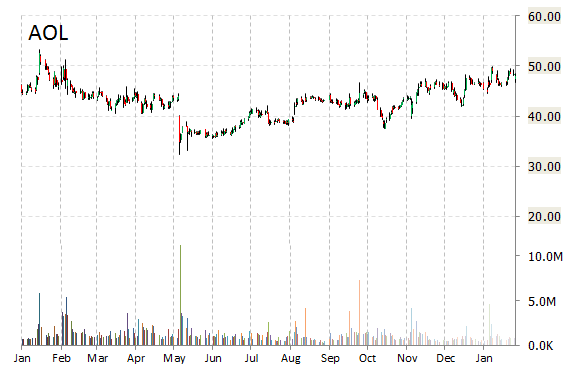

Shares of AOL Inc. (AOL) are trading sharply lower in mid-day trading today after Wells Fargo (WFC) downgraded the stock to ‘Market Perform’ from ‘Outperform’. WFC cut its valuation range on AOL shares to $49-$51 from $55-$57.

In other AOL news, CNBC’s David Faber reported that Yahoo (YHOO) has ruled out a potential acquisition of the company.

On valuation measures, AOL shares are currently priced at 35.99x this year’s forecasted earnings. Ticker has a forward P/E of 18.27 and t-12 price-to-sales ratio of 1.50. EPS for the same period is $1.23.

In the past 52 weeks, shares of the New York-based firm have traded between a low of $32.31 and a high of $51.35 and are now at $44.12. Shares are up 4.03% year-over-year and 4.07% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply