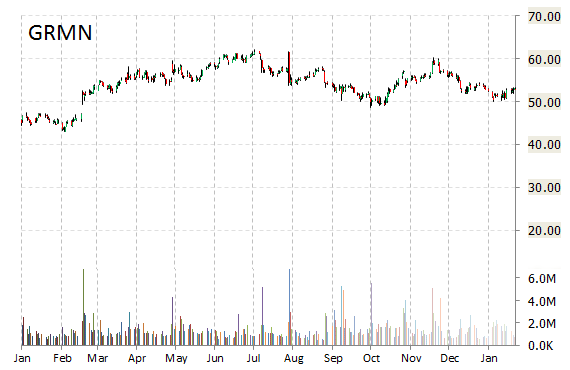

Garmin Ltd. (GRMN) gained $1.40 to $54.41 in mid-day trading today, after the company was upgraded to ‘Outperform’ from ‘Sector Perform’ at RBC Capital Markets. The firm also raised its price target on the stock to $67 from $65 a share.

GRMN shares are currently priced at 33.50x this year’s forecasted earnings, which makes them expensive compared to the industry’s 12.20x earnings multiple. Ticker has a forward P/E of 16.83 and t-12 price-to-sales ratio of 3.59. EPS for the same period is $1.62.

Approximately 697K shares have already changed hands, compared to the stock’s average daily volume of 1.54M shares.

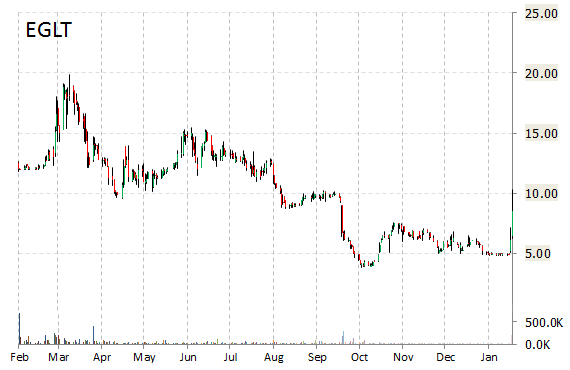

Egalet Corporation (EGLT) lost 34 cents to $8.20 in mid-day trading today, after the company was raised to ‘Buy’ at Canaccord Genuity. The firm also set its price target on the stock to $18 a share.

EGLT’s shares have advanced 48.26% in the last 4 weeks and 40.46% in the past three months. Over the past 5 trading sessions the stock has gained 72.53%. Shares of Egalet are up 50.09% this year.

The Wayne, Pennsylvania-based company, which is currently valued at $134.44M, has a median Wall Street price target of $15.00 with a high target of $18.00.

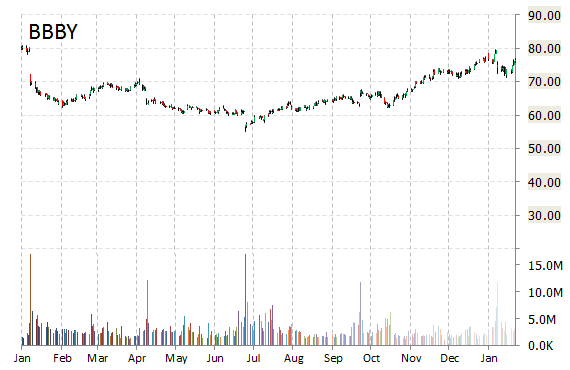

Bed Bath & Beyond Inc. (BBBY) was raised to ‘Outperform’ from ‘Perform’ at Oppenheimer on Monday. The firm also raised its 12 month base case estimate on the stock to $85 from $69 implying 24% expected return.

BBBY shares are currently priced at 15.85x this year’s forecasted earnings, compared to the industry’s 14.12x earnings multiple. The company’s current year and next year EPS growth estimates stand at 5.40% and 7.90% vs industry growth rates of 8.50% and 21.20%, respectively. BBBY has a t-12 price/sales ratio of 1.19. EPS for the same period registers at $4.94.

The Union, New Jersey-based company, which is currently valued at $14.26B, has a median Wall Street price target of $74.00 with a high target of $88.00.

BBBY recently traded at $77.81, up 1.81 percent.

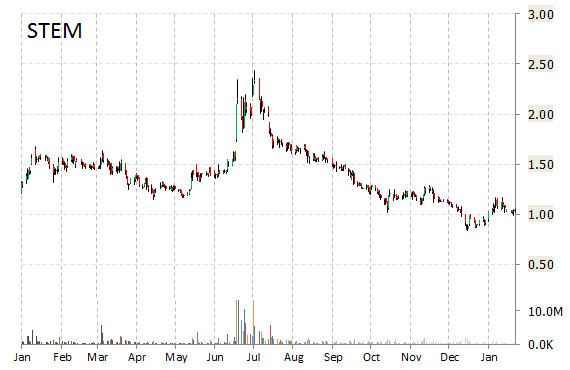

Chardan Capital Markets analysts are out with a report this morning assuming coverage of StemCells Inc. (STEM) with a ‘Buy’ rating and $2.25 price target.

STEM’s shares have advanced 14.13% in the last 4 weeks and declined 9.48% in the past three months. Over the past 5 trading sessions the stock has lost 0.94%. STEM shares are up 11.70% this year.

The Newark, California-based company, which is currently valued at $75.60M, has a median Wall Street price target of $3.75 with a high target of $5.00. STEM is down 33.12% on a year-over-year basis.

Shares of StemCells Inc. gained 6.19% in recent trading.

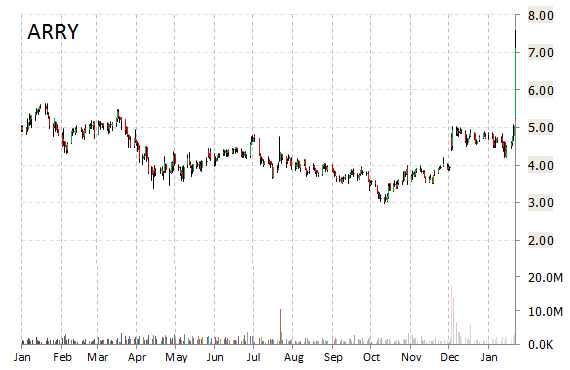

Shares of Array BioPharma, Inc. (ARRY) are up $0.72 to $7.83 in mid-day trading, after the company had its price target raised to $9.00 from $6.00 at Stifel. On trading-measure, ARRY has a beta of 2.98 and a short float of 19.40%. In the past 52 weeks, shares of the biopharmaceutical company have traded between a low of $2.98 and a high of $7.90 with its 50-day MA and 200-day MA located at $4.79 and $4.02 levels, respectively.

ARRY currently prints a one year return of 33.65%, and a year-to-date return of around 50%.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply