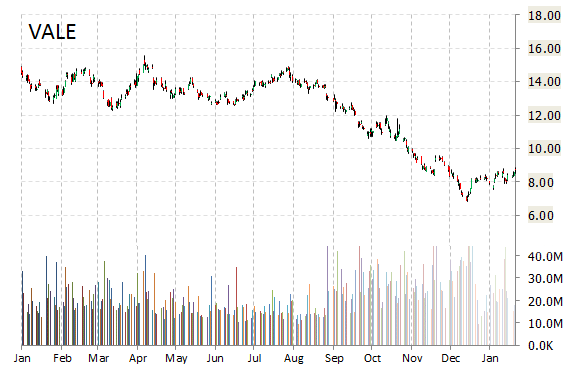

Analystst at Goldman Sachs (GS) issued a report this morning downgrading shares of Vale S.A. (VALE) with a ‘Neutral’ from ‘Buy’ rating. On trading-measure, VALE has a beta of 1.05 and a short float of 4.86%. In the past 52 weeks, VALE shares have traded between a low of $6.82 and a high of $15.59 with its 50-day MA and 200-day MA located at $8.03 and $11.00 levels, respectively.

VALE currently prints a one year loss of about 33.05% and a year-to-date return of around 6.23%.

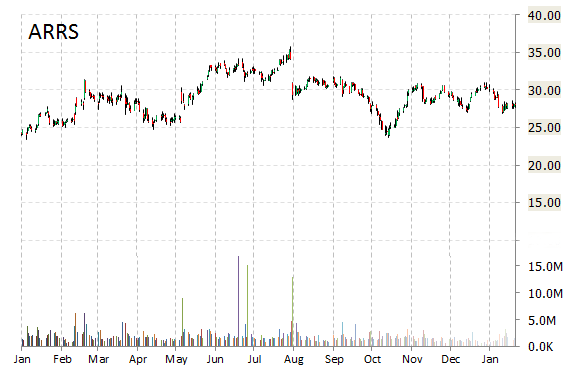

ARRIS Group, Inc. (ARRS) was downgraded to ‘Outperform’ from ‘Strong Buy’ at Raymond James on Friday. On valuation-measures, shares of ARRIS Group have a trailing-12 and forward P/E of 30.69 and 9.75, respectively. P/E to growth ratio is 0.54, while t-12 profit margin is 2.50%. EPS registers at $0.90. The company has a market cap of $3.99B and a median Wall Street price target of $35.50 with a high target of $40.00.

ARRS currently prints a one year return of about 2.22%, and a year-to-date loss of 6.79%.

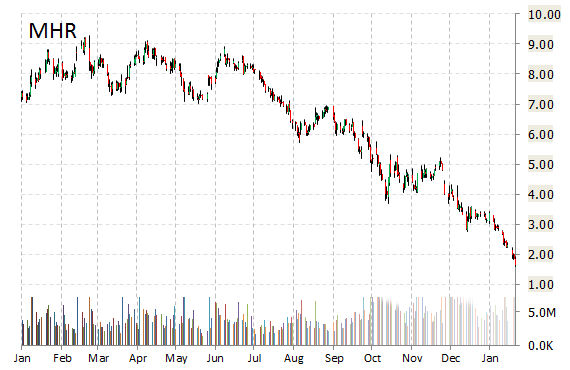

Magnum Hunter Resources Corp. (MHR) gained $0.26 to $1.91 in mid-day trading today. Approximately 16.67M shares have already changed hands, compared to the stock’s average daily volume of 6.58M shares.

The name was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse. In the past 52 weeks, shares of the Houston, Texas-based firm have traded between a low of $1.60 and a high of $9.27. Shares are down 81.10% year-over-year, and 47.45% year-to-date.

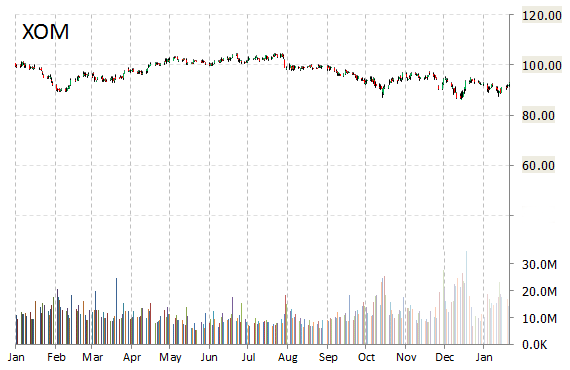

Shares of Exxon Mobil Corporation (XOM) are down $1.31 to $91.56 after equity research firm Credit Suisse issued a downgrade to ‘Underperform’ from ‘Neutral’ on the name.

XOM shares are currently priced at 11.51x this year’s forecasted earnings compared to the industry’s 14.03x earnings multiple. Ticker has a PEG and forward P/E ratio of -6.40 and 19.69, respectively. Price/Sales for the same period is 1.00 while EPS is $7.95. Currently there are 9 analysts that rate XOM a ‘Buy’, 13 rate it a ‘Hold’. 2 analysts rate it a ‘Sell’. Exxon has a median Wall Street price target of $95.00 with a high target of $115.00.

Shares of Altera Corp. (ALTR) are down 84 cents to $34.35 in mid-day trading today after analysts at Barclays issued a downgrade on the name. The analysts lowered the price target for ALTR shares to $32 from $35. Altera was also downgraded to ‘Market Perform’ from ‘Outperform’ at BMO Capital. Price target cut to $33 from $40.

ALTR is currently priced at 23.54x this year’s forecasted earnings, which makes them expensive compared to the industry’s 12.32x earnings multiple. Ticker has a forward P/E of 16.75 and t-12 price-to-sales ratio of 5.63. EPS for the same period is $1.46.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply