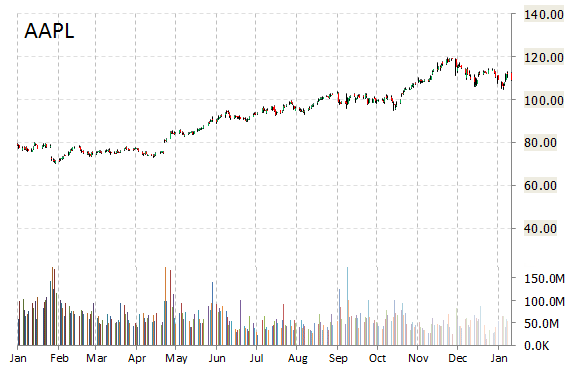

Shares of Apple (AAPL) are up 2.67% to $112.11 in early trade Tuesday after Credit Suisse upgraded the name to ‘Outperform’ from ‘Neutral’ with a price target raised to $130 from a previous $110. The firm attributed the upgrade to Cupertino’s solid and sustainable performance in iPhone sales.

“We raise our earnings per share estimates by 18 percent/20 percent to $9.44/$10.06, given a solid and sustainable iPhone volume base, sizable increase in scope for cash return and earnings per share momentum,” the firm wrote. “We now see $10 earnings per share power in calender year 2016, which drives earnings momentum and our upgrade to Outperform and upside to at least $130.”

In other Apple news this morning, The WSJ reports that one of Apple’s suppliers in China has just unveiled a phone with a sapphire display — sapphire is the world’s second hardest material after diamonds in terms of mineral hardness — that only costs about $160.

On valuation measures, Apple Inc. is currently valued at $640.73B and has a median Wall Street price target of $123.00 with a high target of $150.00. In the past 52 weeks, shares of the tech giant have traded between a low of $70.51 and a high of $119.75 with the 50-day MA and 200-day MA located at $112.42 and $103.61 levels, respectively. Additionally, shares of AAPL trade at a P/E ratio of 1.27 and have a Relative Strength Index (RSI) and MACD indicator of 46.69 and +0.26, respectively.

AAPL currently prints a one year return of about 46.51% and a year-to-date loss of around 1.02%.

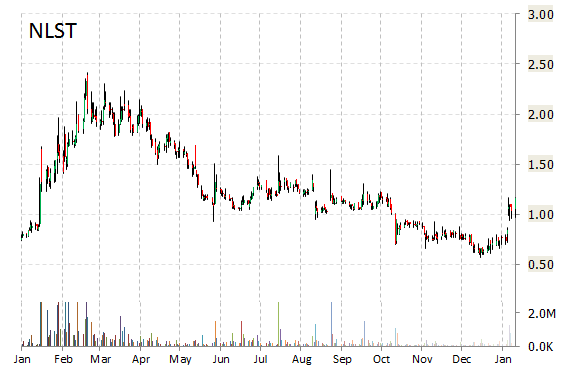

Netlist Inc. (NLST) shares are trading 45% higher in pre-market hours in reaction to a Federal Court order that halts sales of new high-speed computer chips used by SanDisk (SNDK), IBM (IBM) and Other OEMs.

NLST shares recently gained $0.48 to $1.64. In the past 52 weeks, shares of Irvine, California-based company have traded between a low of $0.57 and a high of $2.41. Shares are up 31.82% year-over-year and 56.76% year-to-date.

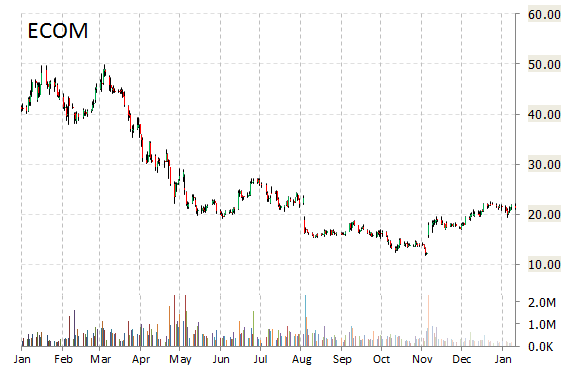

ChannelAdvisor Corporation (ECOM) is one of Tuesday’s notable stocks in decline, down nearly 54%, following a company announcement that said ECOM expects its Q4’14 revenue to be $23.7 million, compared to the prior guidance of revenue in the range of $25.6 to $26.1 million.

“We are disappointed that the fourth quarter did not meet our guidance, Scot Wingo, CEO of ChannelAdvisor said in a statement. “We saw an unusual shift of gross merchandise volume (GMV) to larger customers this holiday season at the expense of smaller customers. Because larger customers enjoy volume discounts in the form of lower take rates, this shift translated to lower variable subscription revenue, even though overall GMV increased 31% year over year for the fourth quarter.”

In other ECOM news this morning, the company was downgraded to ‘Neutral’ and ‘Sell’ at Robert W. Baird and Goldman Sachs (GS), respectively.

ECOM shares recently lost $11.17 to $9.98. The stock is down more than 54% year-over-year and has lost roughly 2% year-to-date. In the past 52 weeks, shares of Morrisville, NC-based company have traded between a low of $9.03 and a high of $49.90.

ChannelAdvisor Corporation closed Monday at $21.15. The name has a total market cap of $248.42M.

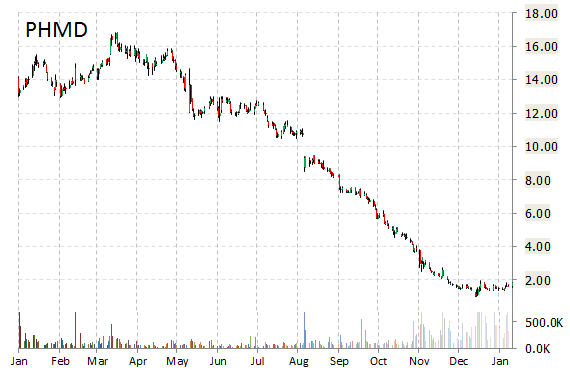

PhotoMedex, Inc. (PHMD) shares are up 39% to $2.65 in early trade. The move comes on a big volume too with the issue currently trading more than 1.7 million shares, which dwarfs the average volume of 391K. Not seeing any news or rumors to account for the move.

PhotoMedex is a skin health company that provides integrated disease management and aesthetic solutions to dermatologists, professional aestheticians, and consumers worldwide. Its stock has a has a median consensus analyst price target of $11, with a 52-week trading range of $1.01 to $16.61.

The T-12 profit margin at PhotoMedex, Inc is (8.93%). PHMD‘s revenue for the same period is $219.39 million.

PhotoMedex has market cap of $48.87 million.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply